Solana Price Prediction: Can a Fed Rate Cut Push SOL to $240?

Despite high inflation, traders are betting that the Federal Reserve will cut interest rates in September, and Solana is at a critical level.

Solana's price is hovering around $200, just as the US Federal Reserve faces one of its toughest annual decisions. The July PCE inflation report shows that prices are still rising at a pace above the Fed's target, yet traders are heavily betting on a rate cut in September. This mix of sticky inflation, labor market concerns, and market optimism is creating a perfect storm for crypto volatility. For Solana, a coin highly sensitive to liquidity shifts, the Fed's next move could determine whether it breaks out to $240 or falls back into consolidation.

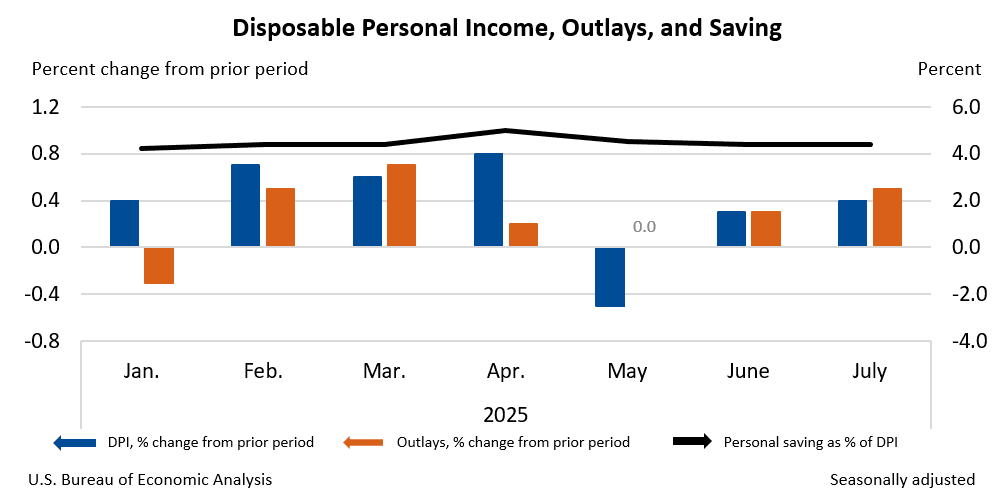

Solana Price Prediction: Inflation Remains Stubborn. Why Does This Matter?

The July PCE report confirms that inflation remains above the Fed's long-term target. Headline PCE held steady at 2.6%, but core PCE rose for the third consecutive month, now reaching 2.9%. This may not seem alarming, but its persistence is exactly what central bankers worry about: despite policy tightening, inflation refuses to cool down.

For crypto traders, this creates a paradox. On one hand, inflation above target usually means higher rates. On the other, Powell and the Fed have hinted that a weakening labor market could outweigh inflation concerns. This tug-of-war makes the September FOMC meeting especially important for Solana's price trajectory.

Solana Price Prediction: Solana Consolidates Near Resistance

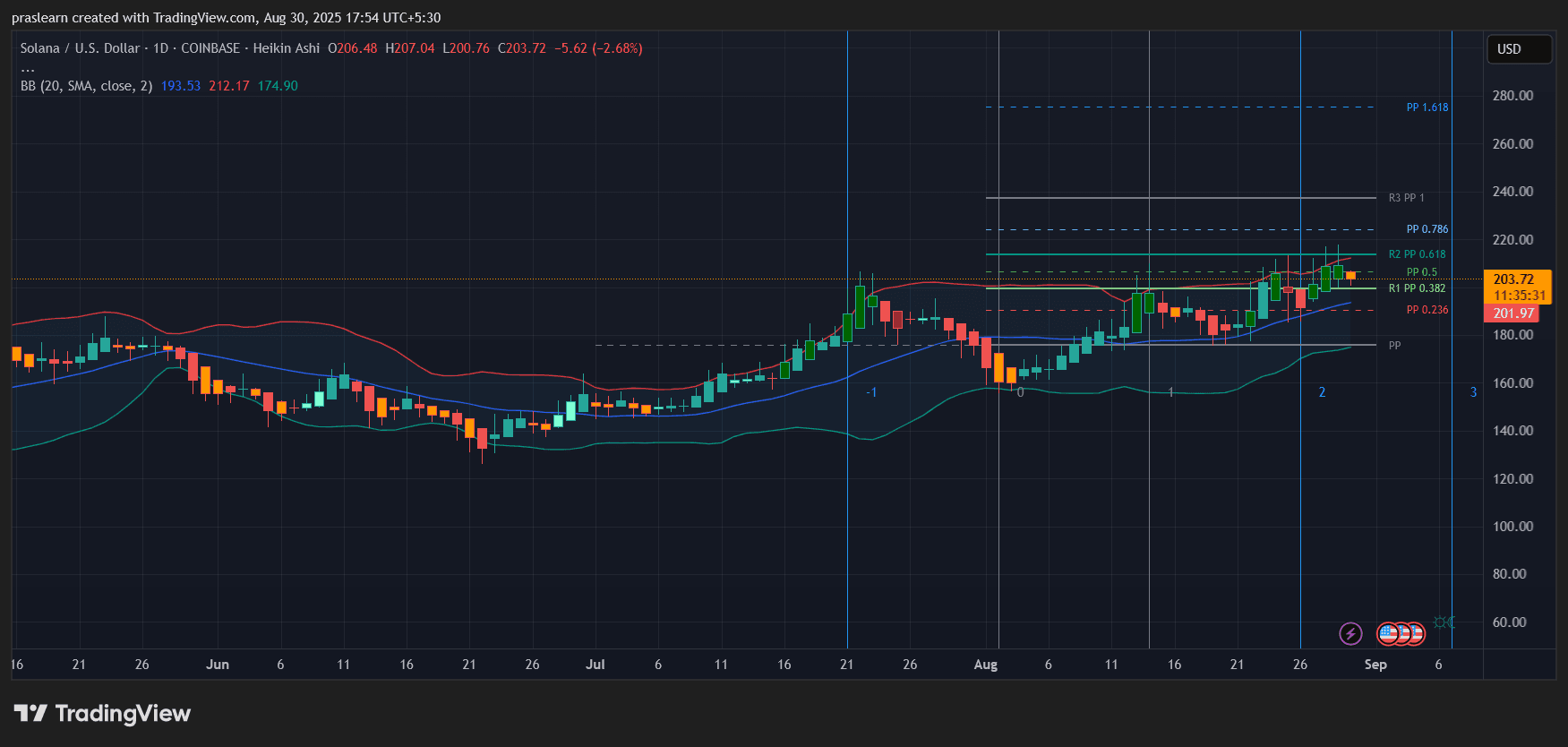

SOL/USD Daily Chart- TradingView

SOL/USD Daily Chart- TradingView Looking at Solana's daily price chart, SOL is trading around $203, hovering below the $212 resistance marked by the upper Bollinger Band and a cluster of pivot resistances. Fibonacci retracement shows key levels at $198 (support) and $220 (major breakout zone). Since mid-July, momentum has been positive, with SOL rebounding from the $160 area, but recent candlesticks show hesitation below resistance.

The 20-day SMA is around $193, providing strong support and indicating buyers are stepping in on dips. If SOL holds this level, it lays the foundation for another rally. A clear breakout above $212-$220 could trigger a move to $240, with $260 as the next extension target.

Market Bets: Traders Move Ahead of the Fed

Despite stubborn inflation, the CME FedWatch tool shows traders see an 87% probability of a rate cut in September. This indicates strong market confidence in a Fed pivot. The market is essentially saying: "Yes, inflation is higher, but the Fed will prioritize growth and jobs."

For Solana, this is bullish in the short term. Rate cuts mean cheaper capital, weaker dollar strength, and more speculative flows into high-growth areas like crypto. But the risks are clear: if the Fed only hints at a single cut or a slower pace, risk assets could sharply pull back.

The Fed's Balancing Act: Inflation vs. Employment

Powell's comments last week have already opened the door to rate cuts, citing a weakening job market. The Fed now faces a credibility test. Cutting too soon could reignite inflation. Waiting too long could see unemployment rise faster than expected. This balancing act injects volatility into every risk asset, and crypto is always the first to react.

For Solana traders, next week's jobs report becomes the catalyst for success or failure. Weak data strengthens the bullish case for a September rate cut, adding momentum to SOL's rally. Strong data complicates matters, potentially keeping Solana's price in the $200-$212 range.

Solana Price Prediction: Why Does Solana React So Strongly?

$Solana is not just another altcoin—it is one of the most liquidity-sensitive Layer 1s. Institutions, funds, and retail all see it as a high-beta proxy for risk appetite. When liquidity is abundant, Solana's price often outperforms Ethereum in percentage gains due to its smaller market cap and higher volatility. Conversely, when liquidity tightens, SOL's price tends to fall more sharply.

This is why the PCE report and Fed outlook matter more to $Solana than most coins. It amplifies macro sentiment, and in a rate-cutting environment, it could be one of the biggest beneficiaries.

Charts and Macro: What's Next for SOL Price?

The chart shows SOL consolidating below the $212 resistance. This fits perfectly with macro uncertainty—the market is waiting for confirmation. A dovish Fed and weak jobs report could be a double trigger, sending SOL above $220 and opening the door to $240 and $260.

On the other hand, if the Fed lowers rate cut expectations, SOL could retest $190, with downside risk pointing to $175. Macro pressures will determine whether this is healthy consolidation or a failed breakout.

The July PCE data confirms one thing: the Fed's job isn't done, and traders are betting on a pivot that may come with strings attached. For $Solana, this environment creates both opportunity and risk. If liquidity returns in September, $SOL could break strongly above $220. But if the Fed pushes back against market expectations, Solana may fall back to its support levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.