- Single-hour volume hits 436.98M units, one of Q3’s highest.

- Support holds at $3.05–$3.09 amid heavy selling.

- Resistance at $3.13 and $3.20 eyed for short-term reversal.

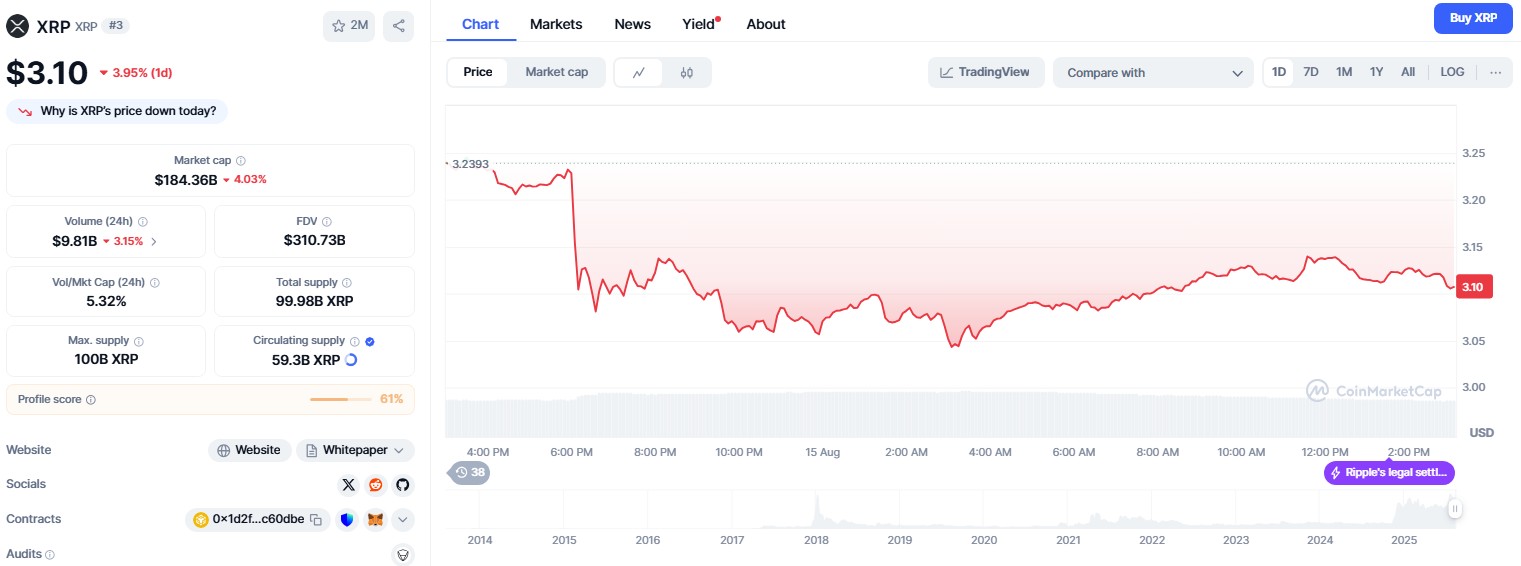

XRP’s price fell in the last 24 hours, sliding from $3.34 to $3.10, as cryptocurrency markets faced over $1 billion in liquidations.

The token is currently trading at $3.10, down 3.95% in the same period, after touching $3.05 — its lowest level in more than a week — before stabilising.

Source: CoinMarketCap

Source: CoinMarketCap

Heavy midday trading saw one of the largest single-hour volumes this quarter, with institutional support emerging near the lower price range.

Despite the pressure, late-session buying helped the token edge back above short-term resistance, indicating potential early accumulation from large holders.

Traders are closely monitoring whether this shift marks the start of a broader recovery or simply a pause before further declines.

Market-wide liquidations trigger steep drop

The decline was part of a broader market correction that coincided with profit-taking in US equities, shifting investor sentiment. Market-wide liquidations surpassed $1 billion, with XRP facing a midday capitulation event.

At 12:00, prices fell from $3.22 to $3.09 on heavy selling, contributing to a single-hour volume spike of 436.98 million units. This was among the largest trading bursts for the token this quarter, reflecting a high level of speculative positioning being unwound in rapid succession.

Ripple’s chief technology officer reiterated the XRP Ledger’s readiness for integration into global financial infrastructure during the downturn, offering a layer of fundamental confidence despite short-term volatility.

Price action and volatility levels

Over the 24-hour period from 03:00 on 14 August to 02:00 on 15 August, XRP saw a trading range spanning $3.34 to $3.05, representing an 8.69% volatility swing.

After the midday drop, the price traded in a narrow $3.05–$3.13 band, signalling reduced sell-side momentum. In the final 60 minutes of trading, two notable volume surges of 4.53 million and 3.76 million units emerged, suggesting renewed institutional interest at support.

Such inflows into spot markets after a sharp drop often point to strategic positioning by larger investors seeking to capitalise on discounted price levels.

Key technical levels to watch

Support has been confirmed between $3.05 and $3.09, tested repeatedly during periods of intense selling. Immediate resistance now sits at $3.13, with a secondary level at $3.20. Declining volumes after the midday spike point to liquidation exhaustion.

The recovery above $3.10 in low-liquidity conditions suggests early-stage re-accumulation could be underway, although follow-through buying above $3.13 will be needed to confirm a short-term reversal.

Factors traders are monitoring

Market participants are watching whether $3.05 will hold in the next wave of volatility, particularly if market-wide liquidations occur again.

Large-holder wallet activity is being tracked for signs of accumulation, and shifts in funding rates in XRP derivatives markets are under review for possible leveraged re-entry.

Correlation with equity markets remains important, with US Federal Reserve rate cut expectations continuing to influence risk sentiment.

As global markets remain sensitive to macroeconomic signals, cryptocurrency price action is expected to remain closely linked to investor appetite for risk assets.