Lido’s Market Share Hits 3-Year Low—Is Ethereum’s Staking Giant Losing Its Grip?

Lido DAO is under pressure from all sides—shrinking ETH staking share, internal restructuring, and rising withdrawal demand—marking a pivotal moment in its role within Ethereum’s evolving ecosystem.

Lido DAO is currently facing pressure from multiple directions: declining market share, organizational restructuring, technical concerns, and a surge in withdrawal demand.

Lido continues to play a significant role in the Ethereum ecosystem. However, to sustain its influence, it must show greater adaptability, innovation, and transparent governance than ever.

Lido’s ETH Staking Market Share Hits a Three-Year Low

Lido, Ethereum’s largest decentralized staking platform, has recently shown several concerning signals. According to data from Dune, Lido’s share of ETH staking has dropped to just 24.6%, the lowest point in the past three years. This represents a significant shift, particularly for a protocol that once was dominant in Ethereum’s liquid staking landscape.

Lido market share. Source:

Dune

Lido market share. Source:

Dune

This decline could stem from multiple factors, including growing competition from rivals like Rocket Pool or staking solutions integrated directly by major exchanges like Coinbase. The Ethereum community actively prioritizes decentralization. This raises questions about whether a protocol controlling numerous validators aligns with Ethereum’s long-term vision.

Beyond its shrinking market share, Lido recently disclosed a vulnerability in the RageQuit mechanism of its “Dual Governance” (DG) system. While the project team confirmed that no user funds were affected and mitigation steps have already been taken, this serves as a reminder that even major protocols are not immune to technical issues that may arise during operations.

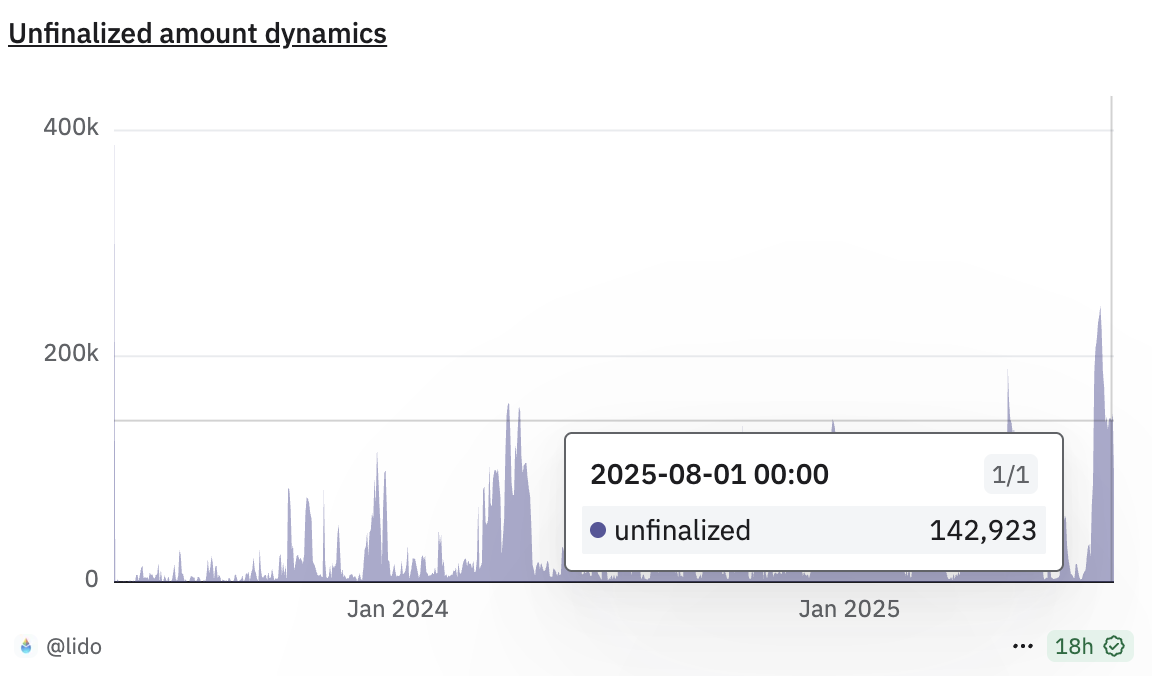

In addition, the ETH withdrawal queue on Lido has reached its highest level since withdrawals were first enabled. Data from Dune shows that ETH pending withdrawal is nearly 143,000. Although this number has decreased from its all-time high at the end of July, it still reflects a shift in confidence among some users, especially as more flexible or secure staking alternatives emerge.

Lido ETH withdrawal queue. Source:

Dune

Lido ETH withdrawal queue. Source:

Dune

In this context, Lido has officially confirmed that it will reduce its contributor team by approximately 15%. According to a public statement by co-founder Vasiliy Shapovalov on platform X (formerly Twitter), this decision was made to ensure the organization can operate more efficiently and adapt to the changing market trends.

“This decision was about costs — not performance. It affects incredibly talented people who helped shape the protocol and community.” Vasiliy Shapovalov shared on X.

Downsizing the team does not necessarily signal a crisis. However, it indicates that leadership is reassessing its human capital strategy, particularly as key performance metrics struggle to sustain prior growth trends. The protocol is entering a pivotal proving ground amid fast-moving technological and cultural shifts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.