Technical Indicators Align for Solana as Bulls Target $180 Barrier Next

Solana has gained nearly 10% in the past few days, with bulls showing signs of reclaiming control. Positive technical indicators, including a rising RSI and BoP, support the rally — but SOL now faces a crucial resistance level at $176.33 that will determine whether further gains are possible.

Popular altcoin Solana has seen a modest recovery, climbing upward since August 2. Despite earlier weakness, the token has since rallied nearly 10%, reaching $171.91 at press time.

The uptick suggests a potential shift in sentiment, with technical indicators hinting at a continuation of the uptrend.

SOL Price Recovery Gains Steam

Readings from the SOL/USD one-day chart show a gradual resurgence of bullish momentum among SOL holders.

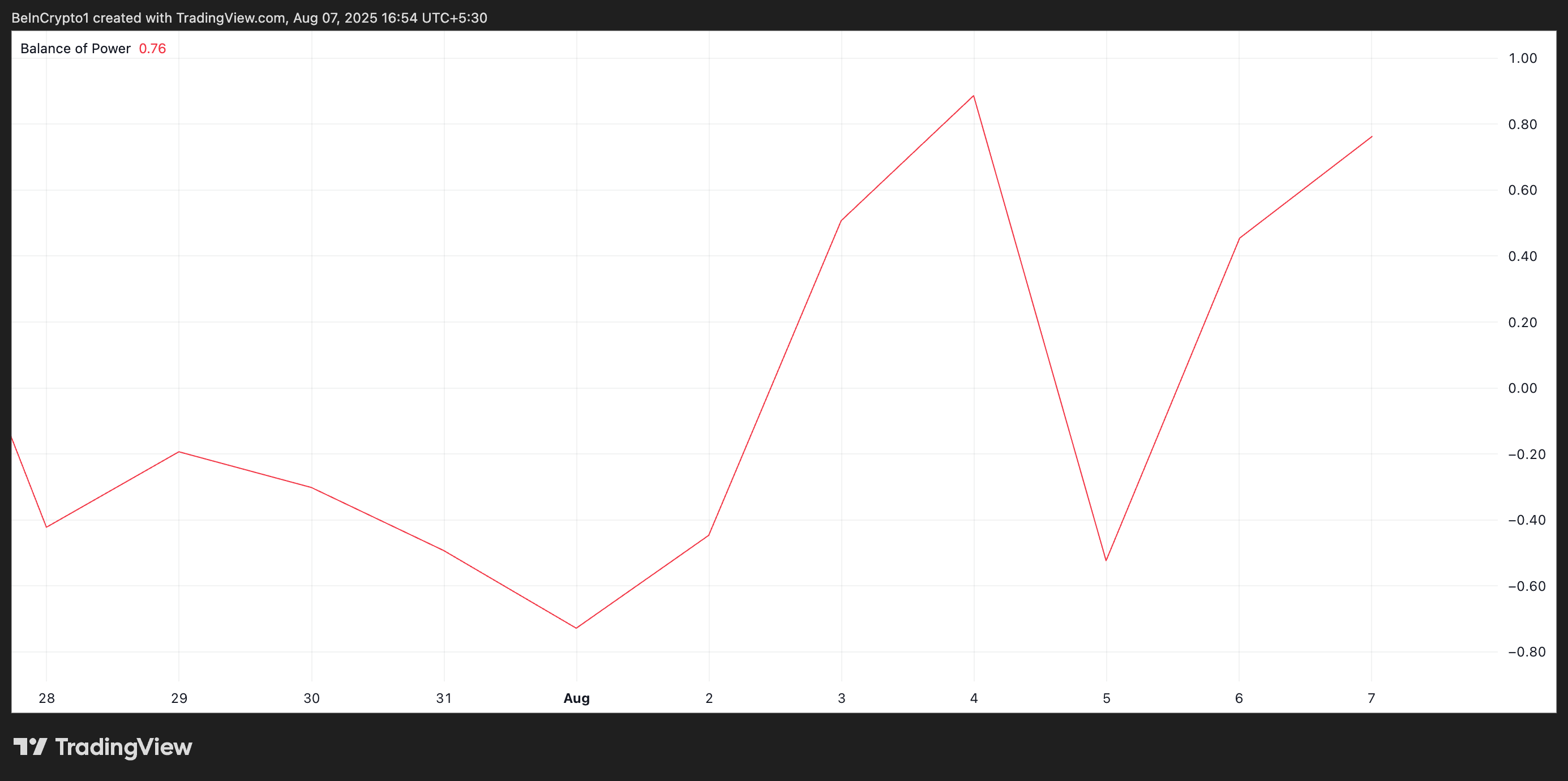

For example, its Balance of Power (BoP) is positive as of this writing, indicating that bias is currently skewed in favor of the bulls. It is presently in an uptrend and stands at 0.76.For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

SOL BoP. Source:

TradingView

SOL BoP. Source:

TradingView

The BoP measures the strength of buyers versus sellers in the market. It compares the price movement within a trading period to determine which side has more control. BoP values typically oscillate between -1 and +1.

A positive BoP suggests that buyers are dominating, pushing prices higher by closing near the top of the range, while a negative BoP indicates that sellers have the upper hand, closing prices near the bottom of the range.

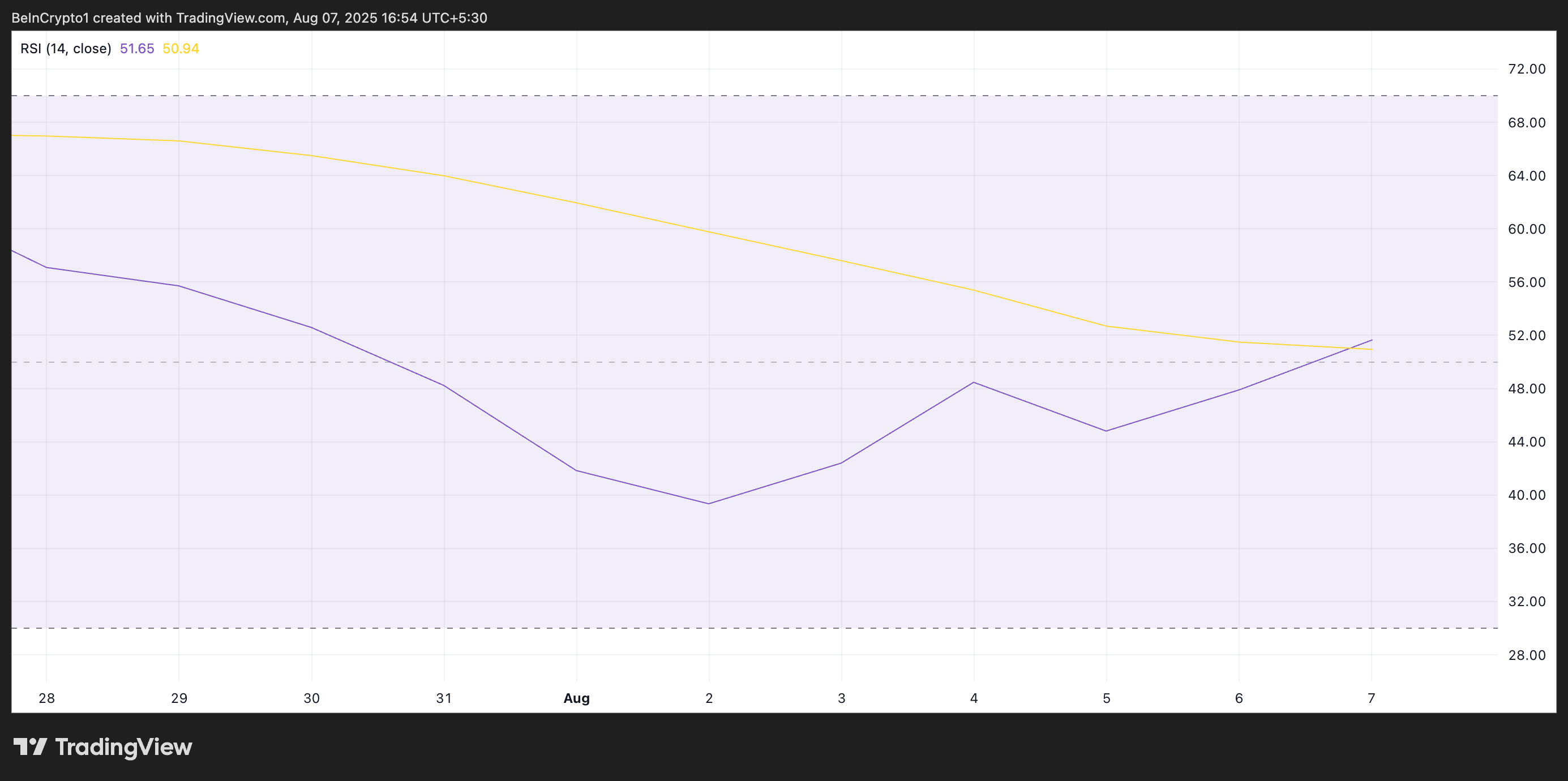

For SOL, its current positive BoP reading signals that bulls are gaining market control, strengthening the ongoing price recovery.Furthermore, the climbing Relative Strength Index (RSI) adds to the bullish outlook for SOL. This key momentum indicator currently stands at 51.65, ticking up, indicating a steady rise in buy-side pressure.

SOL RSI. Source:

TradingView

SOL RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 51.65 and climbing, SOL’s RSI suggests strengthening bullish momentum. Its buyers are gradually regaining control, leaving room for further upside if demand continues to build.

SOL Price Approaches Make-or-Break Moment

A sustained wave of buying pressure could fuel a breakout above SOL’s immediate resistance at $176.33.

If this level is cleared with strong momentum, SOL may be poised to push past the psychological barrier at $180, opening the door to further gains.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, a shift in sentiment or renewed profit-taking could prevent this. If bears regain control, SOL’s price risks a pullback toward the $158.80 support level, erasing recent gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.