HBAR Price Shrugs Off ETF Hype, Yet Flashes Hidden Bullishness Amid Dip Buying

HBAR price is down 9% this week, but whales are loading up. ETF rumors and chart patterns hint at a breakout.

HBAR has fallen nearly 9% over the past week, and even in the last 24 hours, the price is down another 4%, despite swirling rumors that BlackRock may soon file for an HBAR ETF. If true, it would be the third major fund tied to HBAR, after those listed by Canary and Grayscale.

But so far, the market hasn’t reacted with any of the typical ETF-driven euphoria. Instead of surging, HBAR continues to correct, but under the surface, something bullish is brewing, and it starts with whale wallets.

Whales Buy the Dip as Price Quietly Drops

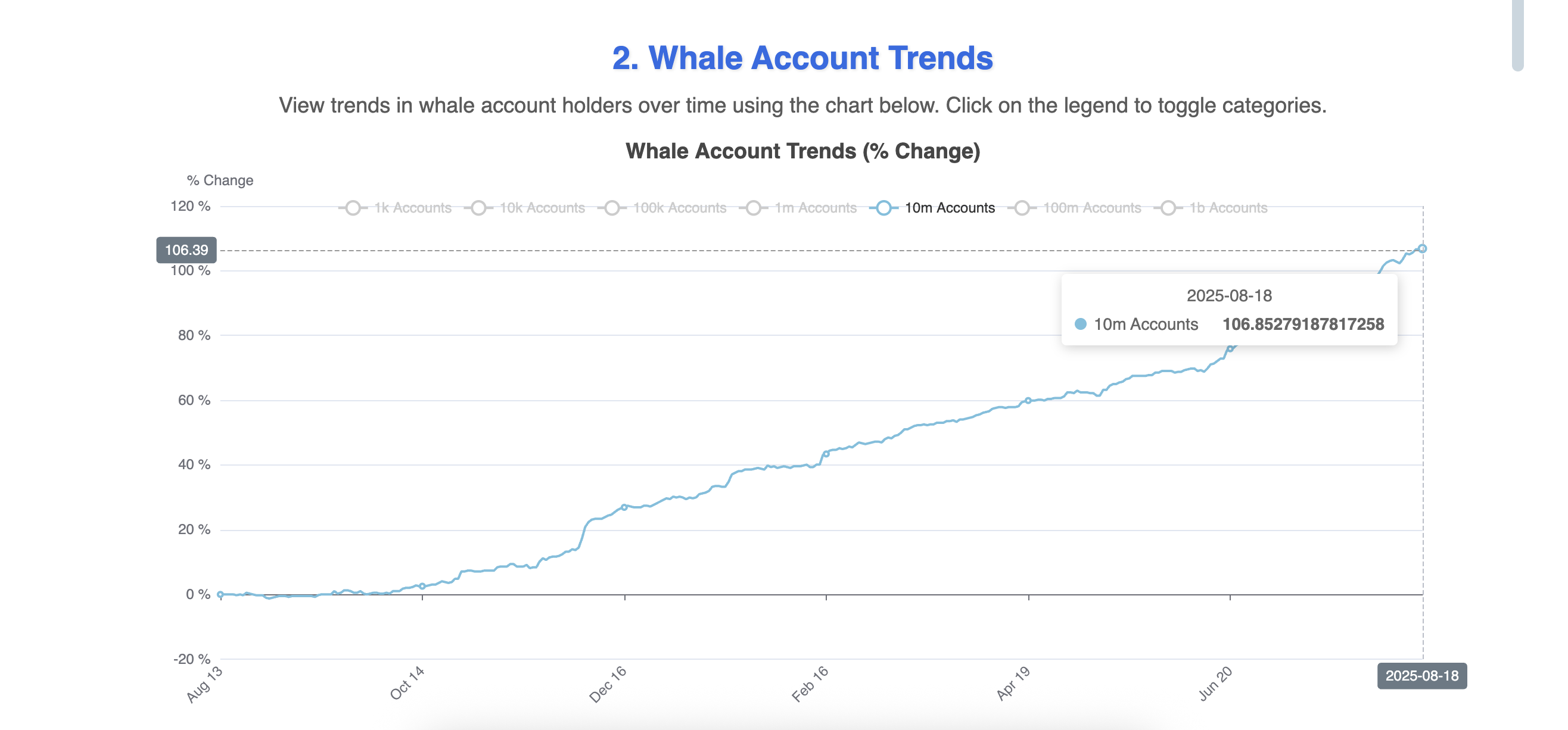

Between August 11 and August 18, wallets holding 10 million or more HBAR increased from 102.28 to 106.85; a rise of 4.57 wallets, which translates to at least 45.7 million HBAR in net accumulation.

HBAR whales keep accumulating:

HBAR whales keep accumulating:

The buying took place while the HBAR price dropped from $0.26 to $0.24, a fall of around 8%. In other words, while most of the market was panicking or staying on the sidelines, this heavyweight cohort loaded up on tokens.

The move suggests high-conviction buying during weakness, possibly in anticipation of the ETF rumors materializing or a technical setup forming.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Two Bullish HBAR Price Patterns Are Now in Play

It is worth noting that the daily HBAR price chart (on a shorter time frame) shows a stalemate-like scenario between the bulls and bears, leading to the range-bound movement. The cohort that comes out on top would determine the next leg of the price action.

The Bull Bear Power (BBP) indicator measures the difference between the high and low prices relative to a moving average, indicating whether bulls or bears are currently stronger. In this case, the indicator reflects a stalemate, with neither side clearly dominating.

HBAR price and the bull-bear stalemate:

HBAR price and the bull-bear stalemate:

It is this level of indecisiveness that made it necessary to move to the 3-day chart, where two clear bullish signals emerge.

HBAR price analysis:

HBAR price analysis:

First, the ascending triangle is holding firm, with rising lows forming against a consistent resistance trendline. The key resistance levels are at $0.26 and $0.29, which form the upper trendlines of the triangle pattern.

Breakout confirmation would be a decisive close above $0.30, which could flip HBAR’s mid-term structure bullish.

Second, a hidden bullish RSI divergence has been forming. Between July 30 and August 17, the HBAR price has been making higher lows, while the 3-day RSI printed lower lows. This is a classic case of momentum resetting while price maintains trend structure, often signaling that sellers are losing grip.

If whale buying momentum continues and the RSI divergence plays out, it could fuel a breakout beyond the $0.30 zone. The confirmation of the BlackRock ETF rumor might add more fuel to this bullish chart pattern. Yet, a dip under $0.22 would invalidate the bullishness and might push the HBAR price towards new lows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.