Matrixdock’s tokenized dold XAUm launches on Sui

Matrixdock has launched its flagship gold-backed token, XAUm, on the Sui blockchain, marking the first issuance of XAUm on a non-EVM chain.

- XAUm is backed 1:1 by LBMA-accredited gold of 99.99% purity and audited by Bureau Veritas.

- The Sui blockchain was chosen for its parallel execution, sub-second finality, and horizontally scalable infrastructure.

Matrixdock, Asia’s leading RWA tokenization platform under Matrixport Group, has officially launched its flagship tokenized gold product XAUm, on the Sui ( SUI ) blockchain — marking the first time XAUm will be issued on a non-EVM chain.

“By bringing gold onchain, XAUm transforms a traditionally static asset into one with expanded digital utility,” said Eva Meng, Head of Matrixdock. “We’re excited to expand XAUm to Sui, a blockchain purpose-built for scalability .”

“Tokenized assets are rewiring global finance, and XAUm on Sui is a powerful example of Sui being at the forefront of this wave of innovation,” commented Christian Thompson, Managing Director of the Sui Foundation.

Matrixdock selected the Sui blockchain for the XAUm launch because of its advanced technical architecture and growing user base. The blockchain’s parallel execution, sub-second finality, and horizontally scalable infrastructure make it ideal for fast, cost-efficient, and high-throughput tokenized asset transactions.

About XAUm

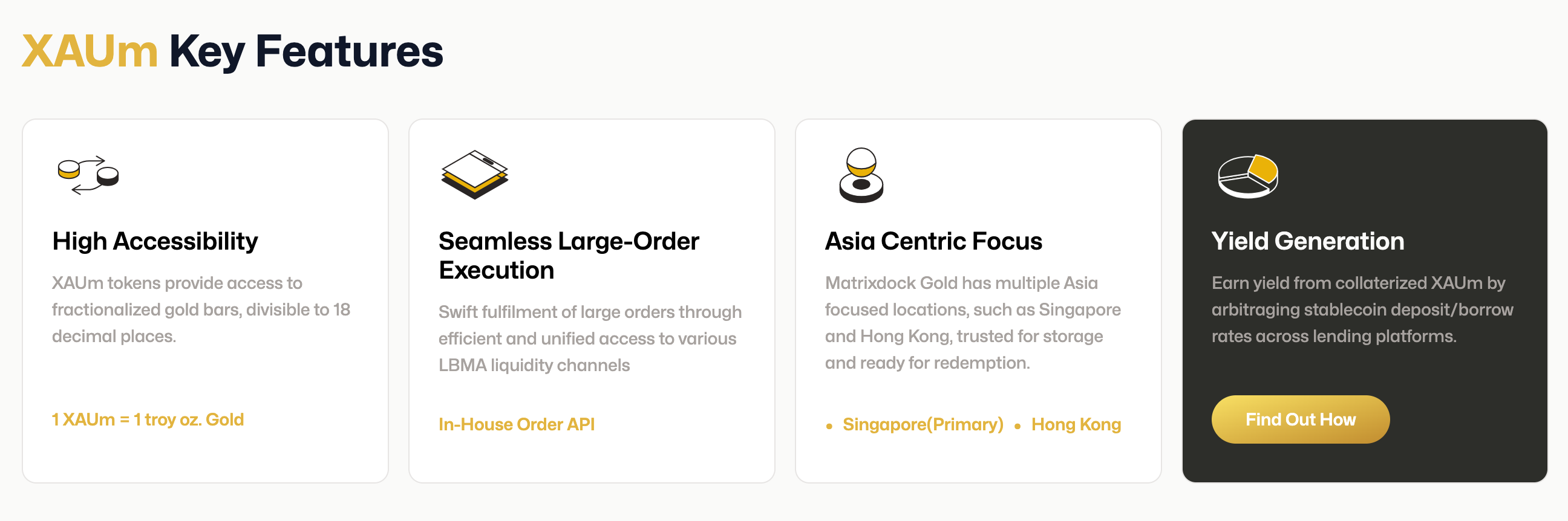

XAUm enables users to hold, trade, lend, and redeem institutional-grade physical gold, combining the stability of tangible gold with the speed and transparency of blockchain technology.

The token is fully backed 1:1 by London Bullion Market Association (LBMA)-accredited gold of 99.99% purity and undergoes rigorous audits by Bureau Veritas. Its H1 2025 physical gold reserve audit report is publicly available .

Source: matrixdock.com

Source: matrixdock.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A $500 billion valuation giant is emerging

With a valuation comparable to OpenAI and surpassing SpaceX and ByteDance, Tether has attracted significant attention.

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

Why does bitcoin only rise when the U.S. government reopens?

The US government shutdown has entered its 36th day, leading to a decline in global financial markets. The shutdown has prevented funds from being released from the Treasury General Account (TGA), draining market liquidity and triggering a liquidity crisis. Interbank lending rates have soared, while default rates on commercial real estate and auto loans have risen, increasing systemic risk. The market is divided over future trends: pessimists believe the liquidity shock will persist, while optimists expect a liquidity release after the shutdown ends. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model is updated.

Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."