Metaplanet’s upgrade to the FTSE Japan Index redirects passive capital into Bitcoin markets by creating indirect BTC exposure for index trackers and large funds. This increases demand-side support for BTC floor prices and ties Metaplanet’s stock flows to broader institutional passive allocations.

-

Index inclusion channels passive capital into BTC exposure

-

Metaplanet holds 18,888 BTC and is now part of major FTSE indices after a mid-cap upgrade.

-

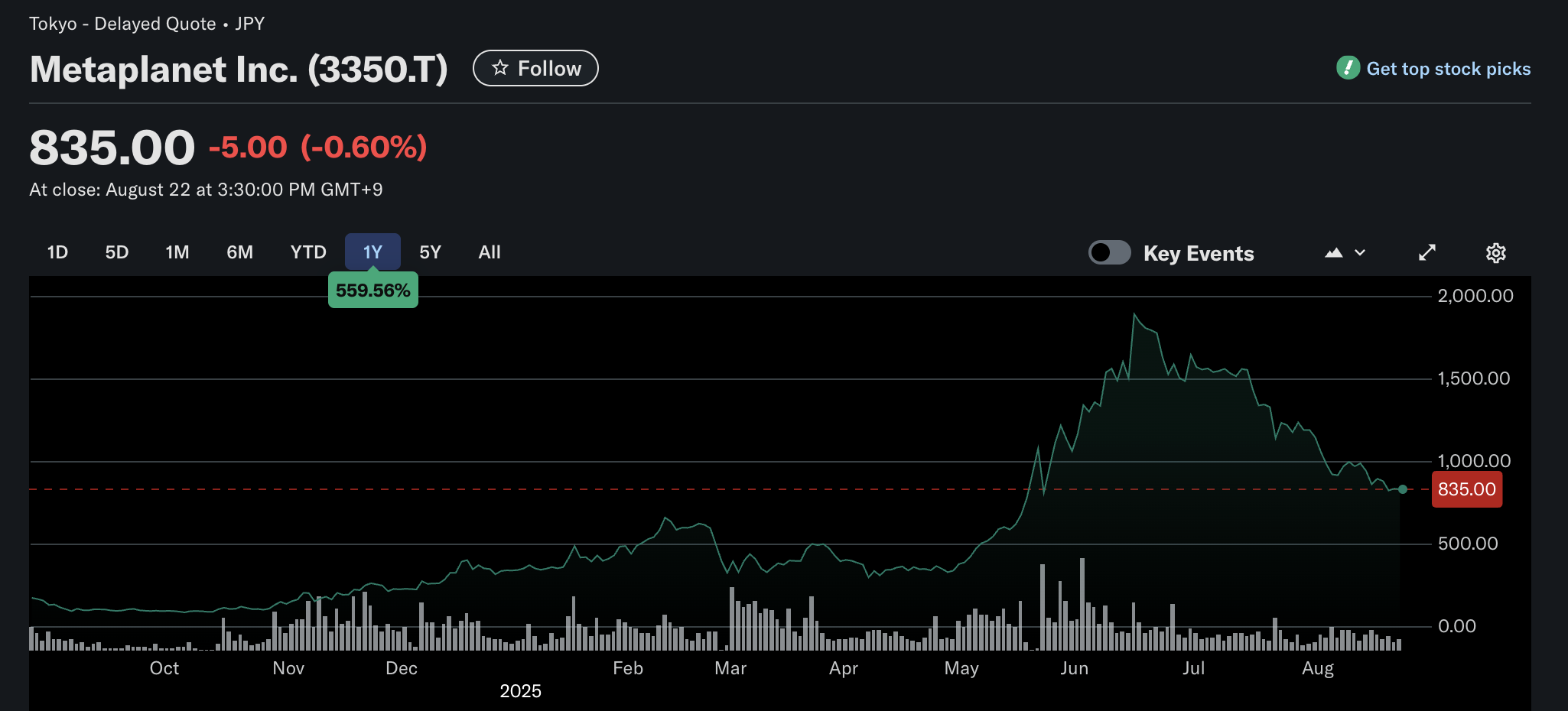

Year-to-date gains ~187% vs TOPIX Core 30’s 7.2% YTD; company targets 210,000 BTC by 2027.

Metaplanet Bitcoin treasury company upgraded to FTSE Japan Index, boosting BTC exposure for passive investors—read how this impacts Bitcoin demand and markets. Learn more.

The inclusion of Metaplanet in major FTSE indices is expected to funnel passive capital flows into the Bitcoin market, supporting BTC floor prices and broadening institutional exposure to Bitcoin through equity index allocations.

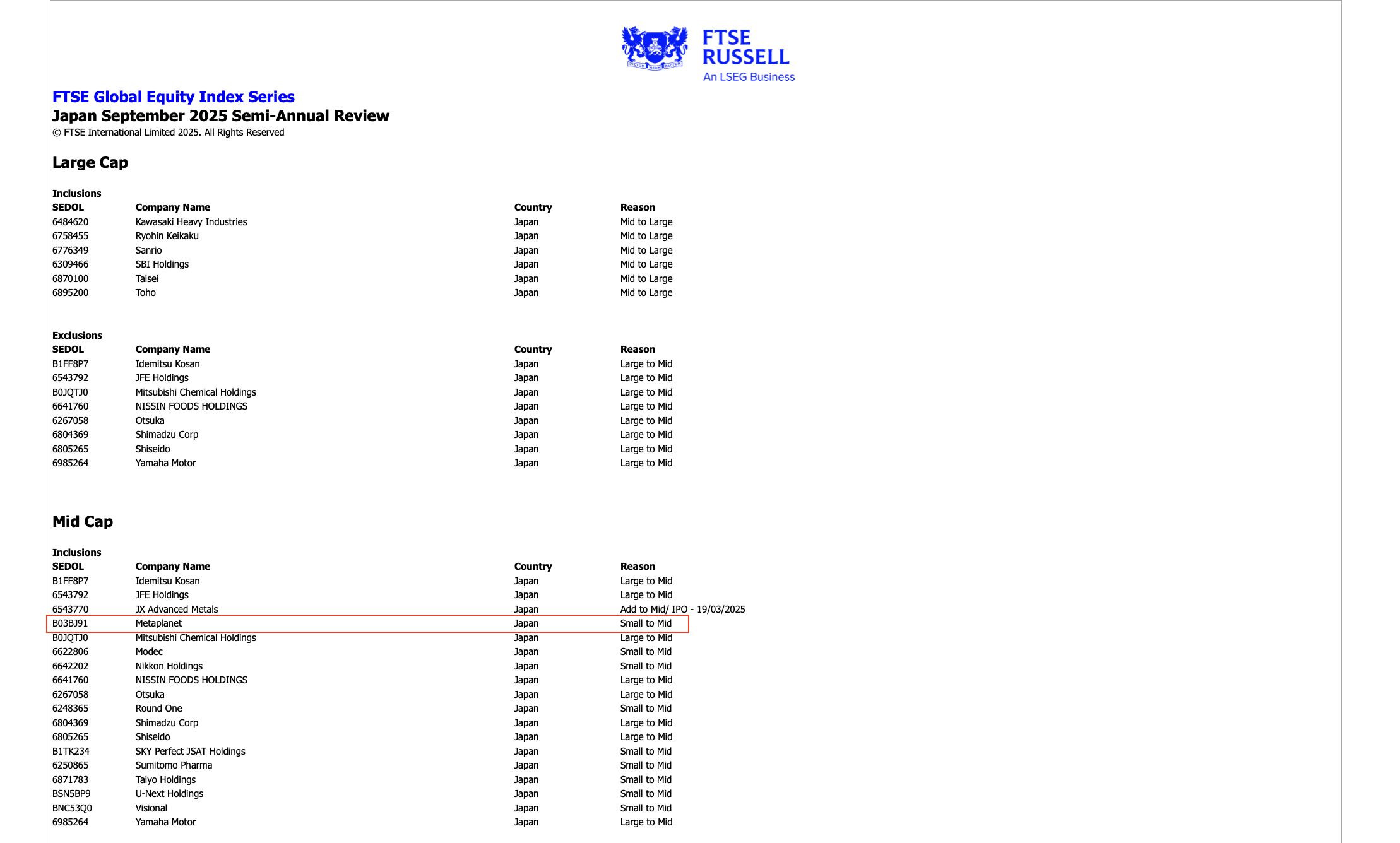

Metaplanet, a Bitcoin treasury company, was upgraded from small-cap to mid-cap in FTSE Russell’s September 2025 Semi-Annual Review and added to the FTSE Japan Index. The FTSE rebalances quarterly; the upgrade followed Metaplanet’s strong Q2 performance and elevated market capitalization.

Inclusion in the FTSE Japan Index also qualifies Metaplanet for the FTSE All-World Index, increasing visibility among global passive funds and ETF replication strategies that track FTSE benchmarks.

The FTSE Global Equity Index Series semi-annual review upgraded Metaplanet from a small-cap stock to a mid-cap stock. Source: FTSE Russell

The FTSE Global Equity Index Series semi-annual review upgraded Metaplanet from a small-cap stock to a mid-cap stock. Source: FTSE Russell

How does Metaplanet’s FTSE Japan Index inclusion affect Bitcoin markets?

Metaplanet’s inclusion increases passive investor exposure to Bitcoin because index-tracking funds will now hold the company’s stock, indirectly linking equity flows to BTC demand. This mechanism can provide consistent buying pressure that supports BTC’s price floor over time.

What are Metaplanet’s current Bitcoin holdings and growth targets?

Metaplanet currently holds 18,888 BTC in its corporate treasury, ranking it among the largest public holders. The company reported YTD gains of ~187% as of August, outpacing the TOPIX Core 30’s 7.2% YTD return. Executives have set a target to accumulate 210,000 BTC by 2027.

Originally a hotel operator, Metaplanet rebranded as a Bitcoin treasury company in 2024. Management has signaled plans to redeploy part of the BTC reserve into income-generating acquisitions, including potential targets such as a digital bank or businesses adjacent to digital assets and payments.

Metaplanet 1-year stock performance, measured in Japanese yen. Source: Yahoo Finance

Metaplanet 1-year stock performance, measured in Japanese yen. Source: Yahoo Finance

Why does index inclusion matter for passive capital flows?

Index inclusion matters because many institutional and retail investment products replicate major benchmarks. When a company enters an index, index-tracking funds and ETFs must buy the stock to maintain accurate weighting. This creates predictable, recurring demand unrelated to company-level fundamentals.

How large could the passive flow impact be?

Quantifying exact flows depends on index weighting and total assets tracking the index. However, the incremental demand is amplified when a company like Metaplanet is promoted to indices with global fund coverage, because large-cap and all-world indices aggregate substantial passive assets across regions.

Frequently Asked Questions

How does Metaplanet compare to other public Bitcoin holders?

Metaplanet’s 18,888 BTC places it among the top publicly traded corporate holders by BTC amount. It surpasses several larger-name corporations in BTC holdings and is Japan’s largest BTC treasury company by holdings, according to publicly available treasuries data.

Will index inclusion force Metaplanet to sell Bitcoin?

Index inclusion itself does not mandate selling BTC. Company capital allocation decisions remain at management discretion. Metaplanet has indicated potential redeployment of part of its BTC into income-generating businesses, not large-scale BTC sales to meet index obligations.

Key Takeaways

- Index flows matter: Inclusion in FTSE indices creates passive demand channels that can bolster BTC support.

- Significant BTC holdings: Metaplanet holds 18,888 BTC and targets 210,000 BTC by 2027, expanding its treasury scale.

- Strategic redeployment: Management plans to use part of its BTC for acquisitions, potentially increasing income-generating assets.

Conclusion

Metaplanet’s upgrade to the FTSE Japan Index strengthens the link between traditional passive capital and Bitcoin exposure. The company’s large BTC treasury and ambitious accumulation target amplify the potential market impact of index-driven flows. Watch index rebalances and treasury updates for signals on sustained BTC demand from equity allocations.