Whales Buy 50M XRP, Pushing Price Rally Toward $3.40 Resistance

- Whales buy 50M XRP worth roughly $165M, pushing price near key $3.40 breakout level.

- XRP rebounds from $3.05 as whale accumulation sparks bullish momentum in the market.

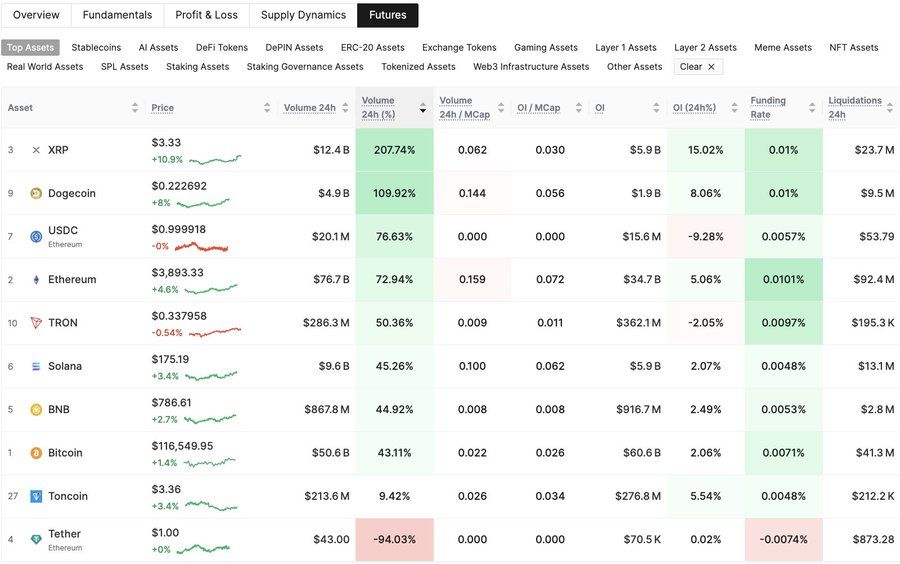

- Futures volume jumps 200%, signaling strong trader interest in XRP’s next move ahead.

XRP has staged a notable rebound after substantial buying from large holders. Crypto analyst Ali reported that wallets holding between 10 million and 100 million XRP increased their holdings by 50 million tokens in the last 48 hours. Based on the market price of $3.31 at press time, this acquisition is valued at approximately $165.5 million.

Source:

X

Source:

X

The surge in whale activity came after an early August pullback, during which XRP fell to lows near $2.90. This new accumulation contributed to a price rally from $3.05 to $3.31. Mid-July histories reveal the same trend, with persistent buying of whales supporting a rise from $2.75 to above $3.65. Meanwhile, declines in large-wallet balances late in July were accompanied by a retracement below $3.00, highlighting the impact that these investors can have on the price trends.

Technical Structure and Key Price Levels

The resistance is at the price of $3.40, where XRP is now testing it after a recent rise. A confirmed breakout above this barrier may result in prices targeting the range of $3.55 to $3.65, coinciding with July peaks. Conversely, the first major support is at the $3.00 mark, and the next support is at $2.90 zone, where the recent rally was initiated.

Source:

Tradingview

Source:

Tradingview

Market data from CoinMarketCap shows XRP’s market capitalization at $196.36 billion, with a 24-hour trading volume of $7.34 billion, down 36.71%. While this decline in volume suggests reduced short-term speculative activity, the magnitude of whale inflows has provided a stabilizing effect. The volume-to-market-cap ratio stands at 3.74%, indicating moderate liquidity, which could support upward movement if buying pressure turns up.

Wider Market Drivers and Regulatory Developments

Other macro factors also affect the price of XRP. The volume of futures trading has surged over 200% in the last 24 hours to $12.4 billion, overtaking Solana and Ethereum. XRP rose significantly after it was reported that Ripple and the Securities and Exchange Commission had resolved to drop ongoing appeals, effectively concluding a lawsuit that had been going on over several years. XRP’s future open interest increased by 15% to nearly $5 billion, suggesting more traders are taking long positions.

Source:

Glassnode

Source:

Glassnode

Meanwhile, anticipation of a positive approval of an XRP exchange-traded fund (ETF) has also contributed to bullish sentiment. According to analysts, potential price increases have been estimated as high as $5 in case an ETF receives regulatory approval. However, SEC Commissioner Caroline Crenshaw voiced opposition to such approval, injecting uncertainty into the timeline.

Analysts cite XRP’s high 0.877 correlation to leading cryptocurrencies, indicating that an overall market shift is likely to affect its direction. In addition, the XRP Ledger’s proven track record of reliability and low fees remains the basis of its attractiveness to institutional investors and retail participants alike.

Related: BlackRock Avoids XRP, Solana ETFs Amid Unclear Rules

Outlook and Potential Price Targets

According to the crypto analyst, STEPH IS CRYPTO, XRP has recently surpassed the upper boundary of a bull flag pattern. Analysis also suggests that the projected action following this breakout would be to trade toward the zone between $4.50 and $5.50 in September or October, a 35% increase from current prices.

Source:

X

Source:

X

The price of XRP will test the $3.40 resistance next. Further buying at this level might shift interest to re-testing July highs, and the inability to breach this challenge might lead to consolidation near $3.10 to $3.40. For now, Whale accumulation, improved technical positioning, and increased derivatives market activity help establish a positive backdrop for the token’s short-term performance.

The post Whales Buy 50M XRP, Pushing Price Rally Toward $3.40 Resistance appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.