5 Reasons Why the Crypto Crash Is Already Underway

The signs are all here. $ Bitcoin is losing momentum, altcoins are bleeding, and BlackRock along with Wall Street whales are quietly exiting. While retail still believes in “to the moon” narratives, the market is already shifting into the final stage of the cycle. Let’s break down the 5 biggest reasons why the crypto crash is underway.

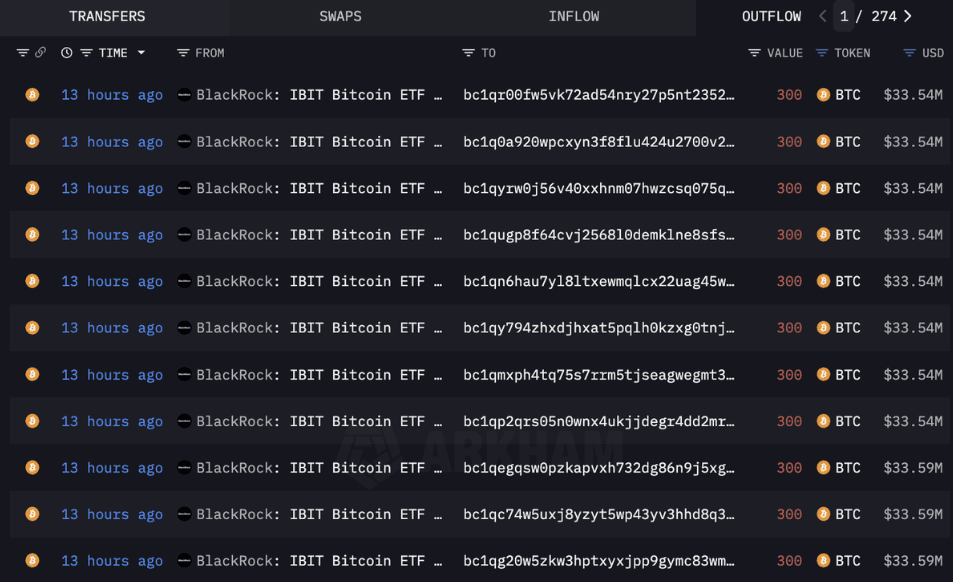

1. BlackRock and Whales Are Selling

The exit has already started. BlackRock isn’t just buying anymore — they’ve begun daily selling, unloading positions onto retail. This is how every cycle ends: whales don’t announce the top, they simply rotate out slowly while retail keeps buying.

2. Smart Money Has Left the Table

The traders who made life-changing gains have already rotated into stablecoins like $USDT. They’ve secured profits and left the market, leaving retail investors as the exit liquidity. By the time most realize it, the door will already be closed.

3. Classic Cycle Top Indicators Are Flashing

The signals are impossible to ignore:

- Bitcoin trading volume is dropping

- Altcoins are failing to follow BTC pumps

- Funding rates are extremely positive

- On-chain wallets are moving coins to exchanges

Every one of these indicators points to a market top.

4. The Retail Trap Is Wide Open

Narratives at the peak are louder than ever:

- “Bitcoin to $500K”

- “Altcoins 100x next month”

- “ETF inflows never stop”

This is exit liquidity marketing. Retail is sold the dream exactly when whales are selling their bags.

5. Altcoins Will Get Wiped Out

History repeats itself every cycle:

- When Bitcoin stalls → alts bleed

- When Bitcoin dumps → alts collapse

Majors typically lose -50%, while small caps fall -90%. It’s the same brutal script, and it’s already starting to play out.

How to Survive the Crash

Don’t wait for the perfect top. Scale out, sell into strength, and rotate profits into stablecoins like $USDT or $USDC. Hold dry powder for the crash and re-enter when fear dominates, not greed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.