Date: Tue, Aug 12, 2025 | 08:20 AM GMT

The cryptocurrency market is making a strong bullish wave as Ethereum (ETH) crossed the $4,300 mark for the first time since 2021. This impressive 45% monthly surge has injected fresh momentum into major altcoins — yet Filecoin (FIL) appears to be lagging behind.

Despite the broader bullish sentiment, FIL is in the red for its monthly performance. However, a closer look at the charts reveals something potentially far more significant — a bullish fractal setup that closely mirrors a past pattern which preceded a massive rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Reversal

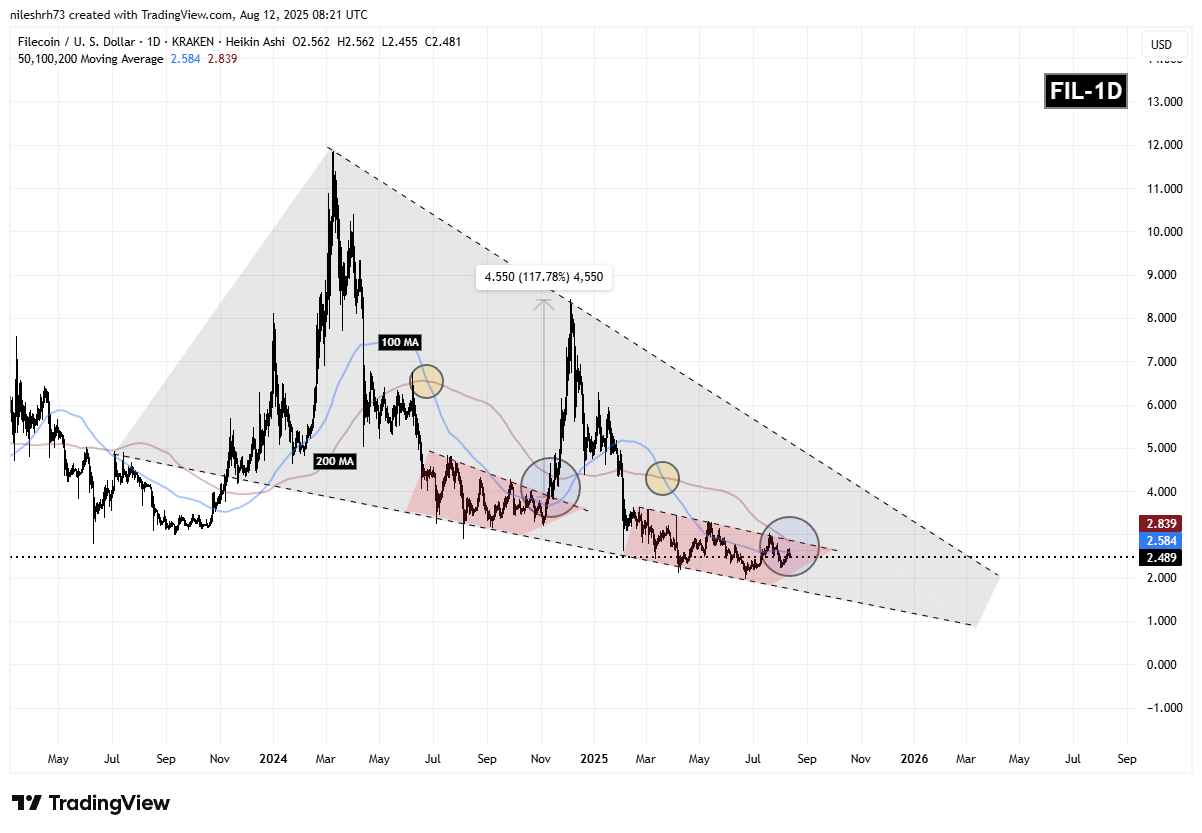

On the daily chart, FIL has been trading within a broad falling wedge — a long-term formation often associated with accumulation phases and eventual bullish breakouts.

Back in late 2024, FIL bounced from its downtrend, reclaimed the 100-day moving average, and broke out of the correction zone (highlighted in red). After crossing above the 200-day moving average — a milestone marked in a blue circle — FIL went on a blistering 117% rally, reaching the wedge’s upper boundary.

Filecoin (FIL) Fractal Chart/Coinsprobe (Source: Tradingview)

Filecoin (FIL) Fractal Chart/Coinsprobe (Source: Tradingview)

Fast forward to now, and the resemblance is striking.

FIL is once again hovering just below a key confluence zone — the 100-day moving average and the resistance trendline. This setup looks eerily similar to the pre-breakout phase of the last rally.

What’s Next for FIL?

If history rhymes, a breakout above both the 100-day MA and the descending resistance of correction phase, followed by a reclaim of the 200-day MA (currently near $2.83), could ignite a strong push toward the upper wedge boundary — potentially targeting the $3.80+ zone.

And should FIL break out from the falling wedge entirely, the move could open the door to a much larger bullish advance.