Bitcoin’s Rally Isn’t Over: 3 Bullish Metrics Confirm August Momentum

Analysts point to three rare metrics — low futures-to-spot ratio, surging BTC dominance in CEX volume, and bullish taker activity — as signs Bitcoin Season is only just beginning in August 2025, despite prices already above $120,000.

Typically, when Bitcoin sets a new all-time high, risk warnings start to appear. However, experts and analysts highlight three new positive Bitcoin metrics emerging in August.

These metrics act as rare signals. They suggest that Bitcoin Season may have only begun this month, even after the price broke above $120,000.

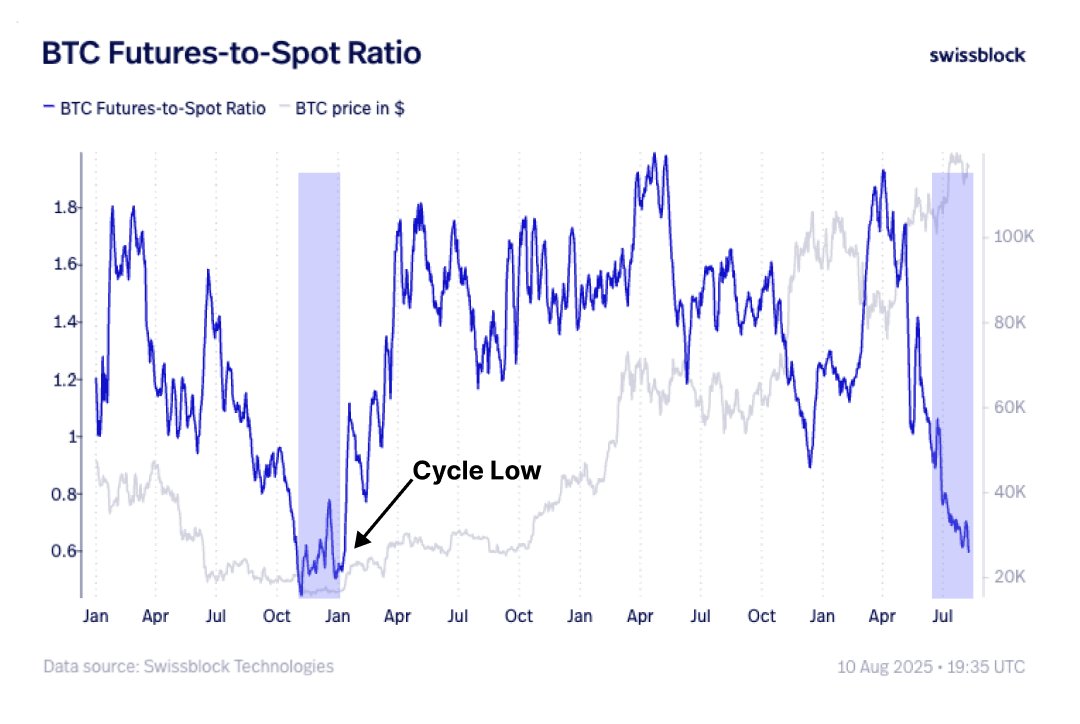

1. Bitcoin Futures-to-Spot Ratio

The first is the Futures-to-Spot Ratio, which has dropped to its lowest level since October 2022. Why is this significant?

According to Swissblock, this ratio measures futures trading volume compared to spot trading volume. A lower ratio indicates that large investors — often called massive allocators — are actively buying BTC on the spot market instead of speculating via futures.

Bitcoin Futures to Spot Ratio. Source:

Swissblock

Bitcoin Futures to Spot Ratio. Source:

Swissblock

“Since the April low, this move has been spot-driven — massive allocators hoovering up every last BTC. Futures-to-spot ratio is back to Oct 2022 lows → a signal of epic spot demand,” Swissblock reported.

Historically, when this ratio plunges, it often marks the cycle’s bottom — similar to late 2022 before BTC skyrocketed above $100,000. This suggests that even with Bitcoin already in six-figure territory, the rally might still be in its early stages.

“The $120.5K breakout target has been hit, now what? Price momentum is aligning… Yes, macro volatility is expected and downside pressure may flare up, but with momentum igniting, we go higher,” Swissblock predicted.

2. CEX Volume Ratio: Bitcoin vs. Altcoins

The second metric is the spot trading volume ratio between Bitcoin and altcoins.

This ratio compares BTC’s spot trading volume to altcoins on centralized exchanges (CEX). When the ratio rises, it shows Bitcoin is attracting more capital — a classic sign of “Bitcoin Season.”

CEX Volume Ratio: Bitcoin vs Altcoin. Source:

CryptoQuant

CEX Volume Ratio: Bitcoin vs Altcoin. Source:

CryptoQuant

CryptoQuant data reveals that this ratio tends to rise alongside Bitcoin’s price. In August 2025, it has rebounded to 3 — its highest since July 2022. This means Bitcoin’s trading volume is now triple that of all altcoins combined.

History shows that when the ratio surpasses 3 and moves toward 5 (as it did in late 2021), BTC often leads strong market rallies. This suggests that today’s market conditions indicate Bitcoin Season hasn’t yet reached its full potential.

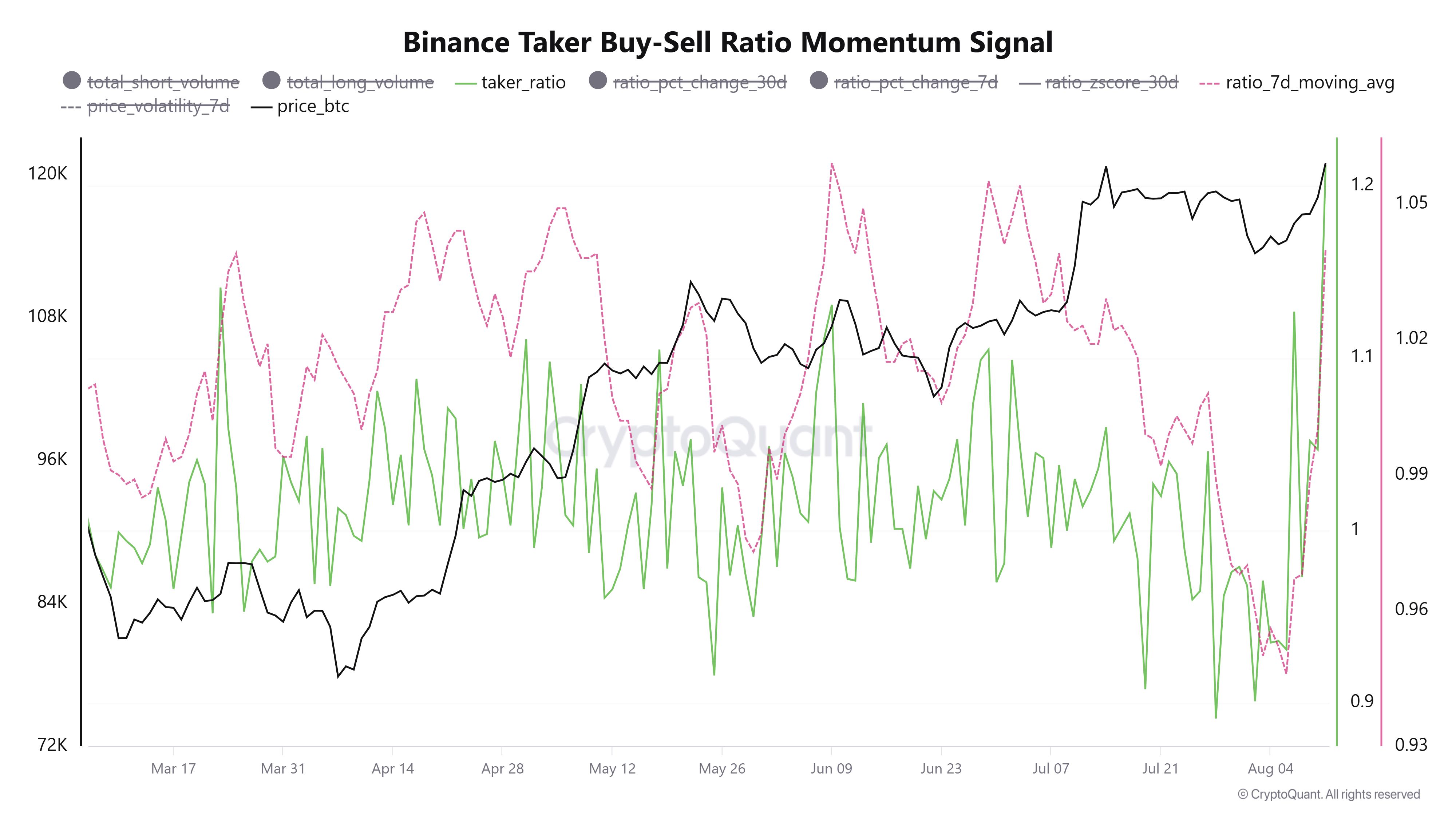

3. Bitcoin Taker Buy-Sell Ratio

Finally, the Taker Buy-Sell Ratio indicates that new buying momentum is building strongly.

According to CryptoQuant analyst Crazzyblockk, this ratio measures the buying volume divided by the selling volume from takers — the active traders initiating market orders.

“Takers set the immediate tone of the market — when they’re aggressively buying, it often precedes bullish moves; when selling dominates, it can signal downside risk,” Crazzyblockk explained.

A value above 1 signals bullish sentiment. Crazzyblockk also notes that when this value exceeds its 7-day average, it signals fresh buying momentum.

Binance Taker Buy-Sell Ratio. Source:

CryptoQuant

Binance Taker Buy-Sell Ratio. Source:

CryptoQuant

This signal was confirmed in August. The Bitcoin Taker Buy-Sell Ratio exceeded its 7-day average and reached 1.21 — the highest since March.

These three metrics — record-low Futures-to-Spot Ratio, recovering CEX Volume Ratio, and bullish Taker Buy-Sell Ratio — all point to Bitcoin Season kicking off in August 2025.

Additionally, recent BeInCrypto analysis suggests Bitcoin could climb further. However, it warns that a drop below $118,900 would invalidate the short-term bullish trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin FOMO trickles back at $94K, but Fed could spoil the party

Beyond Cryptocurrency: How Tokenized Assets Are Quietly Reshaping Market Dynamics

Tokenization is rapidly becoming a key driving force in the evolution of financial infrastructure, with an impact that may go beyond short-term fluctuations, reaching the deeper logic of market structure, liquidity, and global capital flows.

On the eve of the interest rate decision, hawkish rate cuts loom, putting the liquidity gate and the crypto market to the year-end test

A divided Federal Reserve and a possible "hawkish" rate cut.

Gensyn launches two initiatives: a quick look at the AI token public sale and the model prediction market Delphi

Gensyn has launched its public sale with a valuation cap of 1 billion USD, offering the same entry price as a16z for AI computing infrastructure.