FOMC Report Causes Bitcoin Dip: Will Sell-Side Pressure Drag Prices Lower?

Bitcoin faces potential downward pressure after a brief dip following the FOMC report. A recovery above $120,000 is crucial for pushing toward new highs, while a drop below $117,261 could signal further losses.

Bitcoin’s price has been rangebound for the last few days, consolidated between $117,261 and $120,000. However, recent market conditions and external influences, such as the Federal Open Market Committee (FOMC) meeting on Wednesday, caused a temporary decline.

As of now, Bitcoin is priced at $118,419, slightly recovering after dipping to $115,700. Despite this recovery, Bitcoin’s path remains uncertain, owing to factors such as sell-side pressure.

Bitcoin is Showing Signs of a Decline Ahead

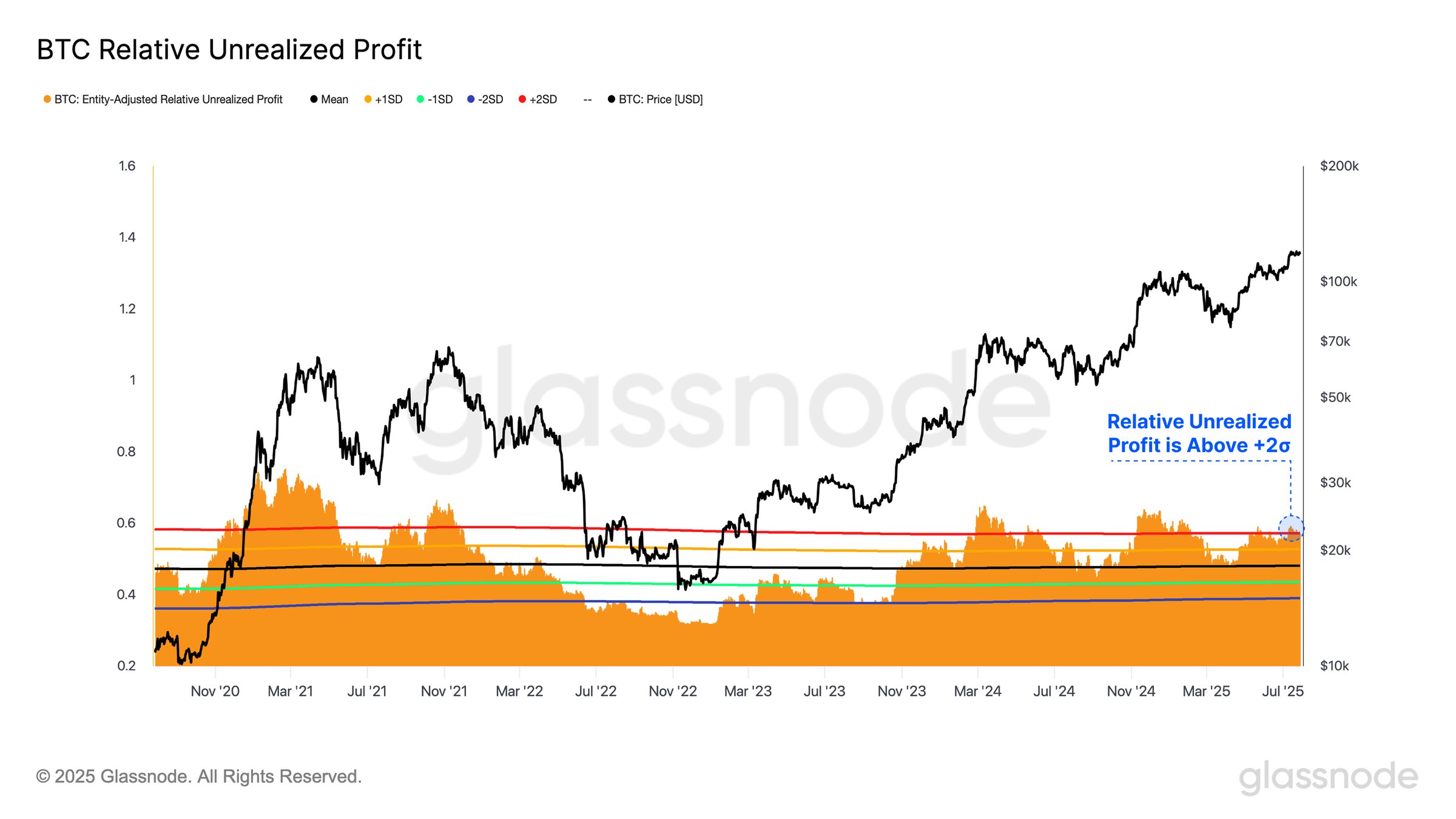

The Relative Unrealized Profit (RUP) has recently broken above the +2σ band, a level often associated with euphoric market phases. Historically, this setup has preceded market tops, signaling a latent sell-side pressure that could eventually drag prices lower.

The current state of the RUP indicates that a pullback may be likely in the coming days, potentially pushing Bitcoin’s price out of its consolidation range. Given past patterns, a shift toward selling could result in further downward pressure.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Unrealized Profit Source:

Bitcoin Unrealized Profit Source:

Bitcoin Unrealized Profit Source:

Bitcoin Unrealized Profit Source:

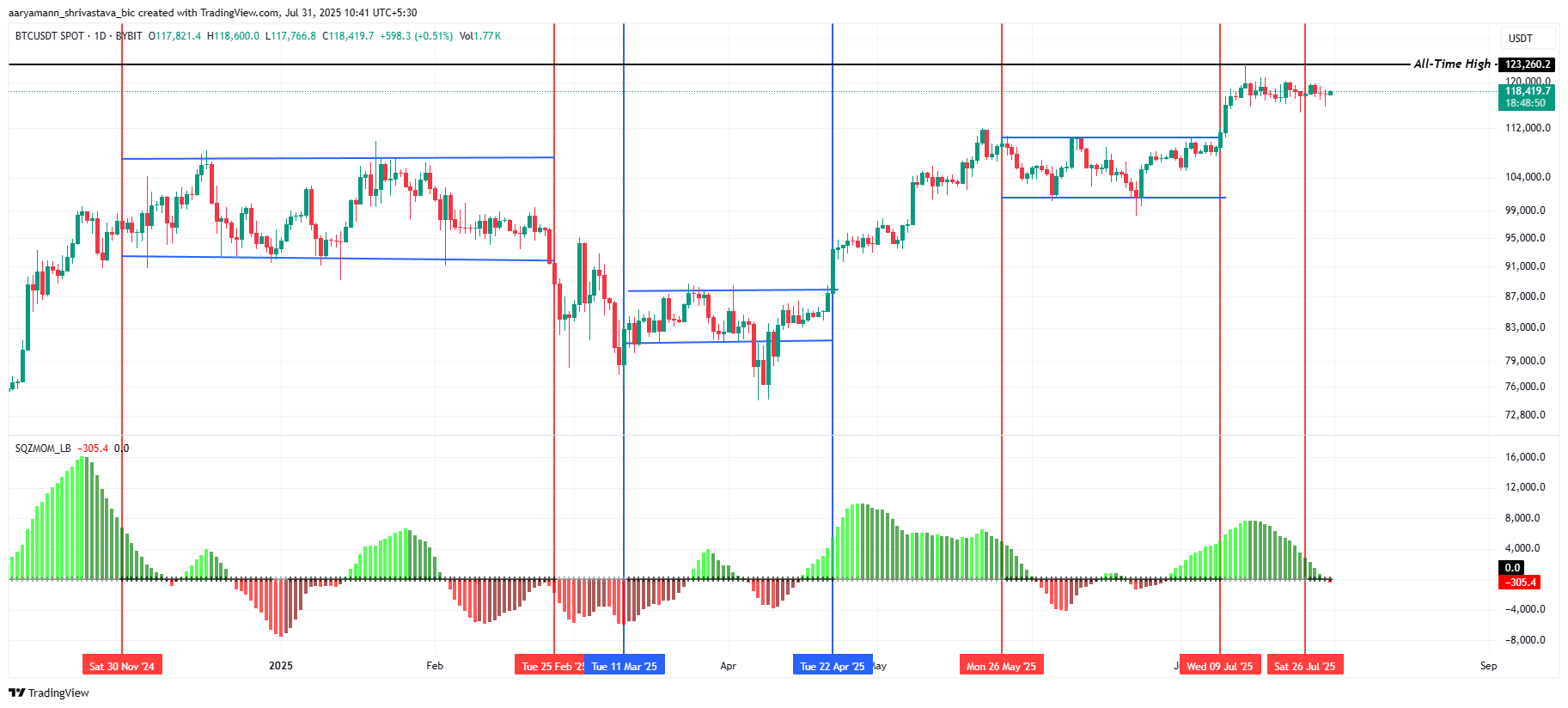

The Squeeze Momentum Indicator (SMI) is signaling that Bitcoin is entering a consolidation phase. Historically, these periods of consolidation, where price movement becomes more limited, have preceded significant price moves once the squeeze is released.

As the squeeze continues to build, Bitcoin’s price is poised for a sharp move in one direction. If the broader market remains bearish, Bitcoin could see a sharp decline, particularly if the SMI confirms this negative trend in the coming days.

Bitcoin SQM. Source:

Bitcoin SQM. Source:

Bitcoin SQM. Source:

Bitcoin SQM. Source:

BTC Price Needs To Jump

Bitcoin is currently trading at $118,410, after falling to $115,700 on Wednesday as the FOMC report came out. The market’s response to the Federal Reserve’s decision to keep interest rates unchanged led to BTC’s recovery, but the underlying market conditions still pose risks.

Bitcoin’s price is susceptible to further declines if investors start booking profits, potentially pushing the cryptocurrency below the $117,261 support level. A drop past this support could lead Bitcoin’s price to $115,000 or even lower.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

The only way this bearish outlook would be invalidated is if Bitcoin manages to hold above $120,000 and reclaim $122,000 as support. A surge above these levels would likely provide the momentum needed to push Bitcoin toward new highs. However, until that happens, Bitcoin’s price remains vulnerable to fluctuations and market pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With the market continuing to decline, how are the whales, DAT, and ETFs doing?

The New York Times: $28 Billion in "Black Money" in the Cryptocurrency Industry

As Trump actively promotes cryptocurrencies and the crypto industry gradually enters the mainstream, funds from scammers and various criminal groups are continuously flowing into major cryptocurrency exchanges.

What has happened to El Salvador after canceling bitcoin as legal tender?

A deep dive into how El Salvador is moving towards sovereignty and strength.

Crypto ATMs become new tools for scams: 28,000 locations across the US, $240 million stolen in six months

In front of cryptocurrency ATMs, elderly people have become precise targets for scammers.