3 Altcoins at Risk of Major Liquidations in The Second Week Of August

Ethereum, Ethena, and XRP could see billions in liquidations this week as leveraged positions face steep risks from rapid price swings. Market imbalances and shifting sentiment are setting the stage for potential sharp moves in all three altcoins.

As the second week of August begins, the total crypto market capitalization has surpassed $4 trillion, officially setting a new all-time high. With trading sentiment improving, bullish expectations deepen the imbalance between long and short positions.

As a result, some altcoins could face significant liquidations this week if prices move against the expectations of short-term leveraged traders.

1. Ethereum (ETH)

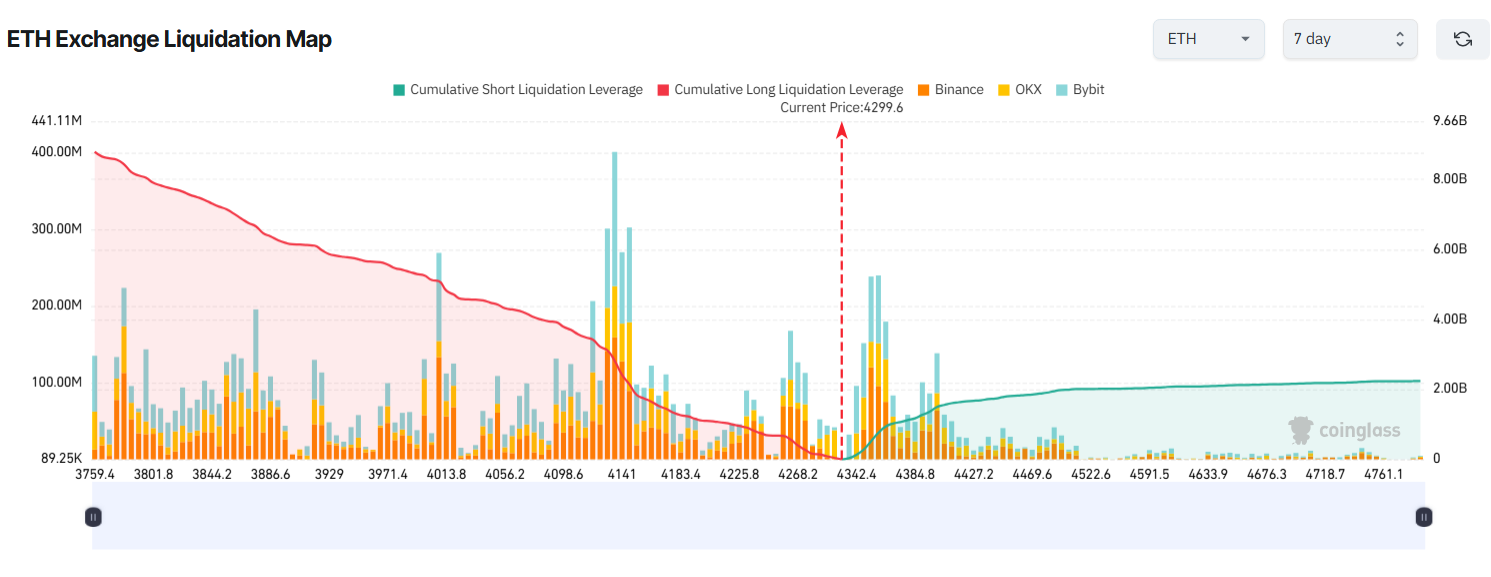

Ethereum’s 7-day liquidation map shows a major imbalance between accumulated liquidation volumes on the long and short sides. Traders continue to allocate capital and leverage to bets that ETH will keep rising after breaking above $4,300.

Coinglass data indicates that longs could lose over $5 billion if ETH drops 7% this week and falls below $4,000. In contrast, a 7% rise to $4,600 would trigger $2 billion in liquidations for shorts.

ETH Exchange Liquidation Map. Source:

Coinglass

ETH Exchange Liquidation Map. Source:

Coinglass

Some traders worry that liquidity flows mainly into ETH, while other altcoins do not see the same inflows. They believe ETH’s rally could lack sustainability if buying pressure fades, potentially leading to a sharp drop and as much as $7 billion in long liquidations.

“If Ethereum drops to $3,600, over $7 billion in long positions would be liquidated — a highly attractive liquidity pool for exchanges… Since liquidity has flowed mainly into ETH while other altcoins remain inactive, this suggests ETH might be positioning to balance the overall crypto market cap in response to potential Bitcoin dominance moves,” investor Marzell said.

2. Ethena (ENA)

Ethena (ENA) has been one of the most talked-about altcoins in August. Thanks to the passage of the GENIUS Act on July 18, Ethena’s USDe stablecoin reached a $10 billion market cap, becoming the third-largest stablecoin after USDT and USDC.

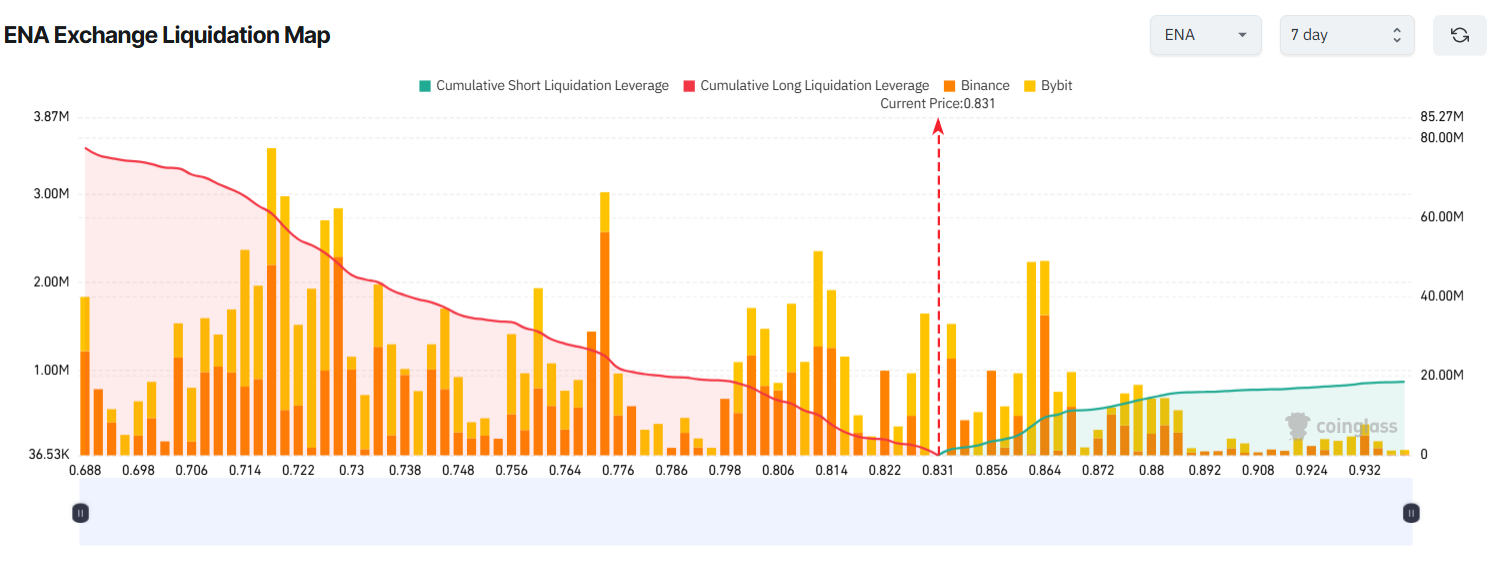

The bullish sentiment for ENA has surged, pushing its price from $0.50 to over $0.80 in August. A recent BeInCrypto report showed that whales are still accumulating ENA, and the liquidation map reflects traders’ expectations of further short-term gains.

ENA’s 7-day liquidation map shows that longs’ total accumulated liquidation volume far exceeds that of shorts.

ENA Exchange Liquidation Map. Source:

Coinglass

ENA Exchange Liquidation Map. Source:

Coinglass

If ENA falls to the psychological support level of $0.70 this week, longs could face over $70 million in losses. On the other hand, if ENA climbs to $0.90, shorts would lose just $16.5 million.

Some traders believe ENA could keep rallying toward $1.50. However, they warn that the token could face profit-taking pressure in the $0.80–$0.90 range.

3. XRP

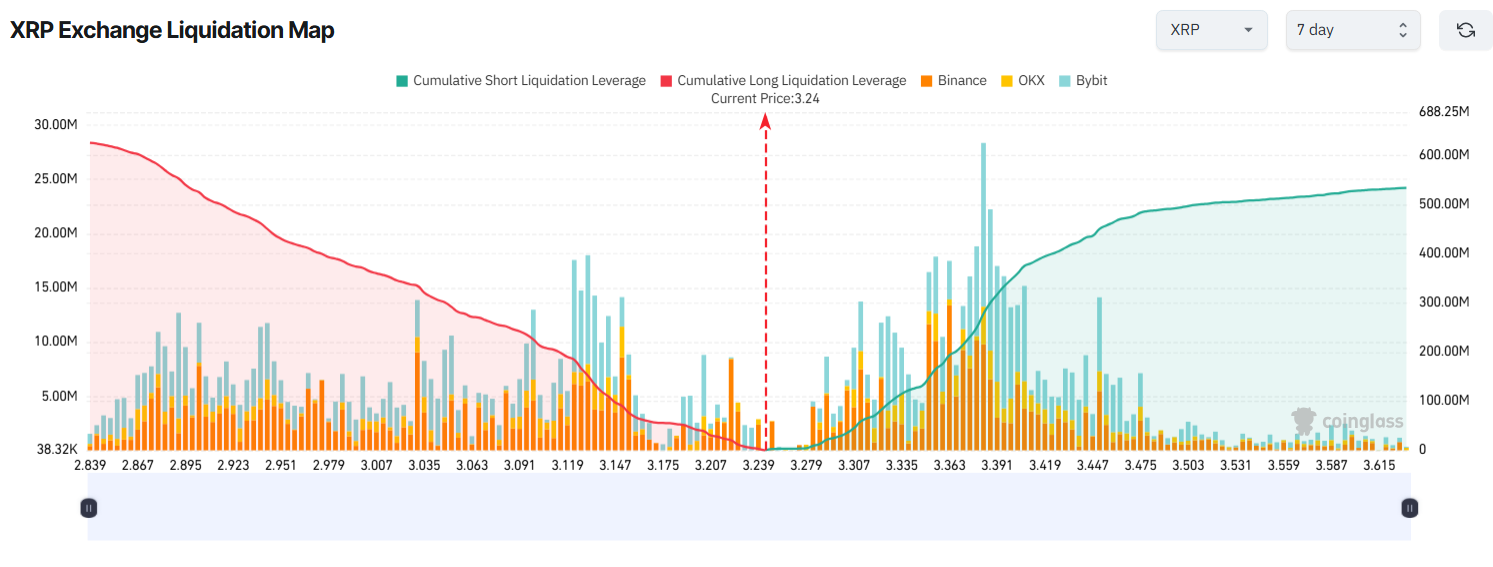

While many altcoins show imbalances in their liquidation maps skewed toward bullish expectations from short-term traders, XRP presents a different picture.

A recent BeInCrypto report revealed that Ripple unlocked 1 billion XRP, sparking concerns of downward pressure. Technical signals also suggest that sellers could soon take control.

Possibly for these reasons, XRP’s 7-day liquidation map shows that traders are placing more money on a bearish scenario.

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

If XRP moves against these bearish bets, shorts could suffer heavy losses this week.

Specifically, if XRP rises 8% to hit $3.50, nearly $500 million in shorts would be liquidated. Conversely, if XRP drops 8% to $3.00, longs would face about $370 million in liquidations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.