Japan Explores Tougher Crypto Regulation For Market Growth

Japan’s crypto regulation is evolving, with proposed changes that aim to better protect investors and address market growth. Key reforms include stricter oversight for fundraising tokens and a focus on transparency.

Japan advances tougher crypto regulation, transitioning oversight from the Payment Services Act to investment-focused Financial Instruments Exchange Act.

The move aims to enhance investor protection as crypto markets expand rapidly.

FSA Initiates Strategic Regulatory Recalibration Amid Market Evolution

The Financial Services Agency (FSA) convened the first meeting of its Crypto Assets Working Group on July 31. Discussions centered around reclassifying crypto assets to treat them more comprehensively as investment products rather than merely payment tools.

Japan Crypto Business Association Vice Chairman Shiraishi documented a remarkable global crypto market expansion from $872 billion to $2.66 trillion. However, Japan’s domestic trading ecosystem demonstrates measured growth trajectories, advancing from $66.6 billion in 2022 to forecasted $133 billion levels.

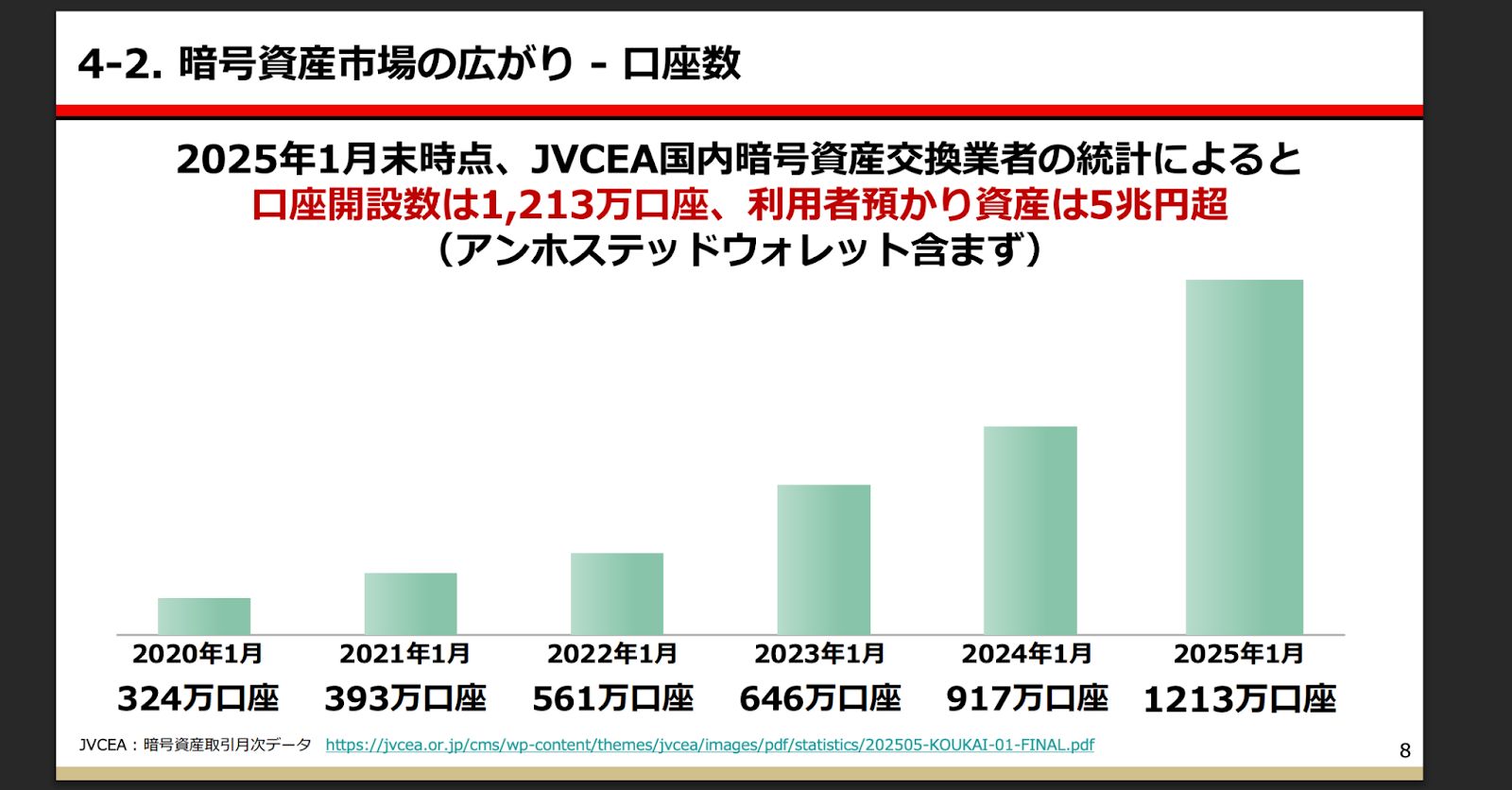

Despite holding 12.1 million accounts worth $33 billion, Japan’s crypto industry perceives diminishing global market influence.

Tougher Regulation and Investor Protection

Proposed regulatory frameworks establish a bifurcated classification system distinguishing fundraising tokens from established digital assets. Fundraising tokens would mandate comprehensive issuer disclosure requirements, while existing assets like Bitcoin maintain exchange-regulated oversight structures.

Tokyo University’s Yuichiro Matsui endorsed comprehensive regulatory reform initiatives, underscoring the critical necessity for updated crypto oversight frameworks. Georgetown University’s Shinichiro Matsuo advocated for multifaceted regulatory approaches emphasizing sustainability, security, adaptability, and strategic international alignment principles.

The complexity surrounding taxation also arose. Tax expert Yuichi Murakami dismissed industry calls for separate crypto wallet taxation, citing widespread fraud, security vulnerabilities, and inadequate calculation infrastructure.

“Claiming wallets need separate taxation for Web3 growth is nonsense unless clear tax reporting and investor protection measures are in place,” Murakami argued on X.

The working group plans detailed regulatory development, addressing transparency, combating fraud, and potentially introducing insider trading laws. Concrete proposals are expected by year-end, with legislative action possible by early 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.