MYX Finance Price Jumps 41% Today, But Why Are Traders Preparing For A Crash?

MYX Finance price soared 41%, defying bearish bets as shorts were liquidated. If MYX holds $14.46 support, it could retest $19.98 ATH, but profit-taking may trigger a reversal toward $11.52.MYX Finance price soared 41%, defying bearish bets as shorts were liquidated. If MYX holds $14.46 support, it could retest $19.98 ATH, but profit-taking may trigger a reversal toward $11.52.

MYX Finance has been riding a strong rally in recent sessions, pushing the altcoin closer to its all-time high.

The bullish momentum has kept MYX among the best-performing tokens, but traders appear divided. While the broader market trends upward, MYX holders and short-term speculators show mixed signals.

MYX Finance Traders Switch Stance

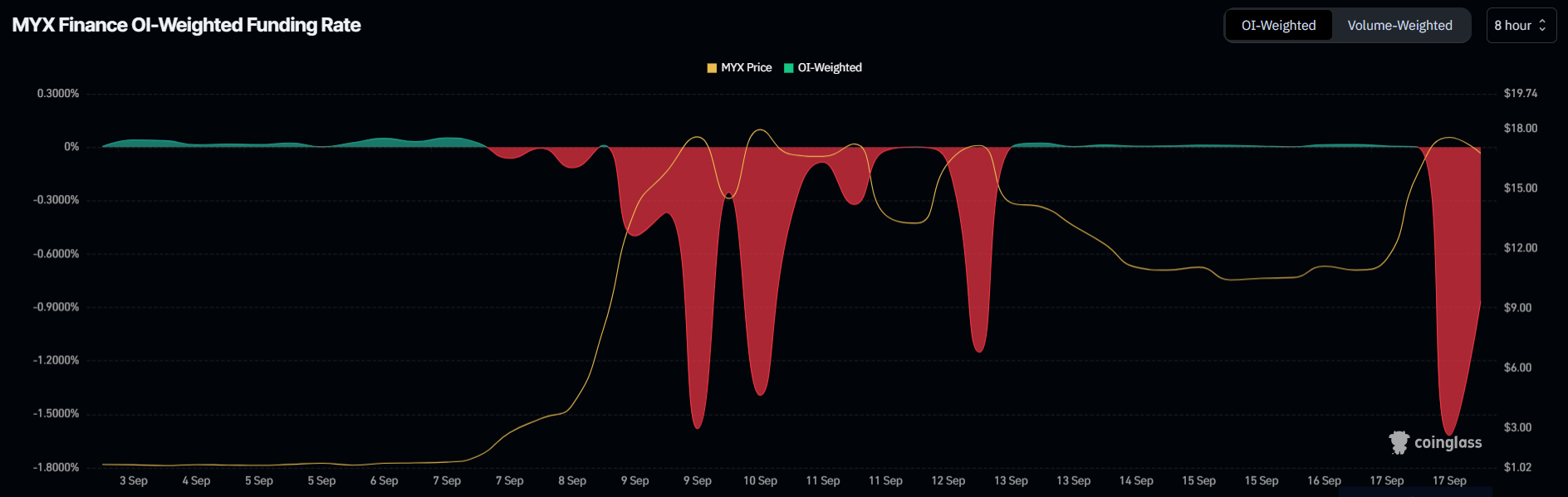

The MYX funding rate recently dropped to its lowest point this week as traders placed short contracts against the token. Many were anticipating a saturation point followed by a reversal, expecting the altcoin to lose momentum after its latest price surge.

However, the decline in funding rates did not produce the anticipated correction. Instead, shorts traders were hit with liquidations as MYX kept climbing. This development is likely to neutralize bearish sentiment in the near term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

MYX Funding Rate. Source:

Coinglass

MYX Funding Rate. Source:

Coinglass

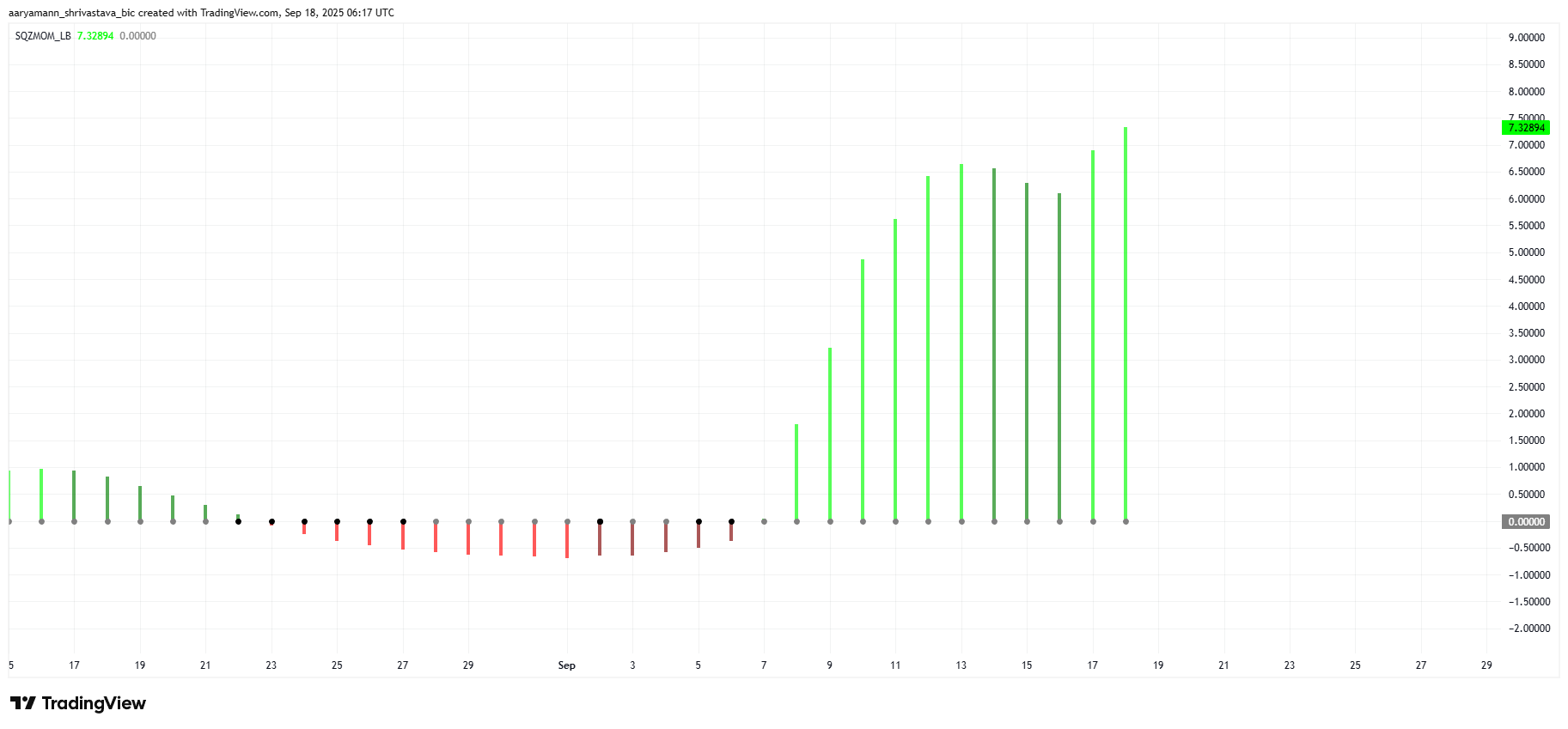

The squeeze momentum indicator is currently flashing a strong bullish signal, suggesting that MYX’s rally has more fuel. The green bars on the indicator highlight a squeeze release, which often coincides with extended upward moves. Momentum continues to strengthen rather than fade.

This technical backdrop indicates that MYX Finance is resisting short pressure and also building the groundwork for additional growth. As long as capital inflows remain intact, the altcoin could maintain its bullish trajectory and reclaim lost ground from recent corrections.

MYX Squeeze Momentum Indicator. Source:

TradingView

MYX Squeeze Momentum Indicator. Source:

TradingView

MYX Price Will Make It To The ATH

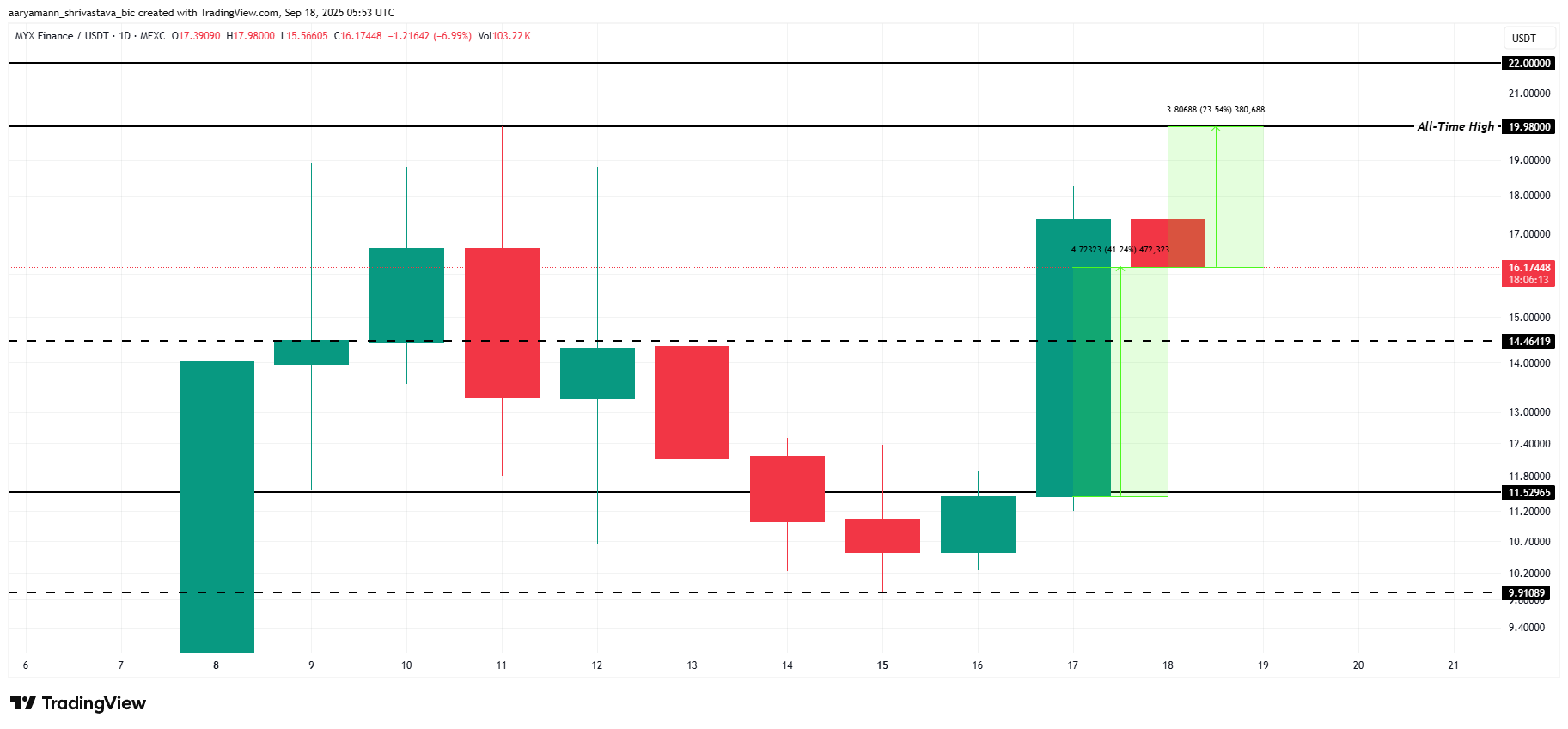

At the time of writing, MYX Finance is trading at $16.17, up 41% in the last 24 hours. The sharp surge has pushed it within striking distance of its all-time high at $19.98, which was set last week.

To revisit this level, MYX must first hold its support at $14.46. A successful bounce from this zone would set the stage for another run toward $19.98, with potential upside extending as high as $22.00.

MYX Price Analysis. Source:

TradingView

MYX Price Analysis. Source:

TradingView

Conversely, if investors decide to lock in profits, the bullish outlook could weaken quickly. A dip below $14.46 may expose MYX to further declines. This will potentially drag the price down to $11.52 and invalidate the current bullish structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin wavers under $88K as traders brace for $14B BTC options expiry

The likelihood of a bitcoin short squeeze to $90,000 increases as funding rates turn negative

After dropping from $106,000 to $80,600, Bitcoin has stabilized and started to rebound, sparking discussions in the market about whether a local bottom has been reached. While whales and retail investors continue to sell, mid-sized holders are accumulating. Negative funding rates suggest a potential short squeeze. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

TGE tonight: A quick look at the ecosystem projects mentioned by Monad on the first day

Including prediction markets, DeFi, and blockchain games.

In-depth Conversation with Sequoia Capital Partner Shaun: Why Does Musk Always Defeat His Rivals?

Shaun not only led the controversial 2019 investment in SpaceX, but is also one of the few investors who truly understands Elon Musk's operational system.