Dogecoin price is consolidating above $0.27 after a weekly breakout, with analysts eyeing targets at $0.39–$0.45 and institutional momentum from a pending ETF and rising open interest supporting further upside.

-

Dogecoin trades above $0.27 with near-term targets at $0.39 and $0.45.

-

Trading volumes tripled in one month as weekly charts confirmed a breakout from a triangle pattern.

-

ETF launch expectations and $6B+ derivatives open interest signal institutional inflows and stronger market participation.

Dogecoin price consolidates above $0.27; analyst targets $0.45; rising volumes and ETF momentum may push DOGE higher — read market levels and trade cues.

Dogecoin holds above $0.27 with targets at $0.45, boosted by ETF launch, $6B open interest, and rising trading volumes.

- Dogecoin consolidates above $0.27 with analysts setting near-term targets at $0.39 and $0.45.

- Trading volumes tripled in one month as weekly charts confirm a breakout from a triangle pattern.

- ETF launch and $6B open interest boost momentum, with long-term projections pointing toward $1.40.

Dogecoin price is consolidating after breaking above the $0.27 resistance that capped rallies throughout the summer. The price currently trades near $0.292, up more than 6 percent from yesterday. Analysts project the next upward leg could take the meme coin toward $0.45, representing nearly a 50 percent move from present levels.

What are the breakout levels and market structure?

According to analysis prepared by Ali Charts (plain text reference), Dogecoin is positioned to advance further after consolidation above $0.27. The analyst noted that DOGE may consolidate briefly and then target $0.39 and the $0.43–$0.45 band as the next resistance zone.

Dogecoin $DOGE may consolidate for a bit, then expect the next leg up toward $0.45! pic.twitter.com/uynq9IF4wd

— Ali (@ali_charts) September 14, 2025

Trading volumes have almost tripled in one month, reflecting strong buying and selling activity around the breakout zone. The weekly chart confirmed a breakout from a multi-month symmetrical triangle, while the rise in participation reinforced the momentum. Historical data shows Dogecoin often accelerates once resistance levels are turned into support, creating strong continuation moves.

Source: Bitcoinsensus(X)

Source: Bitcoinsensus(X)

According to Bitcoinsensus (plain text reference), Dogecoin follows a logarithmic uptrend since late 2022. The coin rose to $0.23 in early 2024, recording a 290 percent increase, and advanced to $0.50 in mid-2025, a 440 percent gain. Current projections place resistance near $1.40, representing a potential 740 percent surge if the trend continues.

Why is institutional interest affecting Dogecoin now?

Dogecoin’s fundamentals are receiving support from structural developments. The launch of a Dogecoin ETF, previously delayed, is expected in mid-September and could bring DOGE into traditional market flows. Bloomberg analysts James Seyffart and Eric Balchunas (plain text references) have highlighted ETF demand as a key connector to mainstream capital.

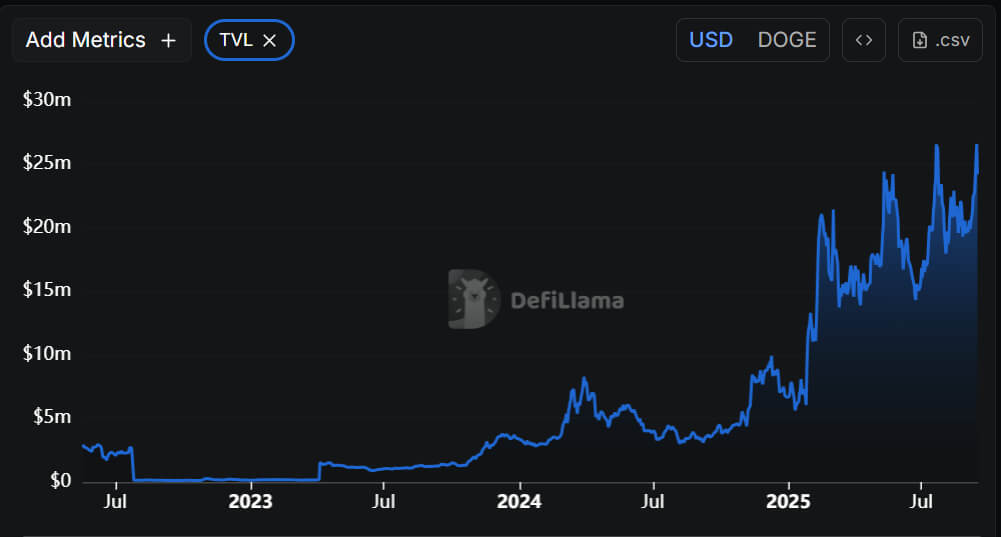

Source: DeFiLlama

Source: DeFiLlama

Data from DeFiLlama (plain text reference) shows Dogecoin’s Total Value Locked (TVL) at $24.23 million, with steady growth since 2024. Derivatives activity has also expanded, as open interest surpassed $6 billion, the highest since December 2024, according to Coinglass (plain text reference).

Rising open interest alongside price indicates capital inflows into new positions rather than liquidations, which supports sustained market momentum. The Market Value to Realized Value ratio stands at 1.35, meaning most holders are in profit. Historical patterns show this level remains below overheated zones, leaving space for further appreciation if momentum holds.

How should traders interpret these signals?

Short-term traders should front-load risk management: use stops below $0.27 and scale into positions on confirmed retests of the breakout. Swing traders can set profit targets near $0.39 and $0.45 while monitoring ETF flow reports and derivatives open interest.

Frequently Asked Questions

What price targets should traders watch for Dogecoin?

Analysts list near-term targets at $0.39 and $0.43–$0.45 following the breakout, with longer-term resistance near $1.40 if logarithmic uptrend momentum continues.

How does ETF approval affect Dogecoin volatility?

ETF approvals typically increase institutional access and liquidity, which can raise both volatility and trend strength as new capital allocates into the asset class.

Key Takeaways

- Breakout confirmed: Weekly close above $0.27 with rising volumes supports continuation.

- Institutional tailwinds: ETF expectations and $6B+ open interest suggest fresh capital inflows.

- Risk management: Use stops below $0.27; targets at $0.39 and $0.45; reassess on TVL and derivatives shifts.

Conclusion

Dogecoin price is showing a technically valid breakout above $0.27, reinforced by tripled trading volumes and expanding open interest. With ETF momentum and supportive market structure, the path toward $0.39–$0.45 is feasible, but traders should manage risk and monitor institutional flows. For ongoing coverage, follow COINOTAG for updates and data-driven analysis.