Ethereum Price Today Surpasses $4,5, and Futures Interest Hits Record High

- ETH Surpasses $4,5 Driven by Risk Appetite

- Open interest in futures grows, but without high leverage

- Layer 1 competition puts pressure on Ethereum's on-chain activity

Ether (ETH) saw a strong rise on Tuesday (12), reaching US$4.600 after US consumer inflation data indicated an increase of just 0,1%. This movement reflected a greater appetite for risk in the market, although derivatives indicators suggest that the strength of this rise may be more limited than it appears.

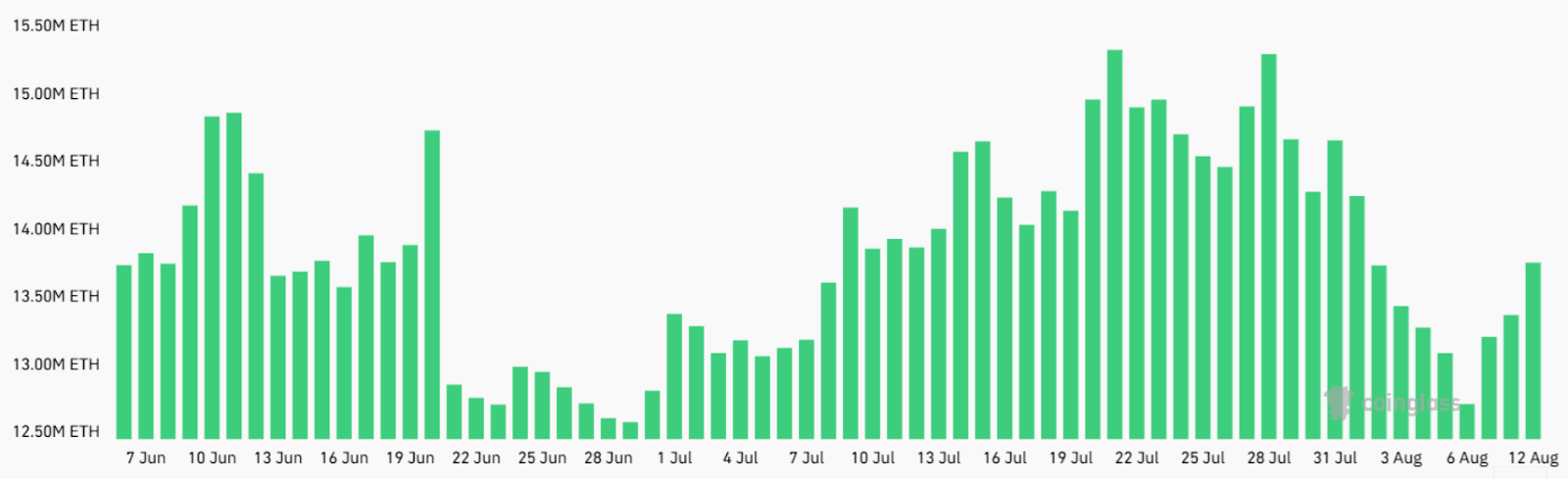

Total open interest in ETH futures contracts rose to $60,8 billion, up from $47 billion the previous week. However, this growth is primarily attributed to price appreciation, as volume in Ether terms is still 11% below the peak of 15,5 million ETH recorded on July 27.

In derivatives, the annualized premium for ETH perpetual contracts is 11%, considered a neutral level. Readings above 13% would indicate high demand for leveraged long positions, something that was only seen last Saturday. Even with a 32% price jump in the last 10 days, the demand for leverage has not returned to the levels seen in previous cycles.

Analyzing monthly futures contracts, which typically trade at an annualized premium of 5% to 10%, the market is also showing caution. After reaching 11% on Monday, the indicator fell back to 8% on Tuesday. This suggests that, despite the significant increase, investors are still closely evaluating Ethereum's fundamentals and on-chain activity.

On-chain data is less optimistic. Total value locked (TVL) on Ethereum fell 7% over the past 30 days, from 25,4 million to 23,3 million ETH. Weekly base layer fees fell to $7,5 million, lower than Solana ($9,6 million) and Tron ($14,3 million).

This combination of increasing competition in layer 1, falling TVL, and low demand for leveraged positions raises questions about the sustainability of ETH's current appreciation, even with the 51% rise in the last month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.