LUMIA +239.73% in 24 Hours Amid Sudden Price Surge

- LUMIA surged 239.73% in 24 hours on Aug 30, 2025, closing at $0.29 after a 833.33% 7-day rally. - The spike was driven by increased liquidity and speculative trading, despite no major partnerships or product updates. - Technical indicators show bullish breakouts with RSI in overbought territory, though analysts warn of potential corrections. - Year-to-date losses of 7727.96% and a 354.84% monthly decline highlight persistent long-term bearish trends.

LUMIA experienced a dramatic price surge of 239.73% within 24 hours on August 30, 2025, closing at $0.29. Over the preceding seven days, the token had rallied by 833.33%, signaling a sharp reversal in sentiment following months of decline. While the one-month performance was negative by 354.84%, the recent 24-hour gain has drawn attention from traders and analysts alike, particularly as the long-term trend remains down by 7727.96% year-to-date.

The rapid rise in LUMIA's price was largely attributed to increased liquidity and speculative trading in the wake of recent on-chain activity and limited fundamental developments. No major partnerships, regulatory updates, or product launches were reported, yet the token’s volume and price movement suggest a significant short-term interest from retail and algorithmic traders. Analysts project that the short-term volatility could continue as the market tests the sustainability of the recent rally, but caution that long-term bearish trends remain intact.

Technical indicators show LUMIA breaking above key resistance levels in the past 24 hours, with a bullish breakout on the daily chart. The RSI has moved into overbought territory, while the MACD has crossed into the positive zone, reinforcing the momentum of the upward move. These signals suggest a continuation of the current trend in the immediate term, though analysts caution that the RSI’s overbought condition may signal a potential near-term correction if volume does not sustain the move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

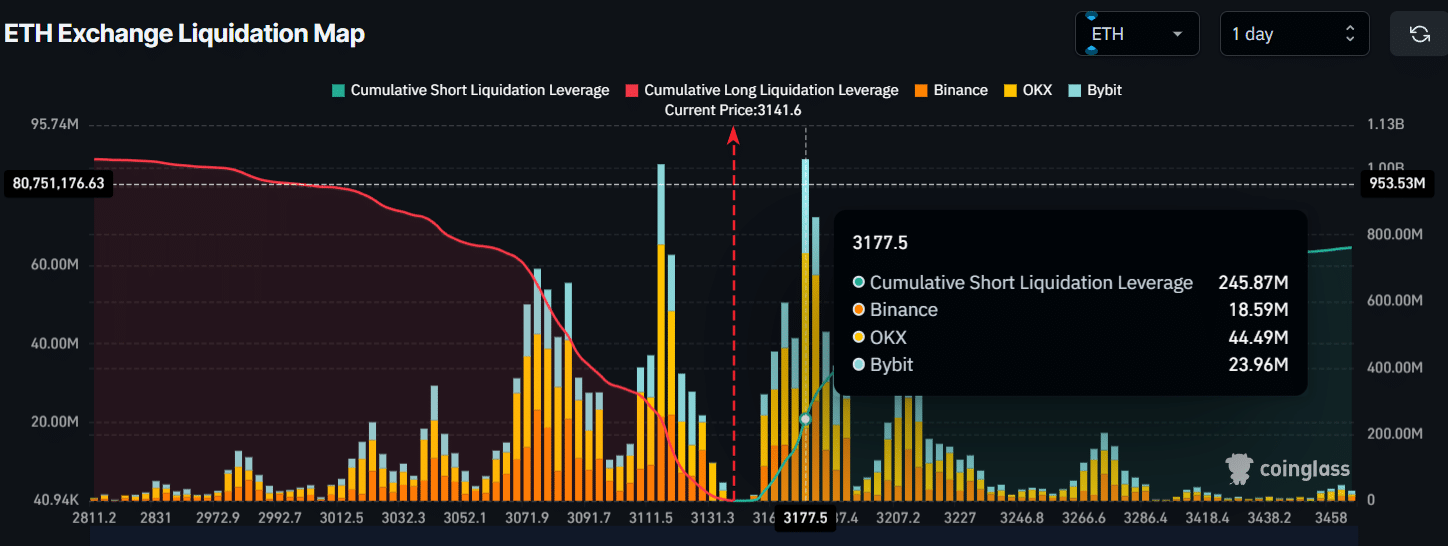

Ethereum is climbing, whales are buying – What happens next?

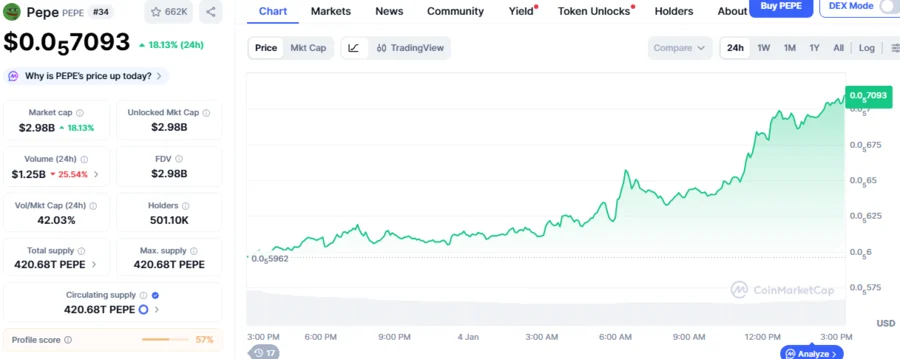

PEPE Eyes Market Rally as Whale Exits ETH, Opens PEPE $12.85 Million Long Position With 3x Leverage

Ripple News: RLUSD Gains Regulatory Backing as Stablecoins Move Toward Bank Oversight

Pi Network News: Can Pi Price Recover If Bitcoin Turns Bullish?