Whale Indicators Show a New Price Direction For Bitcoin

Bitcoin price faces key resistance as whale selling pressure eases and HODL waves show fresh accumulation.

Bitcoin price rose 2.5% over the past 24 hours, trading near $115,700, but it still trails Ethereum and others that have already pushed to new highs.

Despite being almost 7% below its peak, several key on-chain and technical signals suggest the setup for a breakout is forming, much like the rally seen earlier this month.

Whale Selling Pressure Is Weakening

For weeks, the Bitcoin price lagged behind as whales rotated capital into other assets, leaving retail buyers to drive much of the move.

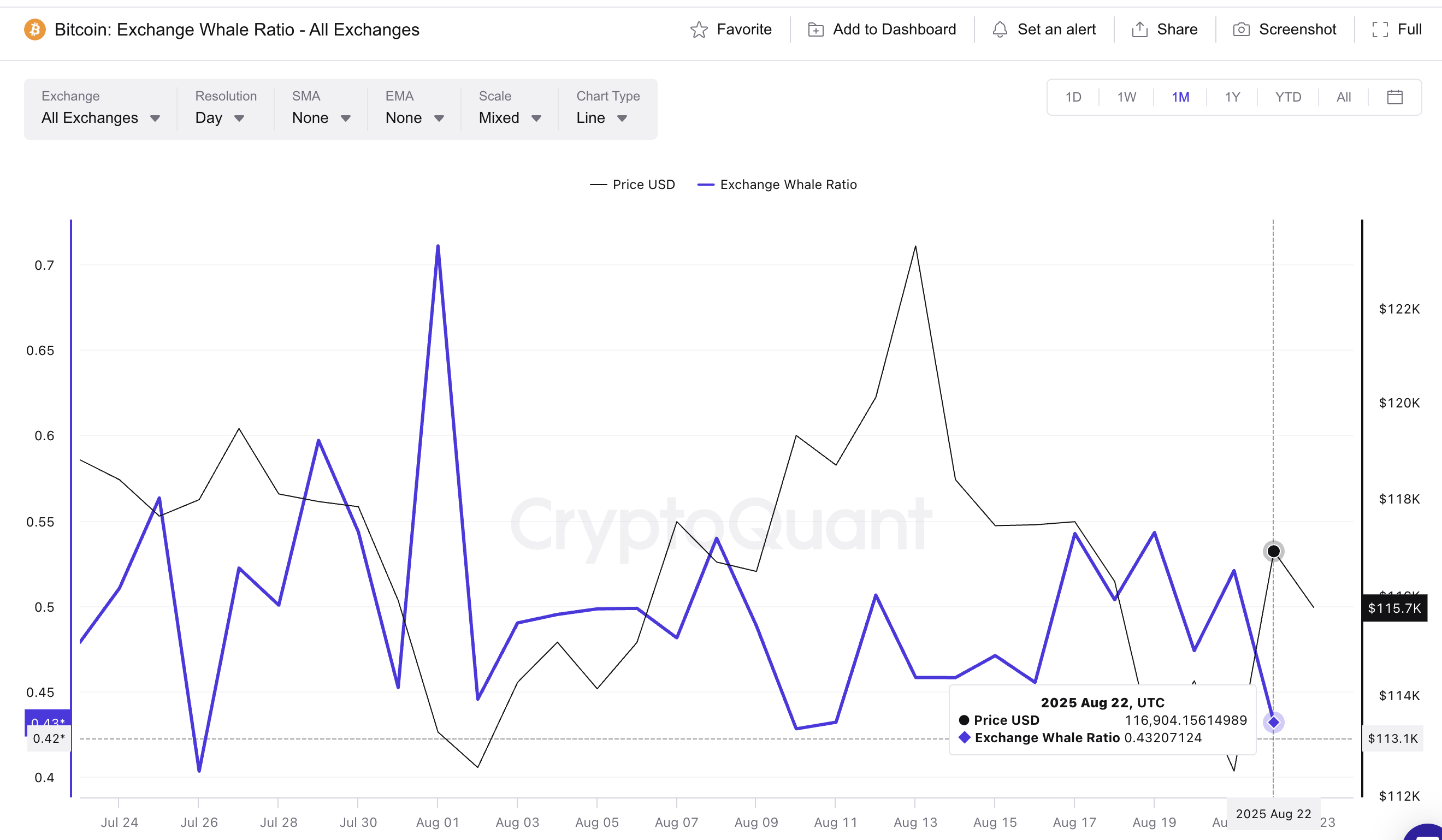

That made it critical to track whether whales were finally slowing their selling. The Exchange Whale Ratio, which measures the share of the top 10 inflows compared to all inflows to exchanges, provides that signal.

Bitcoin Whales are Now Selling Fewer Tokens:

Bitcoin Whales are Now Selling Fewer Tokens:

This ratio has fallen from 0.54 on August 19 to 0.43 on August 22, its lowest in nearly two weeks. A similar drop occurred on August 10, when the ratio fell to 0.42. That move preceded a sharp rally in Bitcoin from $119,305 to $124,000 — a gain of roughly 3.9%.

If history repeats, the current setup could open the door for a similar upside extension, arguably towards a new all-time high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

HODL Waves Point to Accumulation

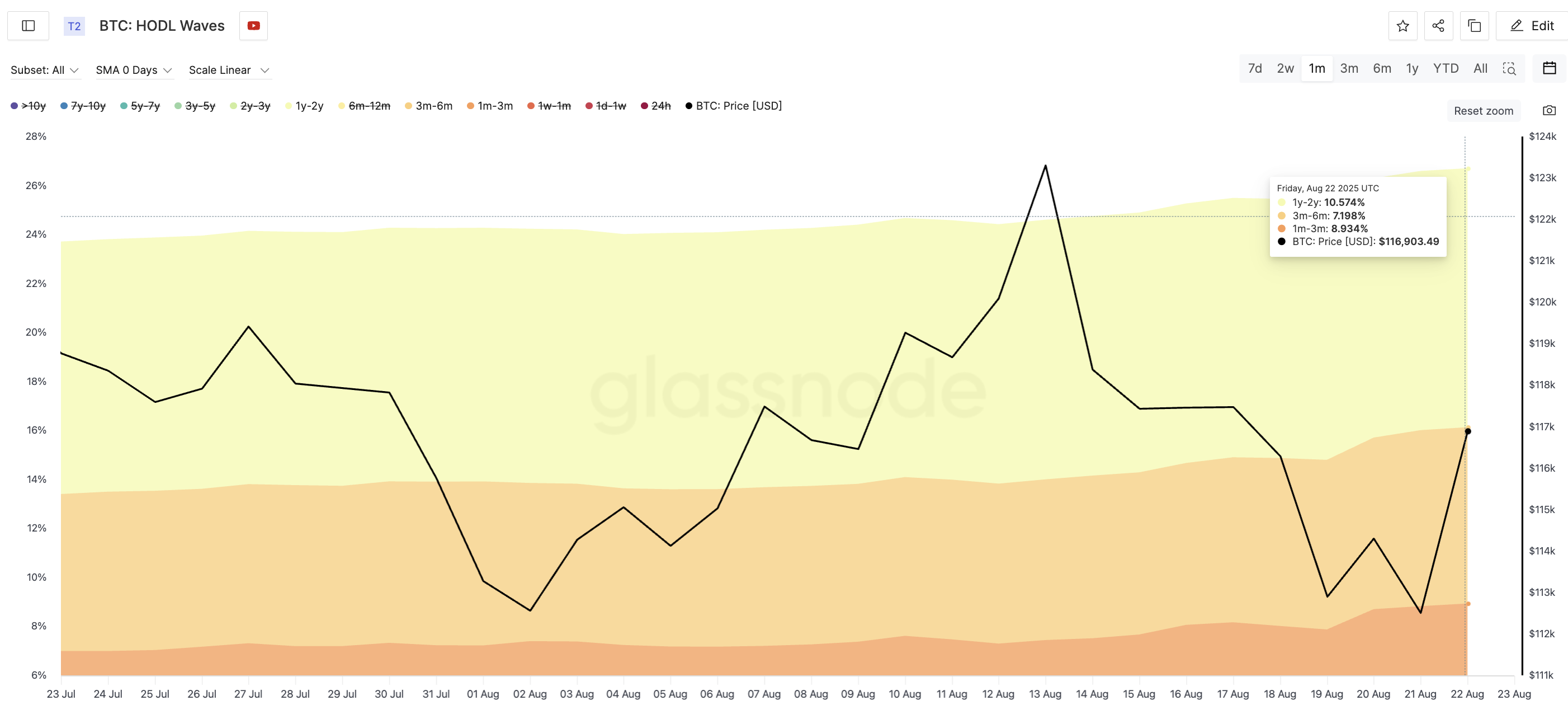

With BTC selling pressure easing, the next question is whether mid-term and long-term holders are accumulating. The HODL Waves metric tracks the percentage of Bitcoin supply held across age bands.

Bitcoin Buying Pressure Intensifies:

Bitcoin Buying Pressure Intensifies:

Over the past month, key cohorts have expanded their positions:

- 1y–2y wallets rose from 10.31% to 10.57%

- 3m–6m wallets climbed from 6.40% to 7.19%

- 1m–3m wallets grew from 6.99% to 8.93%

This broad accumulation during volatility suggests that conviction is there. Combined with lower whale exchange flows, the structure points to a market that is gearing up for a Bitcoin price breakout.

Bitcoin Price Levels Define the Breakout Path

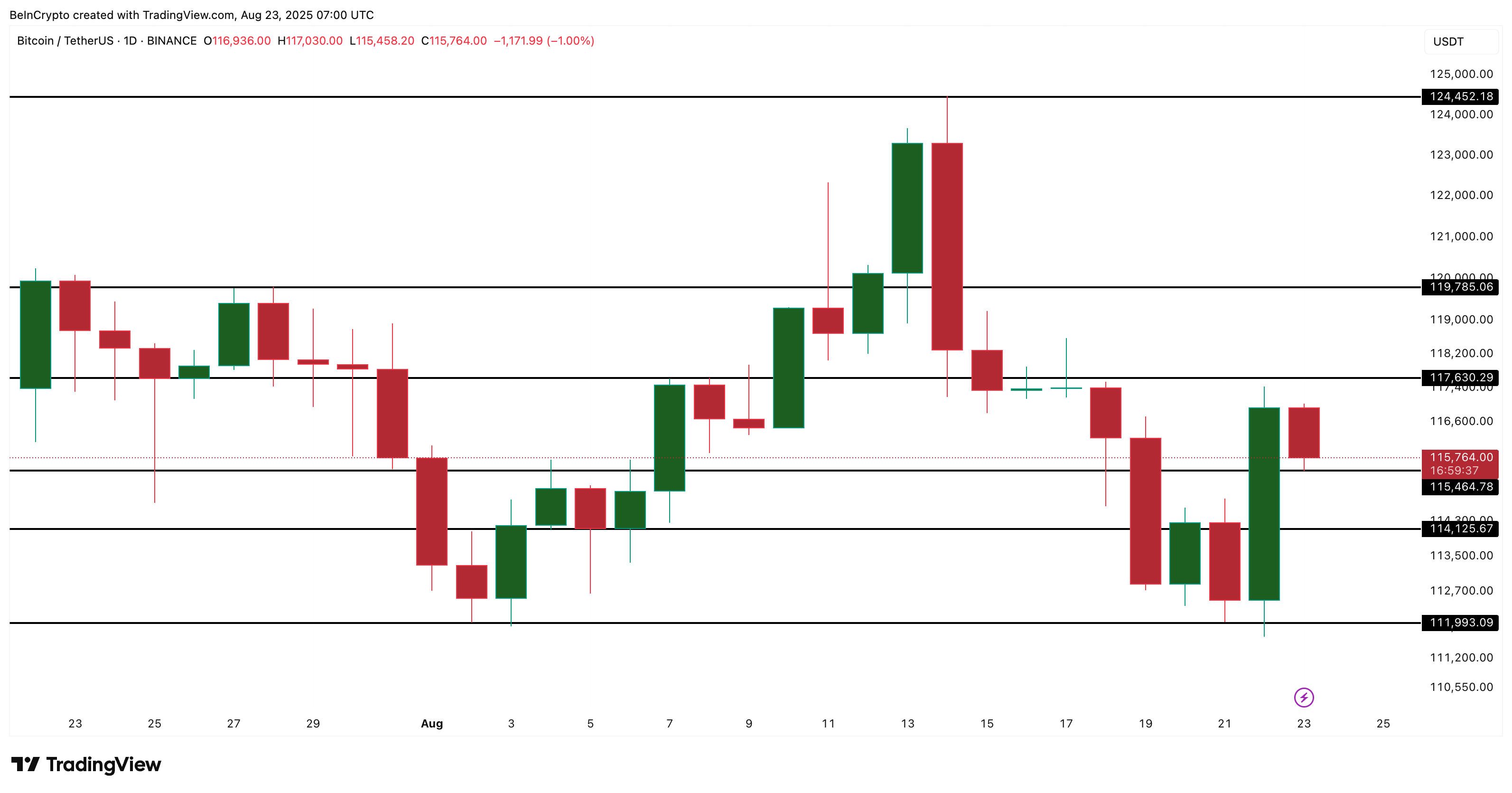

The technical picture ties these signals together. Bitcoin currently trades just above strong support at $115,400. A critical resistance lies at $117,600, with $119,700 acting as the key breakout trigger for the Bitcoin price to push towards and even beyond its all-time high.

Bitcoin Price Analysis:

Bitcoin Price Analysis:

On the other hand, a slip below $114,100, and especially $111,900, would shift the momentum bearish in the short-term

If the exchange whale ratio repeats its August 10th pattern, the Bitcoin price could climb nearly 4% from current levels. That would push the price past $119,000, directly into breakout territory.

From there, the stage would be set for a retest of the all-time high, validating the idea that this rally is delayed, not denied.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.