Bitcoin Price Fights Off 10-Day Sell Streak—Are Buyers Gaining Control?

Bitcoin price is battling heavy selling pressure after 10 straight days of inflows into exchanges. While sellers remain active, short-term holder NUPL has dropped to three-month lows, a pattern that previously marked the start of rallies. The next move depends on whether buyers can defend today’s rare outflow.

The Bitcoin price has struggled to break free from selling pressure. Over the last seven days, BTC dipped about 3%. In the last 24 hours, gains have been only 0.3%, and even the hourly chart shows no real movement.

This range-bound action reflects a tug-of-war between buyers and sellers. On-chain data, however, shows one hopeful sign that could decide the next move.

Exchange Flows Show 10 Days of Pressure

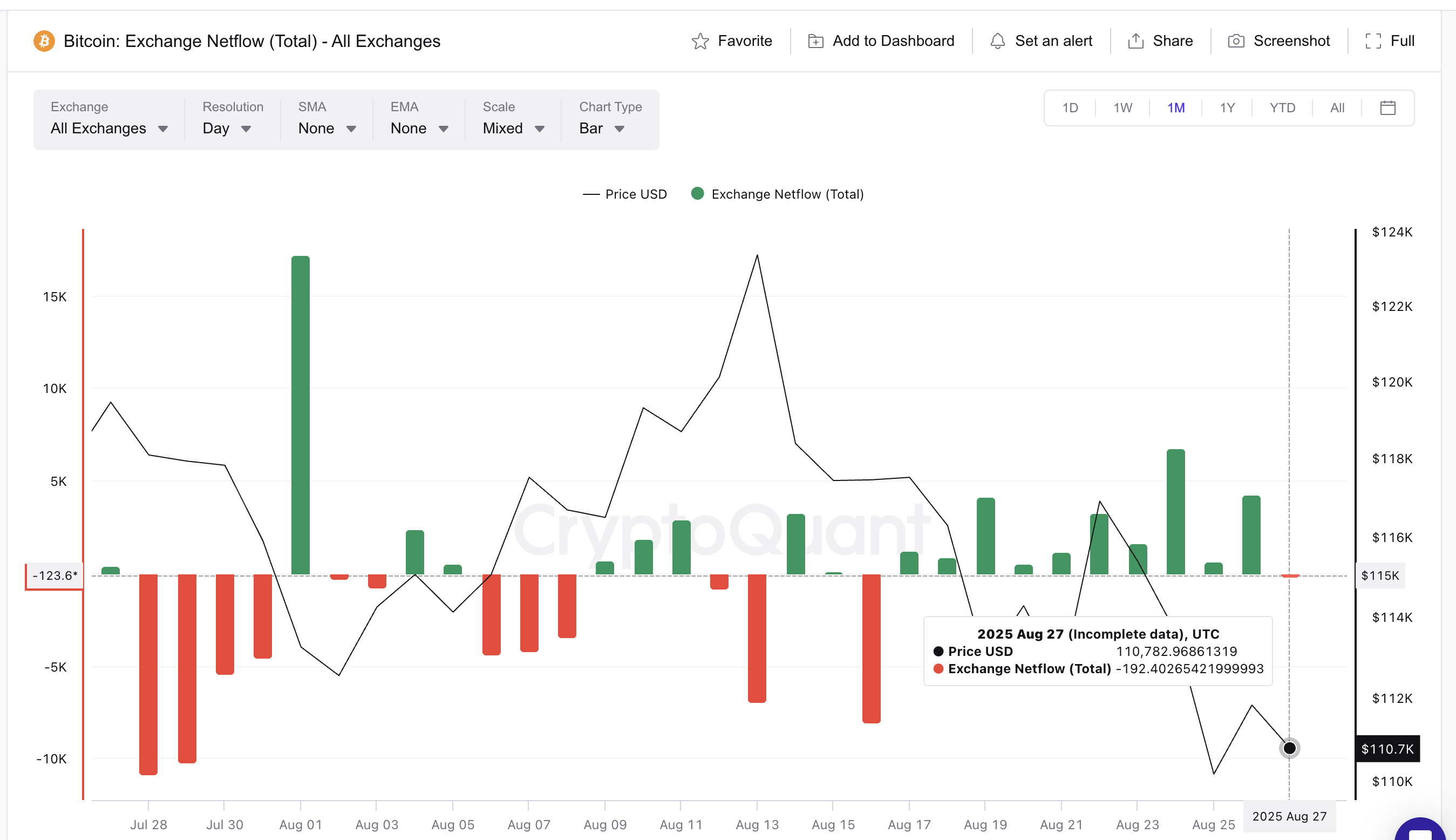

One way to track pressure is through exchange net flows. Positive net flows mean more coins are entering exchanges, often a sign of selling. Negative net flows, or outflows, mean coins are leaving exchanges, which usually signals buying.

Bitcoin inflows have been steady for 10 straight sessions. On August 24, they peaked at 6,775 BTC, one of the largest daily figures in months. Even after that, inflows stayed high — on August 26, the value was still over 4,239 BTC.

Bitcoin Inflow Streak:

Bitcoin Inflow Streak:

For the first time in 10 days, the picture changed slightly today. Net flows have turned marginally red, at –192 BTC. This shows that sellers may finally be losing grip, even if only by a small margin.

At press time, it looks like buyers are trying to take control, but the result is not confirmed. If inflows rise again, the streak could extend to an 11th day, and the selling narrative would remain intact.

Short-Term Holder NUPL Offers a Glimmer of Hope

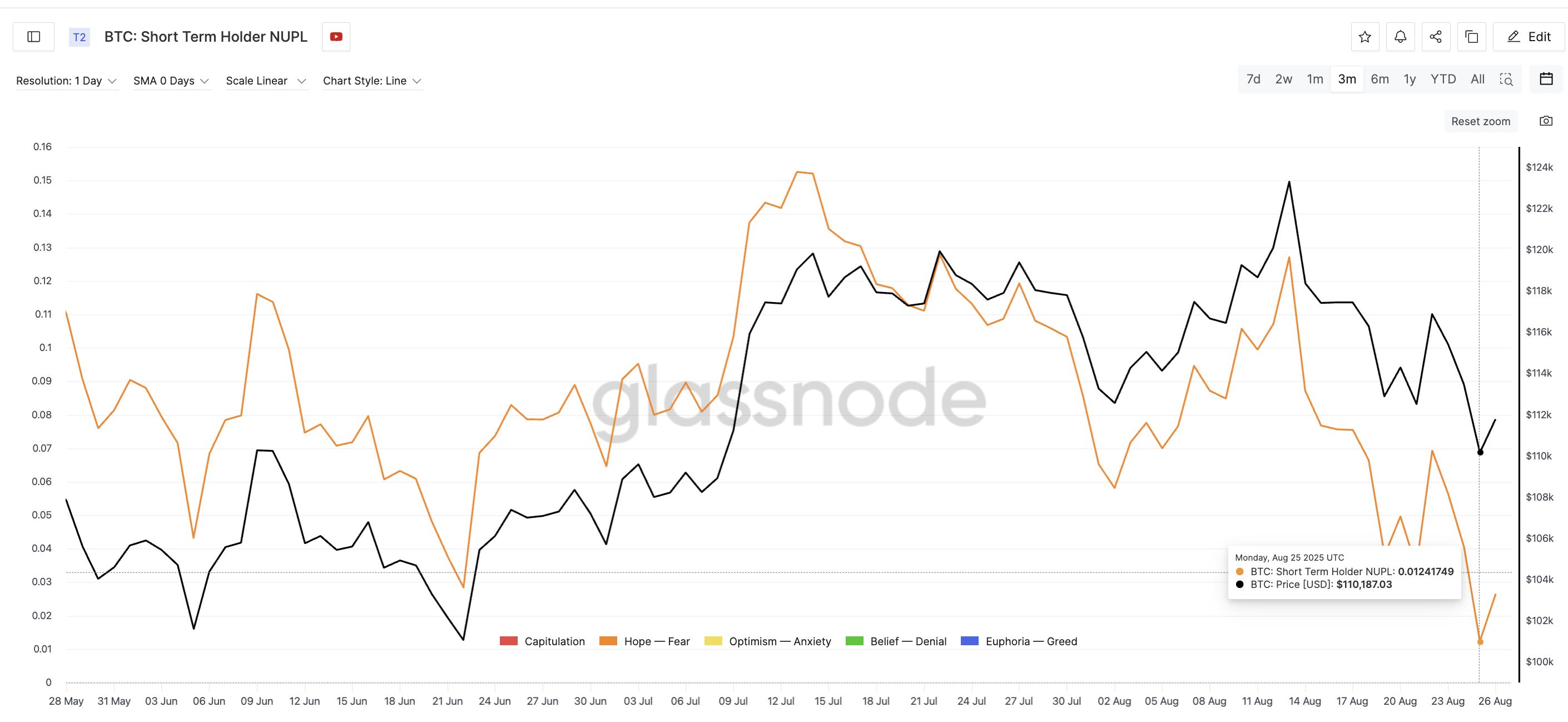

A hopeful signal comes from short-term holders — investors who have owned Bitcoin for less than 155 days. Their activity is tracked using a metric called NUPL (Net Unrealized Profit/Loss). This measures how much profit or loss these holders are sitting on, compared to when they bought.

Bitcoin Price And Short-Term Holder NUPL:

Bitcoin Price And Short-Term Holder NUPL:

Short-term holder NUPL has collapsed by almost 90% in just over 40 days. It fell from a high of 0.152 in mid-July to a low of 0.012 on August 25, its lowest level in three months. It has ticked up slightly since then, to 0.026, but still remains near the bottom.

This is important because each time the short-term holder NUPL dropped to such low levels recently, the Bitcoin price has staged a rebound. On June 5, when the value fell to 0.04, the Bitcoin price rallied from $101,626 to over $110,000. On June 22, at 0.02, prices again climbed soon after.

And on August 2, when the metric touched 0.05, Bitcoin jumped from $112,571 to $123,345.

The same setup is now visible. If the pattern repeats, this could mark the beginning of another Bitcoin price rebound.

Bitcoin Price Levels to Watch

The Bitcoin price is currently trading between $108,600 and $112,300. This tight range shows how balanced the tug-of-war has become.

Bitcoin Price Analysis:

Bitcoin Price Analysis:

If the sellers regain strength and inflows rise for an 11th day, Bitcoin could break below $108,600. That would open the way for deeper losses.

However, if buyers defend today’s small outflow and NUPL patterns repeat, the first target remains a clean close above $112,300. Above that, Bitcoin could extend toward $116,500, and then $118,400, which would be the levels to beat for a bigger upside move.

For now, Bitcoin is caught between continued selling pressure and a single hopeful signal from short-term holders. If the inflow streak breaks, the bulls may finally get their chance to push higher. If not, another leg down may be on the cards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan sees first decline in cash in circulation in 18 years in 2025 as BOJ ends stimulus measures

Ledger Customers Face Renewed Privacy Risks After Global-e Data Exposure

$VIRTUAL Surges to Top of Crypto Gainers: Here’s What Sparked the Run

EUR/JPY Outlook: Advances toward 183.50 amid BoJ rate hike ambiguity, bullish momentum remains