Bitcoin Faces Cooling Demand as US Buyers Pull Back

BTC cools after hitting a new high, with reduced U.S. demand and falling ETF inflows suggesting a potential price pullback.

Since clinching a new all-time high of $122,920 on Monday, Bitcoin’s price has trended sideways, reflecting the slowdown in market momentum.

The muted price action comes as many traders take profits after the recent surge, while on-chain indicators point to fading appetite from US-based investors.

BTC Price Pauses Rally as US Investors Step Back

On-chain data shows a marked dip in trading activity among US participants over the past week. This increases the risk of an extended consolidation phase, or even a short-term correction.

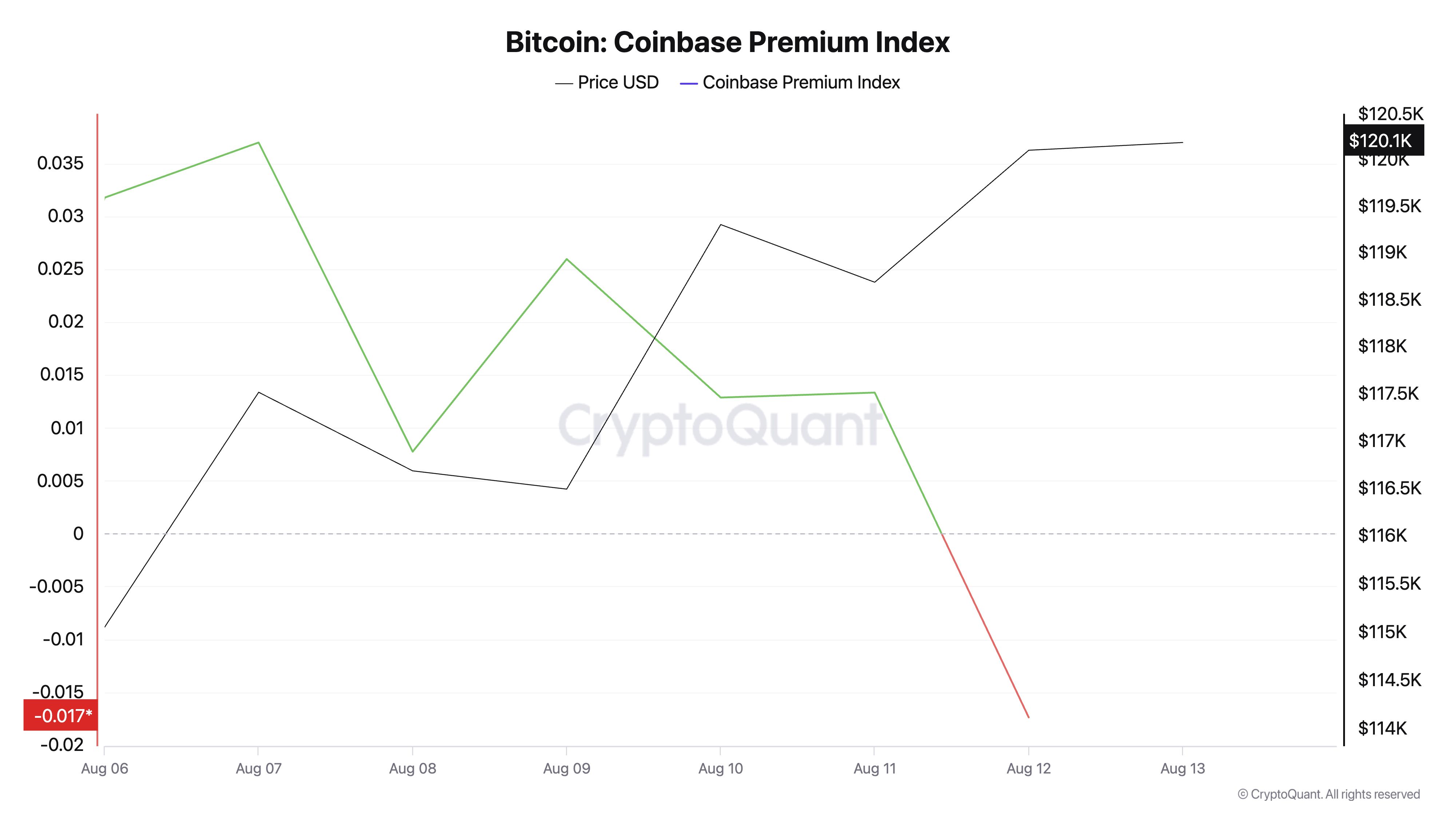

According to data from CryptoQuant, BTC’s Coinbase Premium Index (CPI) has fallen steadily over the past week, signaling a decline in buying interest from US-based investors.

Per the data provider, this closed at a seven-day low of -0.017 yesterday.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin: Coinbase Premium Index. Source:

CryptoQuant

Bitcoin: Coinbase Premium Index. Source:

CryptoQuant

This metric measures the difference between BTC prices on Coinbase and Binance, serving as a reliable gauge of US investor sentiment.

When CPI rises, BTC trades at a premium on Coinbase compared to international exchanges, signaling stronger buying pressure from US-based investors.

Conversely, when it falls or turns negative, it indicates that demand on Coinbase is trailing behind global markets, due to profit-taking or fading interest among US buyers. This is currently in play, as reduced demand from US investors may be a contributory factor to the coin’s sideways movement after it reached its record high two days ago.

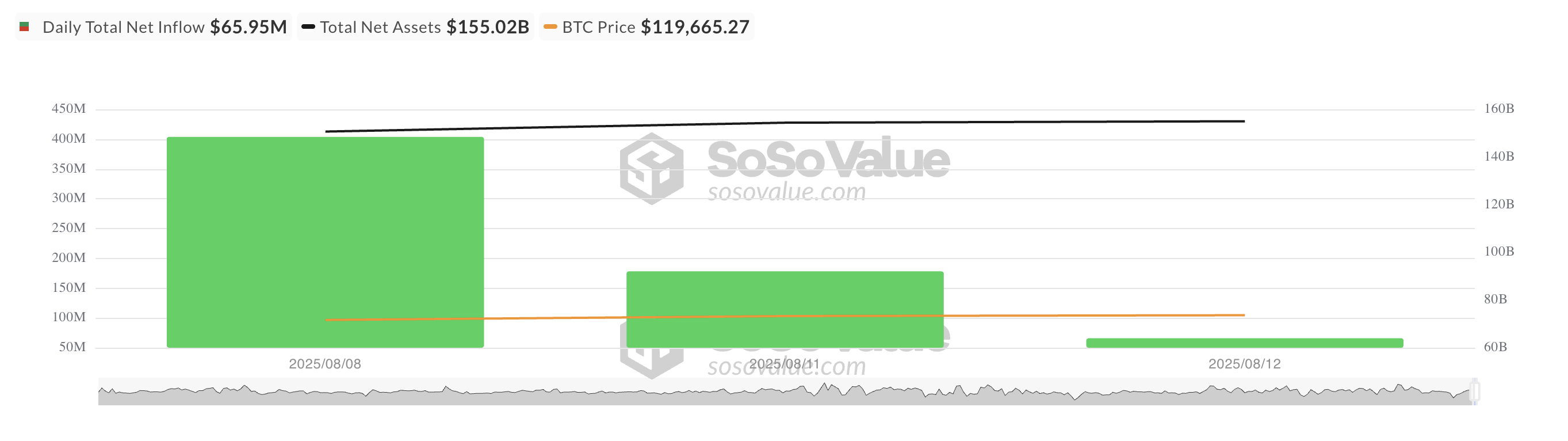

Further, this cooling sentiment has also been reflected in the decline in spot inflows into BTC-backed exchange-traded funds (ETFs) since the start of the week.

Per SosoValue data, while BTC-backed funds have maintained positive net inflows since Monday, the volume of these inflows has been steadily dropping.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

This points to a modest, yet noticeable pullback in institutional participation.

$118,000 Floor or $122,000 Ceiling?

These trends suggest that the wave of aggressive buying seen during BTC’s recent rally may be losing momentum. If this continues, BTC could extend its decline and fall to $118,851.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if sentiment improves among US-based investors and they increase coin accumulation, BTC’s price could resume its uptrend and revisit its all-time high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock CEO: Crypto Wallets Hold Over $4 Trillion in Assets, 'Asset Tokenization' Is the Next Financial Revolution

BlackRock has revealed that its goal is to bring traditional investment products such as stocks and bonds into the digital wallet, which is over a $4 trillion ecosystem.

Global Cryptocurrency Turmoil: G20 Regulatory Warnings, New Crypto Bank Approved, and US-China Tensions Shake the Market

From a $1.9 billion crypto collapse to new stablecoin and tokenization projects, global markets are struggling amid escalating US-China trade tensions and increasing regulatory pressure.

Brevis receives collective praise from the Ethereum community—Is ZK finally becoming practical?

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average of only 6.9 seconds, using just 64 RTX 5090 GPUs.

From SDK to "Zero-Code" DEX Building: Orderly's Three-Year Masterpiece

Orderly ONE proves that sticking to one thing and doing it to the extreme is the right approach.