NFT Sales Surge to $574 Million in July as Ethereum Collections Lead Market Rally

Non-fungible token (NFT) sales climbed to more than 574 million dollars in July, marking the second-highest monthly volume this year, according to data from CryptoSlam.

Non-fungible token (NFT) sales climbed to more than 574 million dollars in July, marking the second-highest monthly volume this year, according to data from CryptoSlam.

The figure represents a 47.6 percent increase from June’s 388.9 million dollars, though it remains below January’s peak of 678.9 million dollars.

While total transactions fell 9 percent from 5.5 million to five million, the average sale value rose to 113.08 dollars, the highest in six months. This indicates growing demand for higher-value digital assets . The number of unique buyers declined 17 percent to 713,085, while unique sellers increased 9 percent to 405,505, suggesting a market shift toward fewer but larger purchases.

Source

:

NFT Price Floor

.

Source

:

NFT Price Floor

.

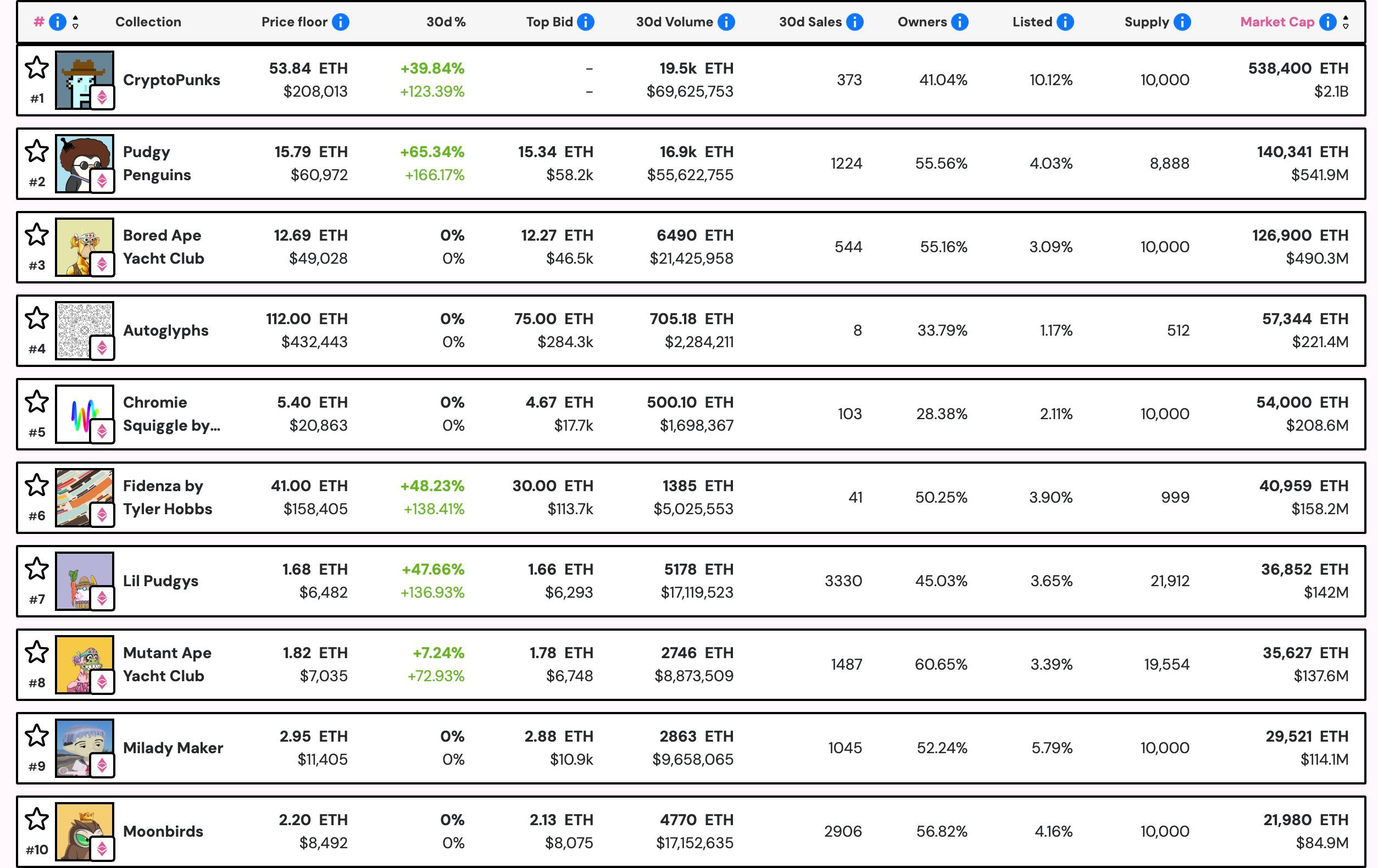

NFT Price Floor data shows the sector’s total market capitalization has surged 21 percent since late July, reaching more than 8 billion dollars. Ethereum’s price rally has played a key role, with the asset trading above 3,800 dollars after jumping 62 percent from early August levels of around 2,400 dollars.

Ethereum-based collections dominated the market in July. CryptoPunks led trading with more than 69.2 million dollars, followed by Pudgy Penguins with 55.5 million dollars. Polygon’s Courtyard NFTs ranked third with 23.8 million dollars. Pudgy Penguins also posted the strongest growth, with floor prices rising 65.44 percent, outpacing other top collections such as Bored Ape Yacht Club and Mutant Ape Yacht Club.

Ethereum maintained its dominance in blockchain-based NFT sales with 275.6 million dollars in July, a 56 percent increase over the previous month. Bitcoin followed with 74.3 million dollars, while Polygon recorded 71.6 million dollars. Polygon’s sales volume dropped by 51.1 percent from June, while BNB Chain recorded a 54 percent decline, reflecting a growing consolidation of activity on Ethereum and a narrowing focus on premium NFT collections. Meanwhile, CoinGecko reported a 20% daily jump in total NFT market cap, from $5.1 billion to $6.3 billion, further signaling renewed interest in the space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.

Vitalik donated 256 ETH to two chat apps you've never heard of—what exactly is he betting on?

He made it clear: neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Prediction Market Supercycle