Spark (SPK) Crashes 50% From All-Time High—Whales Exit, Buyers Retreat

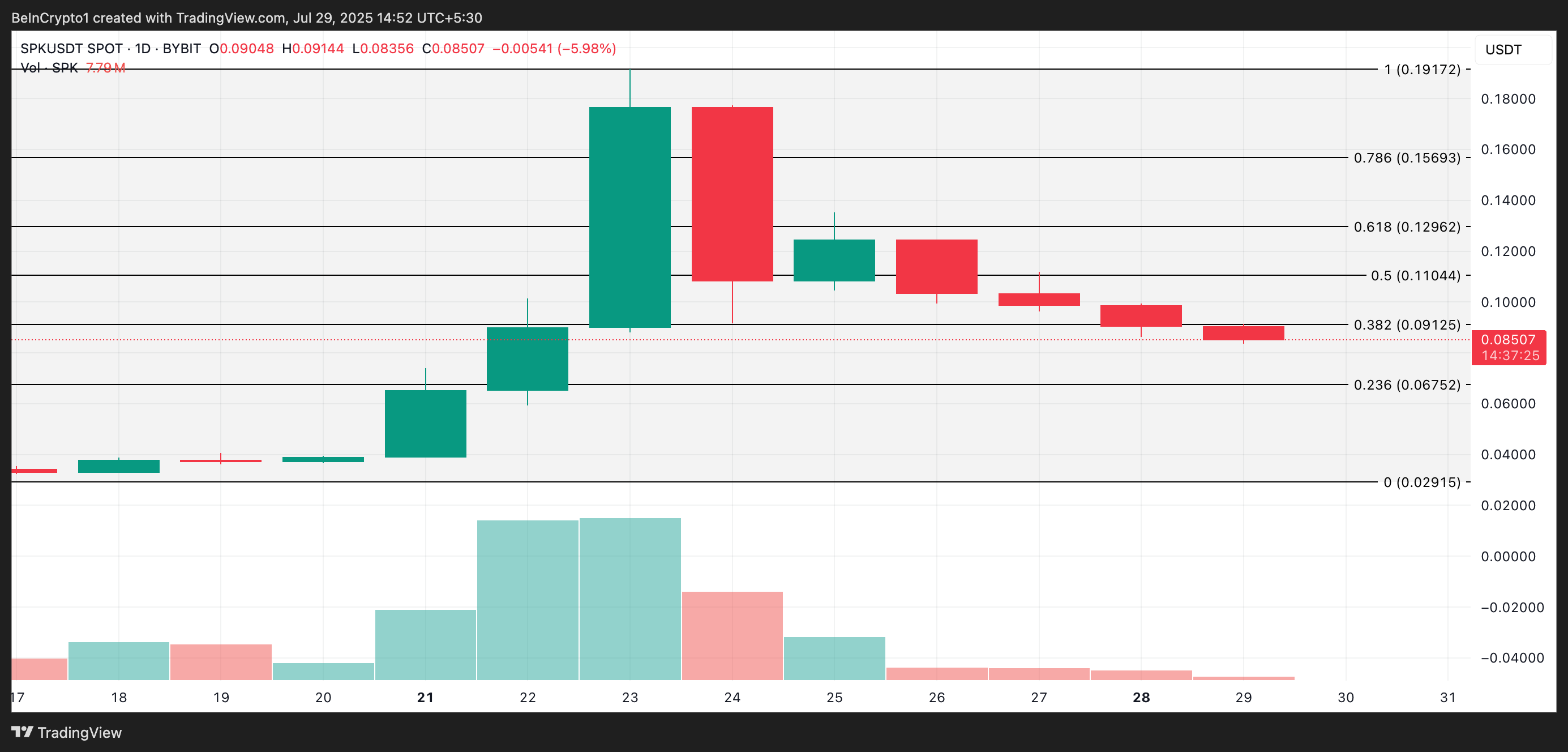

Since reaching an all-time high of $0.19 on July 23, SPK has seen its price plunge by 50% amid intense profit-taking activity.

The sharp downturn comes as bullish sentiment around the token continues to weaken, raising the possibility of further losses in the near term.

SPK Whales Retreat, Bears Take Over

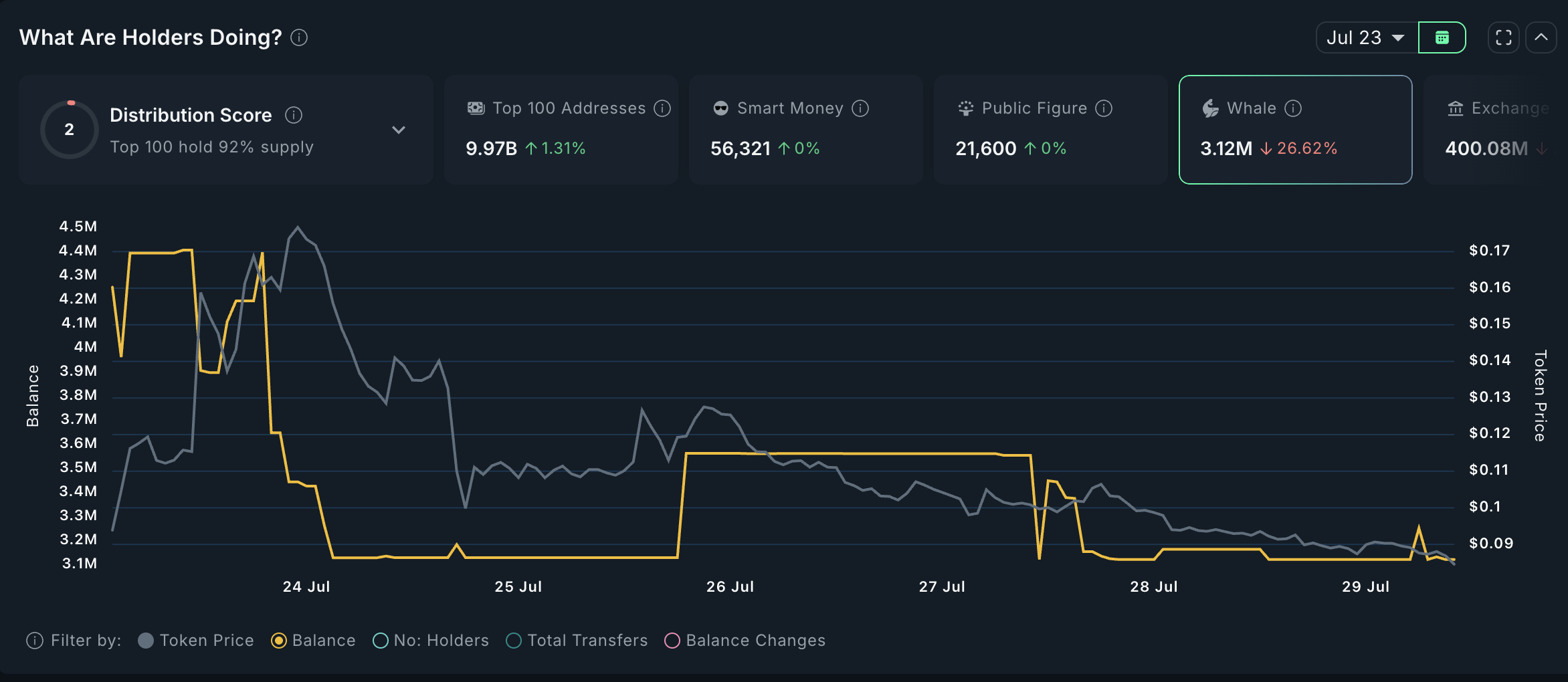

On-chain data from Nansen reveals that large holders—wallets valued over $1 million—have steadily reduced their SPK exposure. Since July 23, token balances across these whale wallets have fallen by 27%, highlighting the retreat by major stakeholders.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The impact could be even more pronounced if short-term holders—many of whom are typically quick to exit at the first sign of weakness—begin to follow suit.

With bullish conviction already eroding, a fresh wave of distribution from “paper-handed” investors could worsen the sell-off, pushing SPK deeper into correction territory.

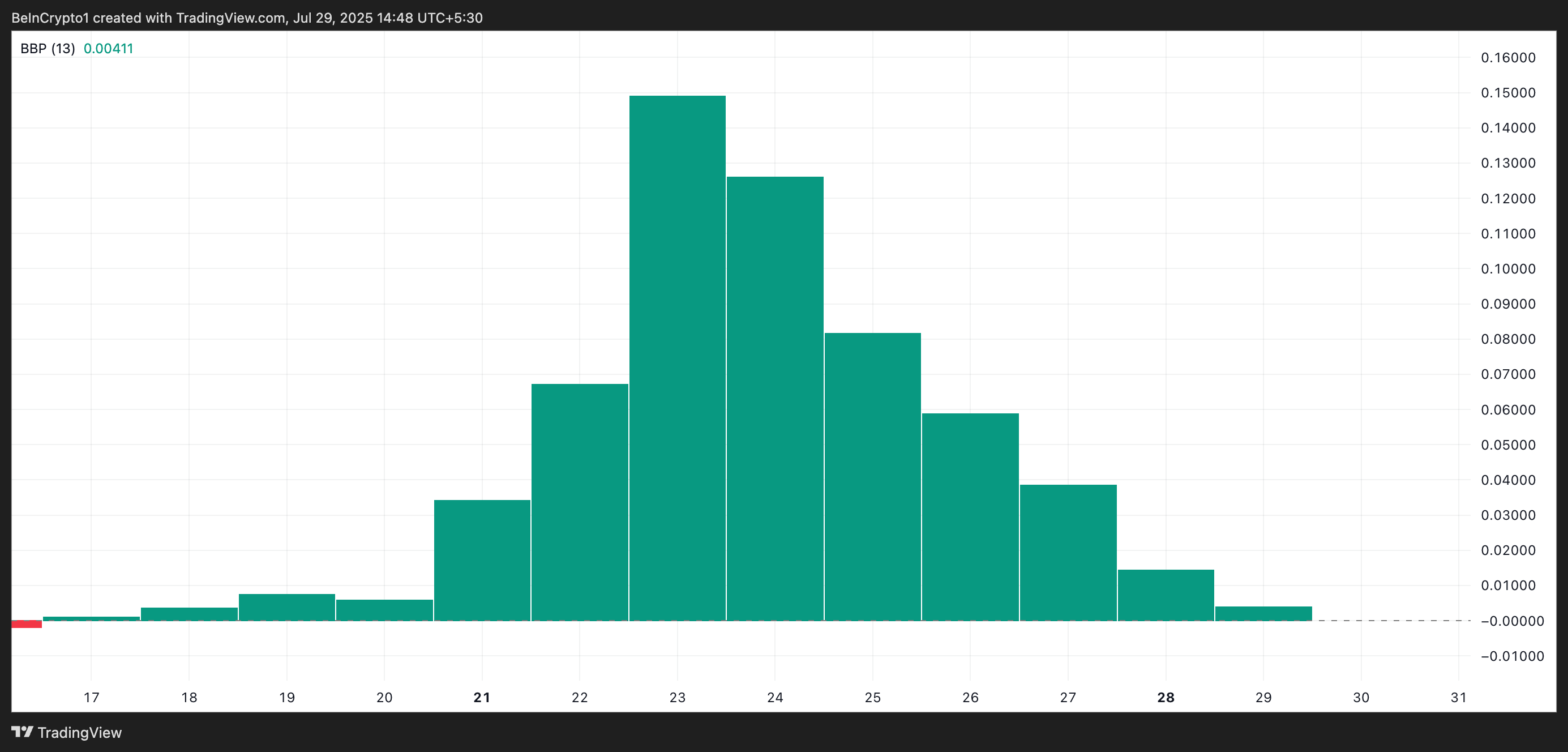

Further confirming the downtrend, SPK’s Elder-Ray Index shows a consistent weakening in bullish momentum. Since the onset of the price decline, the indicator has printed green bars—typically a sign of buyer strength.

However, their sizes have progressively shrunk with each trading session. This contraction signals a steady drop in SPK’s buying pressure, which confirms the market retreat.

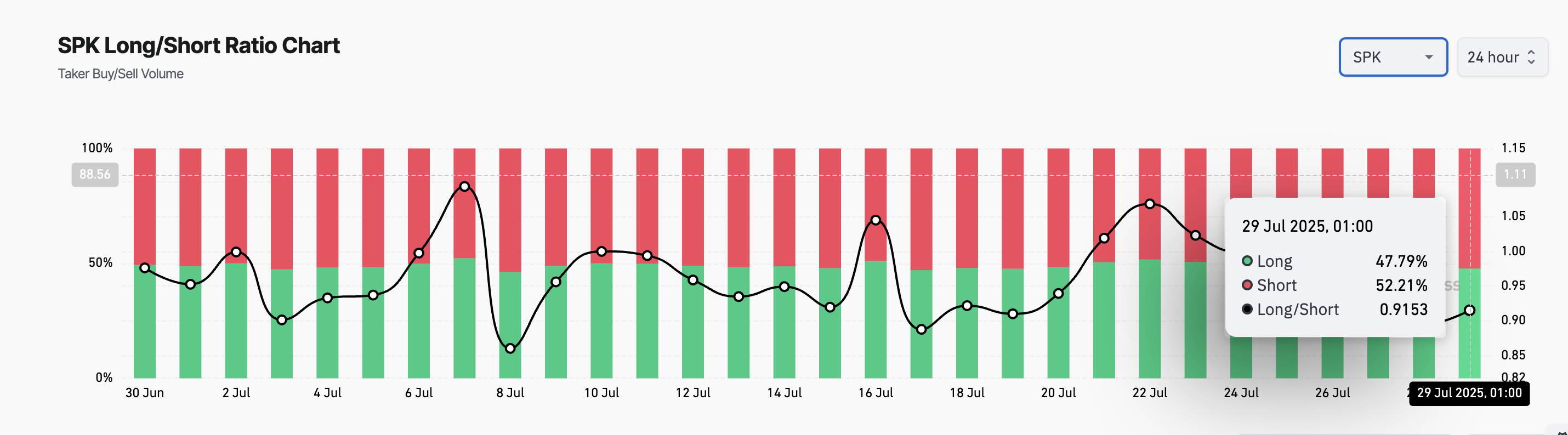

Additionally, bearish sentiment is reflected in the token’s futures market by its long/short ratio. At press time, the ratio stands at 0.91, indicating a growing preference for short positions over longs.

The long/short metric measures the proportion of bullish (long) positions to bearish (short) positions in an asset’s futures market. When the ratio is above one, there are more long positions than short ones. This suggests bullish sentiment, with most traders expecting the asset’s value to rise.

On the other hand, a long/short ratio below 1 means that more traders are betting on the asset’s price to decline than those expecting it to rise.

In SPK’s case, the current ratio of 0.91 suggests that traders are increasingly positioning for further downside, confirming the pessimistic outlook seen in spot market sell-offs.

SPK Bears Tighten Grip as Volume Falls

At press time, SPK trades at $0.085, shedding 7% of its value over the past 24 hours. Amid the broader dip in activity across the crypto market, the altcoin’s trading volume has plunged by over 30% during that period.

When an asset’s price and trading volume fall, it signals weakening market interest and fading momentum. This combination suggests a lack of buyer confidence in SPK and hints at potential for further downside.

In this case, SPK’s value could drop to $0.067.

However, a spike in demand could trigger a break above $0.091.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.