VanEck Predicts Bitcoin Could Reach THIS NUMBER by End of 2025

VanEck’s Bold Bitcoin Prediction Call

Asset manager VanEck , with $133 billion under management, has projected that $ Bitcoin could climb to $180,000 by the end of 2025. This prediction comes after its Q1 2025 forecast failed to materialize, as volatility and macroeconomic headwinds stalled Bitcoin’s rally.

At today’s price of $115,000, the target implies a 55% upside within 16 months.

Why Analysts Remain Bullish

Despite past missteps, VanEck’s outlook aligns with broader optimism among analysts . Some, like Tom Lee , have even put forward a $250,000 target, citing accelerating ETF inflows, institutional adoption, and a tightening supply post-halving.

The bull case centers on:

- Strong ETF inflows pushing liquidity higher.

- Broader adoption from institutions and retail.

- Halving-driven scarcity keeping supply shock alive.

The Risks That Could Derail the Rally

While the upside potential is huge, several risks temper expectations:

- Macroeconomic uncertainty, including inflation and Fed policy.

- Geopolitical instability, which could drive investors toward or away from risk assets.

- Profit-taking behavior, as Bitcoin has already quadrupled in two years.

These risks make a straight-line rally unlikely, with corrections expected along the way.

Probability Outlook: 35–45% Chance

Based on current conditions, the likelihood of Bitcoin reaching $180,000 by December 2025 sits around 35–45%. While ETF demand and adoption could push BTC higher, macro and regulatory risks remain a counterweight.

Still, for long-term investors, the trend remains intact: Bitcoin continues to cement its role as a major global asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

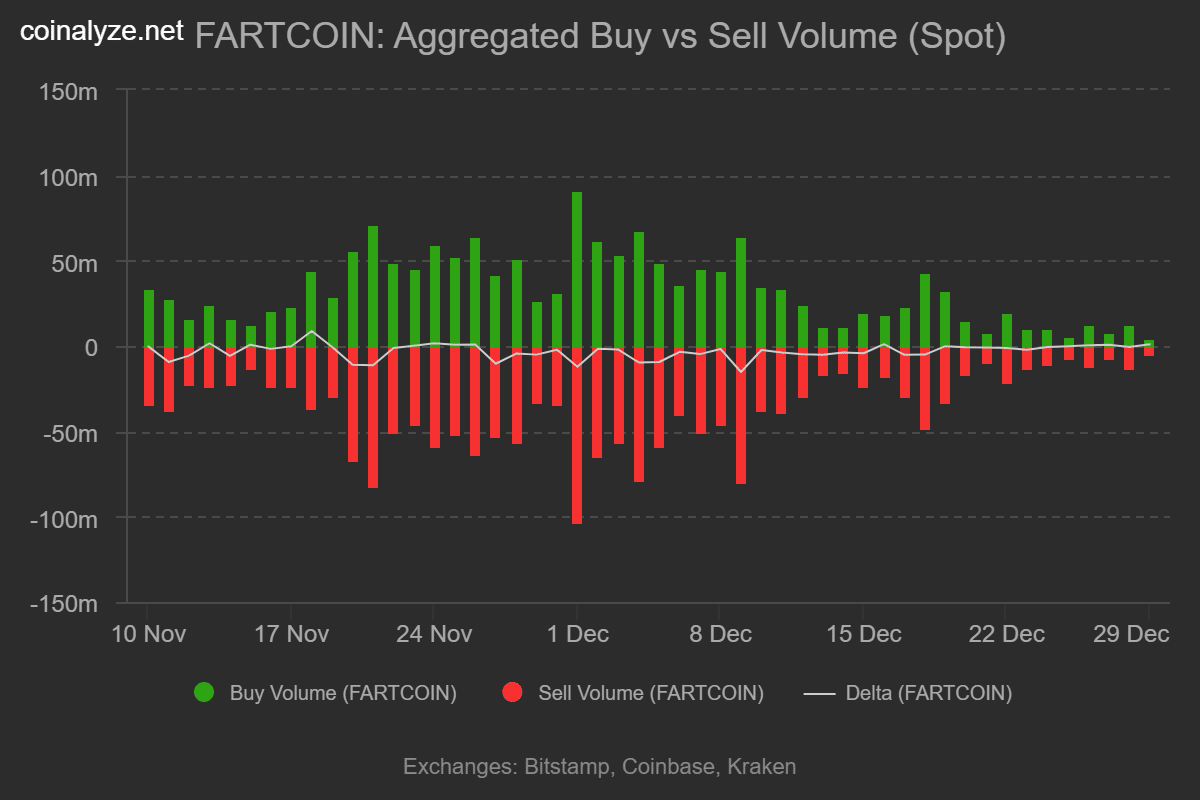

FARTCOIN sees $2.66mln whale buying – Is $0.36 back on table?

Bitcoin 2026 Prediction: Galaxy Digital CEO Reveals Crucial Catalyst for Major Rally

SEC Crypto Enforcement: Waters’ Scathing Critique Exposes Regulatory Retreat

SEC Crypto Regulation Pioneer Cicely LaMothe Concludes Pivotal Term, Leaving Lasting Legacy