Lido, a prominent Ethereum $3,559 -based liquid staking protocol, has announced a significant restructuring initiative to ensure long-term sustainability by cutting 15% of its workforce. Co-founder Vasiliy Shapovalov took to X to announce that hundreds of employees from Lido Labs, Lido Ecosystem, and Lido Alliance teams will be affected by the decision. Shapovalov emphasized that the cost-focused decision is not related to performance but is instead aimed at maintaining operational focus in alignment with the interests of LDO coin holders. Lido, launched in 2020, ranks second in the liquid staking space with a total locked value of $31 billion.

Focused Cost Management Strategy

Shapovalov stated that the timing of the decision, made despite the rise in prices, was deliberate. The reduction in the workforce is a necessary measure to enhance long-term resilience by trimming unnecessary expenses and concentrating on the core objectives of the protocol. According to him, these layoffs will serve as a buffer against future market fluctuations while maintaining the current revenue stream of the altcoin .

The layoffs were implemented as a joint decision across the three organizational structures within the Lido ecosystem. The goal is to allocate more resources to key activities such as technical development and community building. Shapovalov also assured that “fair compensation and support” would be provided to the affected employees throughout the process.

Lido’s Market Position

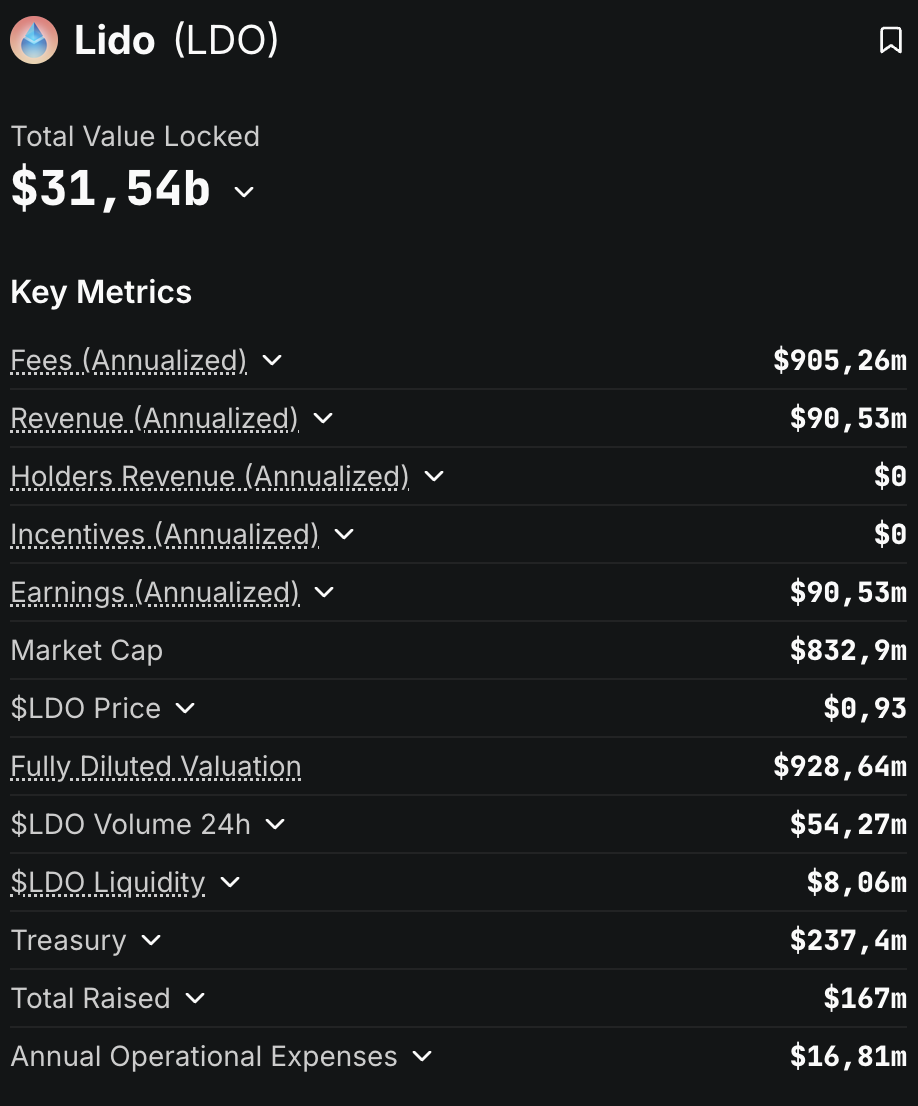

Built on Ethereum, Lido enables users to contribute to network security while keeping their ETH holdings liquid. The release of Lido v3 in February, featuring modular stVault smart contracts, paved the way for more advanced staking plans. According to data from DeFiLlama, the protocol holds a locked value of $31 billion with approximately $90 million in annualized revenue.

Despite the announcement, LDO coin experienced a 4.3% increase in the last 24 hours, as per CryptoAppsy’s price data. However, on a weekly basis, the altcoin has seen a 21.6% decline, trading at $0.9273. Analysts assert that although there may be short-term price fluctuations, the cost reduction strategy could enhance the financial health of the protocol, thereby potentially boosting investor confidence in the medium term.