Global Crypto ETPs Attract $572M Inflows, Led by Bitcoin and Ethereum Products

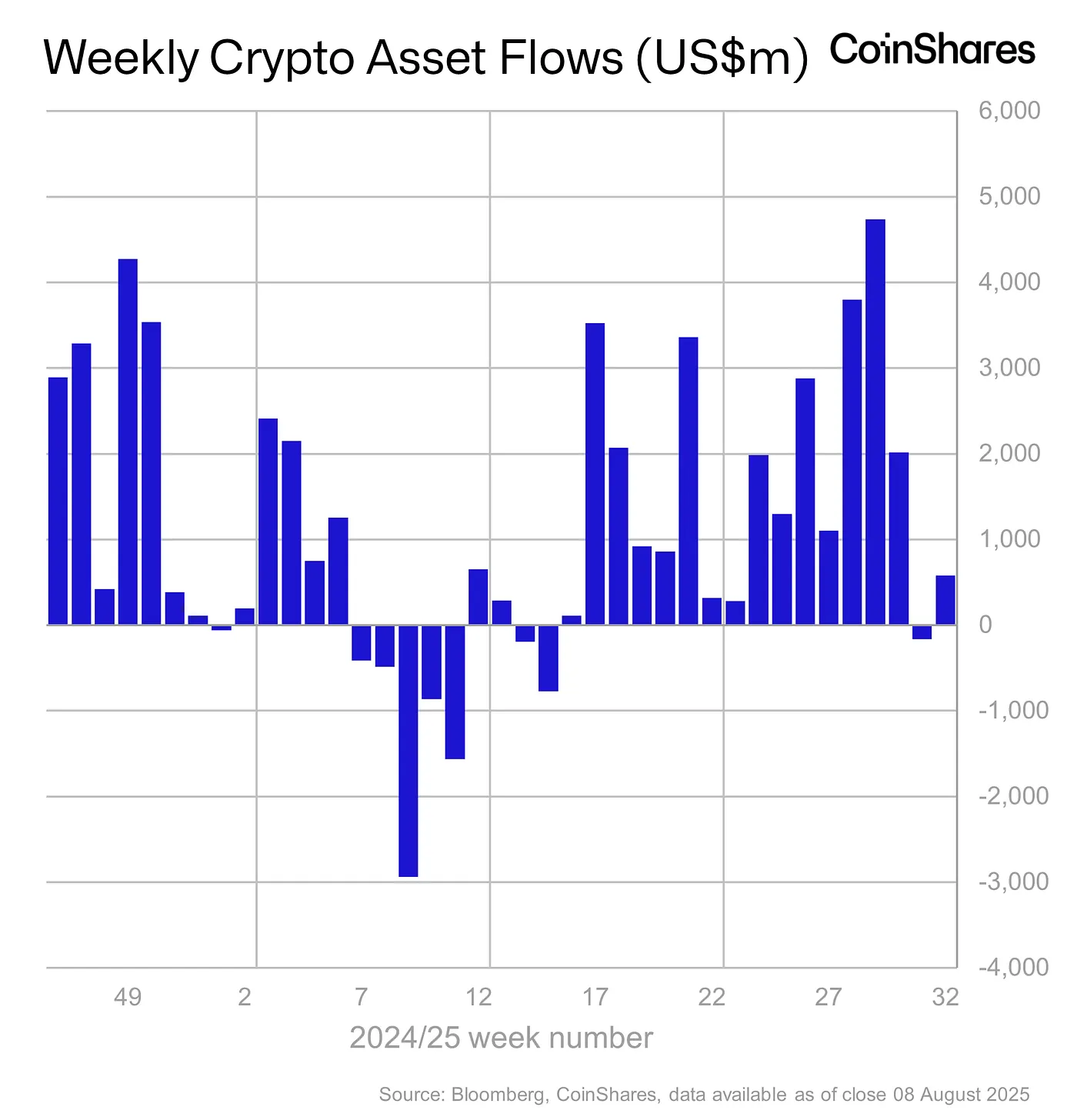

Global crypto exchange-traded products (ETPs) recorded $572 million in inflows during the trading week ending Friday, according to data from European digital asset manager CoinShares.

Global crypto exchange-traded products (ETPs) recorded $572 million in inflows during the trading week ending Friday, according to data from European digital asset manager CoinShares.

The strong demand comes amid improving market sentiment and growing institutional participation in digital assets .

Bitcoin-backed investment products remained the primary beneficiary, securing $520 million in net inflows for the week. The flagship cryptocurrency’s market dominance and its role as the most accessible institutional gateway into crypto continued to attract asset managers.

Source

:

CoinShares

Source

:

CoinShares

Ethereum products also saw renewed interest, pulling in $21 million in inflows. The second-largest cryptocurrency has been buoyed by optimism surrounding the potential approval and launch of spot Ethereum ETFs in the United States, as well as broader adoption of its blockchain for stablecoin settlements and tokenized assets.

Other altcoin-linked ETPs recorded mixed performance. Solana products drew $8 million in inflows, reflecting sustained interest from investors seeking exposure to high-throughput blockchains. Meanwhile, multi-asset ETPs saw net outflows, suggesting some investors are consolidating positions into top-tier digital assets.

The inflows mark the fourth consecutive week of positive net investments into crypto ETPs, signaling a shift in institutional appetite after months of cautious positioning. CoinShares analysts attributed the momentum to falling interest rates expectations, weakening U.S. dollar strength, and growing clarity on regulatory pathways for crypto-based financial products in key markets.

Trading volumes in crypto ETPs surged to $2.3 billion for the week, well above the year-to-date weekly average. Analysts say this uptick underscores a resurgence in market activity, with asset managers and professional traders positioning ahead of potential catalysts in the coming months.

CoinShares noted that while market volatility remains a factor, the steady inflows suggest that institutional investors are increasingly treating digital assets as a core component of diversified portfolios.

Despite recent price volatility in Bitcoin and Ether, institutional appetite appears to be strengthening, with digital assets increasingly seen as a strategic component of diversified portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.