Figma Q2 revenue strong, adjusted net profit slightly below expectations, shares fall over 14% after hours

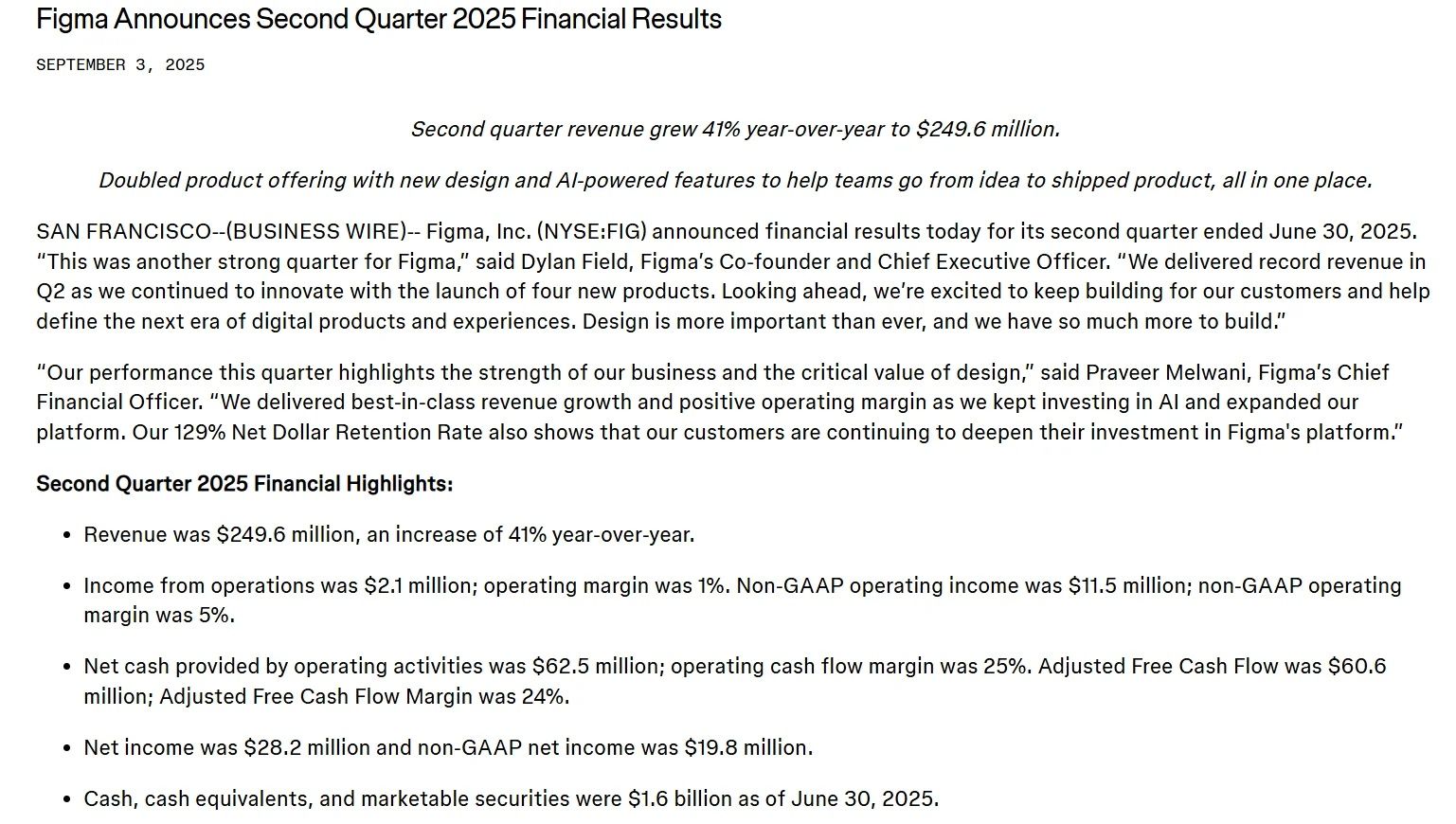

Design software company Figma has released its financial results for the second quarter ending June 30, 2025. The financial report shows: Q2 revenue was $249.6 million, a year-on-year increase of 41%, with adjusted net profit of $11.5 million. Full-year revenue is expected to be between $1.021 billion and $1.025 billion.

Key Financial Highlights for Q2 2025:

Revenue reached $249.6 million, up 41% year-on-year

Operating income was $2.1 million, with an operating margin of 1%;

Non-GAAP operating income was $11.5 million, with a non-GAAP operating margin of 5%

Operating cash flow was $62.5 million, with an operating cash flow margin of 25%

Adjusted free cash flow was $60.6 million, with a free cash flow margin of 24%

Net profit was $28.2 million;

Non-GAAP net profit was $19.8 million, below market expectations of $20.2 million.

As of June 30, 2025, the company held a total of cash, cash equivalents, and marketable securities of $1.6 billion.

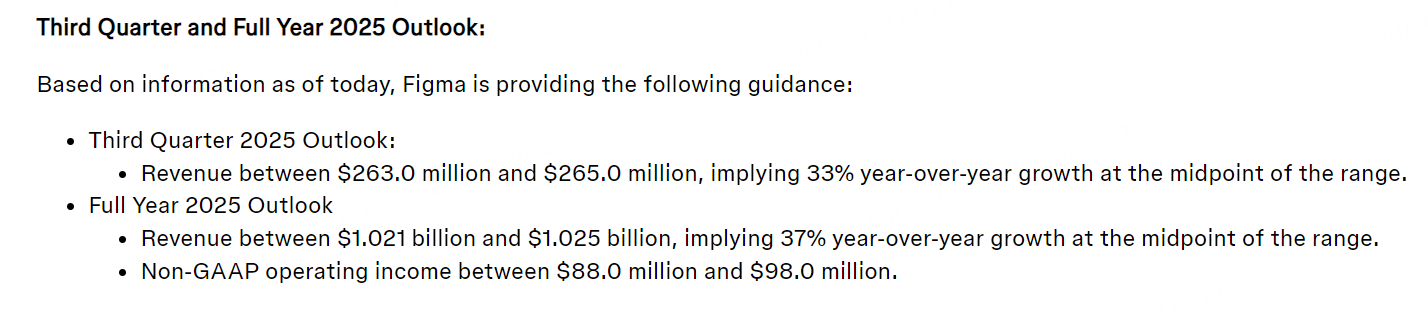

Figma also announced its expectations for the third quarter and full year of 2025:

For the third quarter of 2025, revenue is expected to be between $263 million and $265 million. Based on the midpoint of the range, the year-on-year growth rate is about 33%;

For the full year 2025, revenue is expected to be between $1.021 billion and $1.025 billion, with the midpoint corresponding to a year-on-year growth rate of about 37%;

At the same time, non-GAAP operating profit is expected to be between $88 million and $98 million.

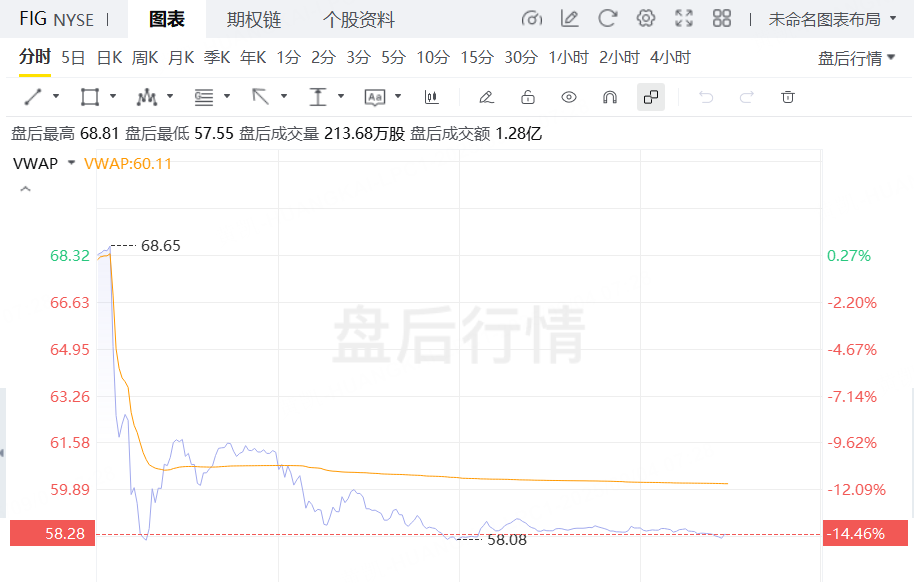

After the financial report was released, Figma's after-hours stock price fell by more than 14%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dragonfly Partner’s heartfelt essay: Reject Cynicism, Embrace Exponential Thinking

The industry's focus is shifting from Silicon Valley to Wall Street, which is a foolish trap.

Vitalik's 256 ETH Bold Gamble: Privacy Communication Needs More Radical Solutions

He made it clear that neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Polymarket: The Rise of Cryptocurrency Prediction Markets