Pi Network Price Slips Toward All-Time Low With No Fresh Demand in Sight

Pi Network’s token struggles within a narrow trading range, with weak demand and low volume pointing to a bearish outlook. The asset risks breaking down unless fresh momentum enters the market.

Pi Network’s native token has extended its lackluster performance by yet another day, tumbling 7% in the last 24 hours.

The fresh decline has pushed the asset closer to the lower trend line of the narrow trading range it has traded within since July 15, putting its all-time low back in sight. With new demand still significantly absent, the question is no longer if—but when—a breakdown could occur.

Will PI Break Down or Bounce?

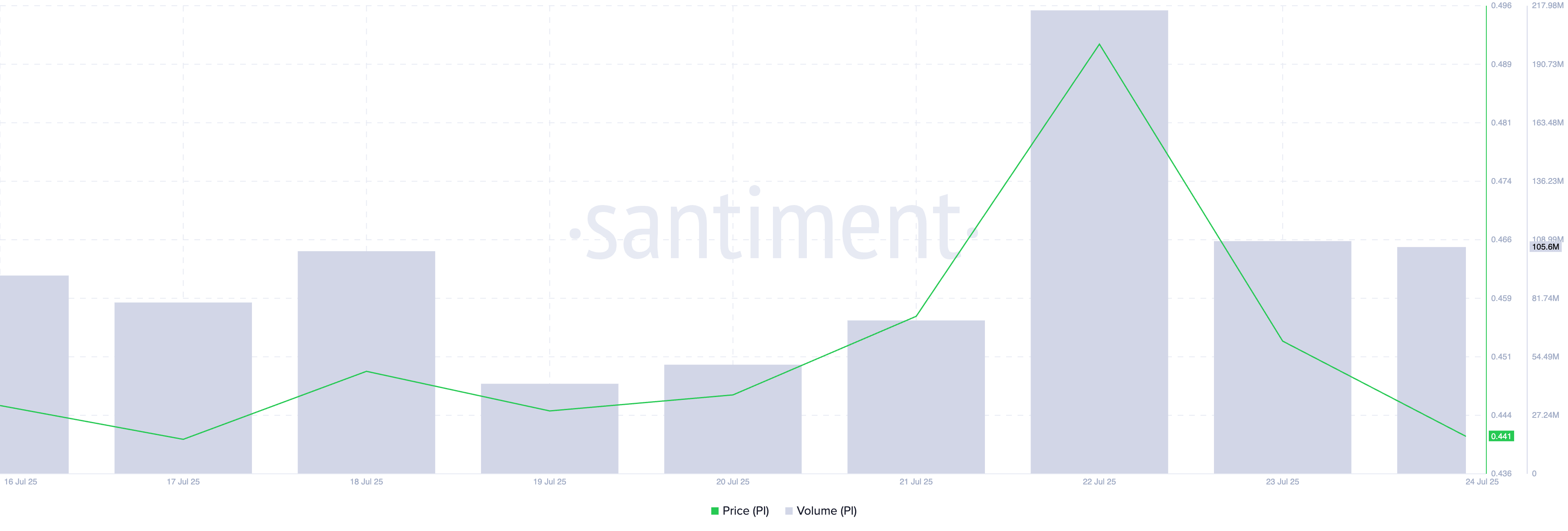

The PI token price has traded within a tight range since July 15, struggling to break free from the $0.43 support and the $0.46 resistance. Despite multiple attempts to push above the upper boundary, each rally has failed due to weak demand, forcing the token back into sideways movement.

In its spot markets, daily trading volumes remain low, suggesting waning market participation and little appetite for a bullish reversal. Over the past day, this is down 14% and totals $105 million at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

PI Price and Trading Volume. Source:

PI Price and Trading Volume. Source:

When an asset’s price and trading volume drop simultaneously, it confirms weakened market interest and fading momentum from buyers and sellers. This suggests a lack of conviction among IP traders, which could worsen its price performance if volume does not recover.

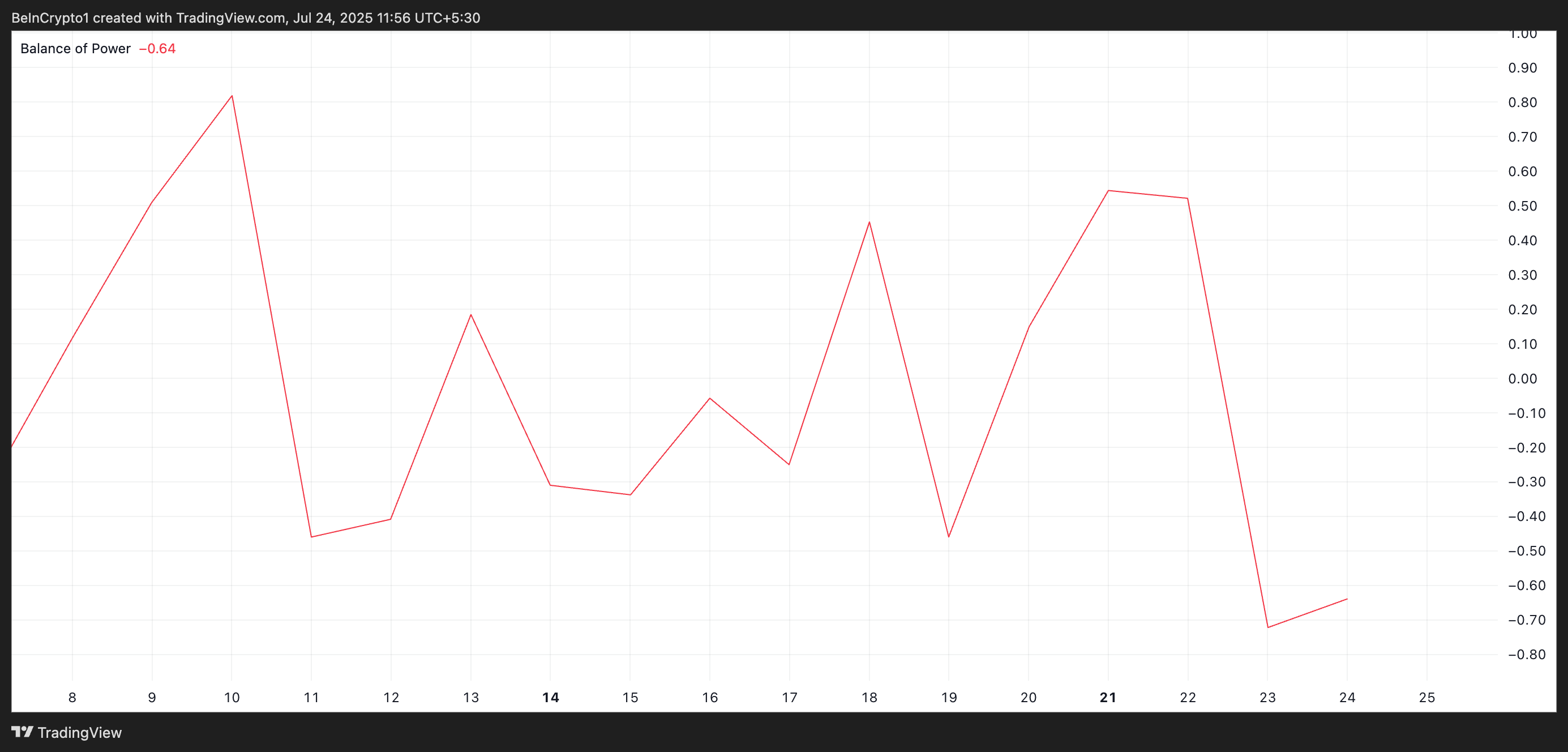

Furthermore, momentum indicators continue to show that buying pressure has thinned significantly. For example, PI’s Balance of Power (BoP) returns a negative value of -0.64 as of this writing, highlighting the sell-side pressure in the market.

PI BoP. Source:

PI BoP. Source:

The BoP indicator measures the strength of buyers versus sellers in the market. When its value is positive, buyers dominate the market over sellers and drive newer price gains.

Conversely, a negative BoP reading signals that sellers are in control, with little to no buyer resistance. PI’s BoP reinforces the bearish outlook for the altcoin, suggesting that selling activity could continue if fresh demand fails to enter the market.

PI Eyes $0.40 Breakdown or $0.50 Breakout

If selloffs persist, a slip below the support floor at $0.43 is likely. In this scenario, PI risks plunging to its all-time low of $0.40. If distribution continues, PI could even register new price lows.

PI Price Analysis. Source:

PI Price Analysis. Source:

On the other hand, a positive catalyst could propel a break above resistance at $0.46. If this happens, the PI token price could climb toward $0.50.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.