Institutional Investors Express Rising Confidence in Stocks Amid Increased Bearishness on the US Dollar: Goldman Sachs Survey

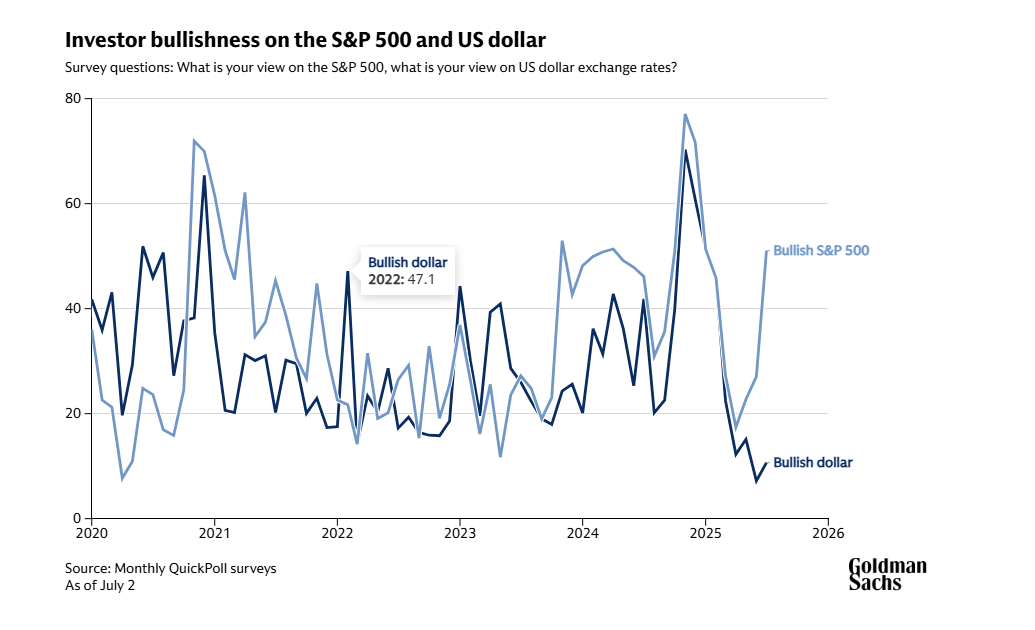

There’s a growing divergence between institutional investors’ expectations for US stocks and the dollar, according to a new survey conducted by the financial giant Goldman Sachs.

Goldman’s survey indicates investors are expressing increased bullishness on US stocks, particularly on Tesla, Meta, Alphabet, Amazon, Apple, Microsoft and Nvidia, the large tech firms that make up the “Magnificent Seven.”

Conversely, the same institutional investors are demonstrating a surge in bearishness on the dollar amid US fiscal issues.

Oscar Östlund, a managing director at Goldman, notes that dollar bears now outnumber bulls by a ratio of more than 7:1.

“One of the most important paradigm shifts over the last couple of months has been the decoupling of the dollar and US equities.”

Source: Goldman Sachs

Source: Goldman Sachs

Goldman’s investor survey has only clocked bearish dollar sentiment next to a bullish view on US stocks three times in the past 9.5 years.

In terms of stocks, 51% of Goldman’s respondents were bullish on the S&P 500, while 32% were bearish.

Östlund says that equity bullishness could suggest market vulnerability to a reversal.

“A very one-sided position is a sign of a stretched market. In itself, a very strong consensus is not a reason for the market to turn, but it makes for a market that’s susceptible to relatively sudden changes based on even minor catalysts.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens

Polygon Exec Predicts Surge to 100,000 Stablecoins, Banks Scramble to Retain Capital