Market Pulse: Week 29

Bitcoin breaks above $120K as investor conviction surges. This week’s Market Pulse analyzes rising spot and ETF flows, aggressive futures positioning, and elevated on-chain profitability - highlighting both bullish momentum and rising correction risks.

Overview

With Bitcoin breaking out of its recent choppy range to a new ATH, market sentiment has shifted decisively toward optimism. Price momentum accelerated alongside a 46.6% surge in spot volume and a reversal in CVD, indicating meaningful investor participation and a shift toward aggressive buying.

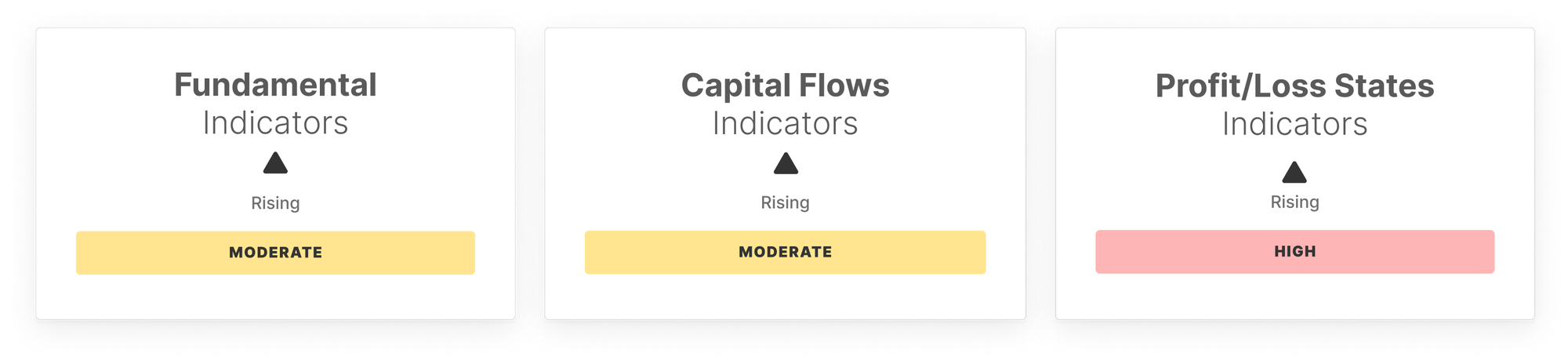

On-chain activity picked up, with transfer volume and ETF flows exceeding statistical highs, reflecting renewed interest from both retail and institutional segments.

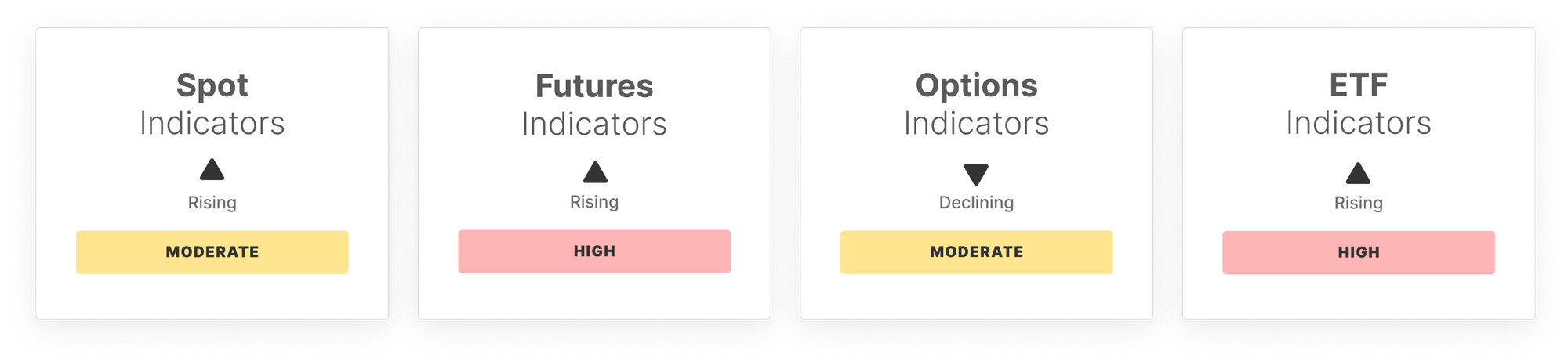

The futures market echoed this enthusiasm, with open interest rising above its high band and funding rates spiking to $2.1M, signaling elevated long-side conviction.

Options market behavior showed a nuanced shift, with rising open interest and skew flipping negative, suggesting increasing demand for upside exposure. However, the narrowing volatility spread hints at a more tempered outlook, possibly reflecting expectations of reduced volatility after recent price moves.

Capital rotation metrics point to a slight increase in short-term holder activity, yet the dominance of long-term holders remains intact, supporting market stability. Meanwhile, profit/loss indicators signal caution, with realized profit-taking rising and nearly 99% of the supply in profit, suggesting elevated euphoria and potential risk of corrections.

In sum, the market is in a high-profit, high-conviction phase, supported by both derivatives and spot participation. While the breakout is backed by strong metrics, heightened profit margins and positioning imbalances call for increased vigilance going forward.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.