Solana vs Ethereum: The ATH Race Begins — Which Coin Will Break Records First?

Solana vs Ethereum: 谁先突破新高?

The crypto market is heating up, and two of the biggest altcoins — Ethereum (ETH) and Solana (SOL) — are at the center of attention. Both tokens are edging closer to their previous all-time highs (ATHs), sparking a fierce debate: which one will get there first?

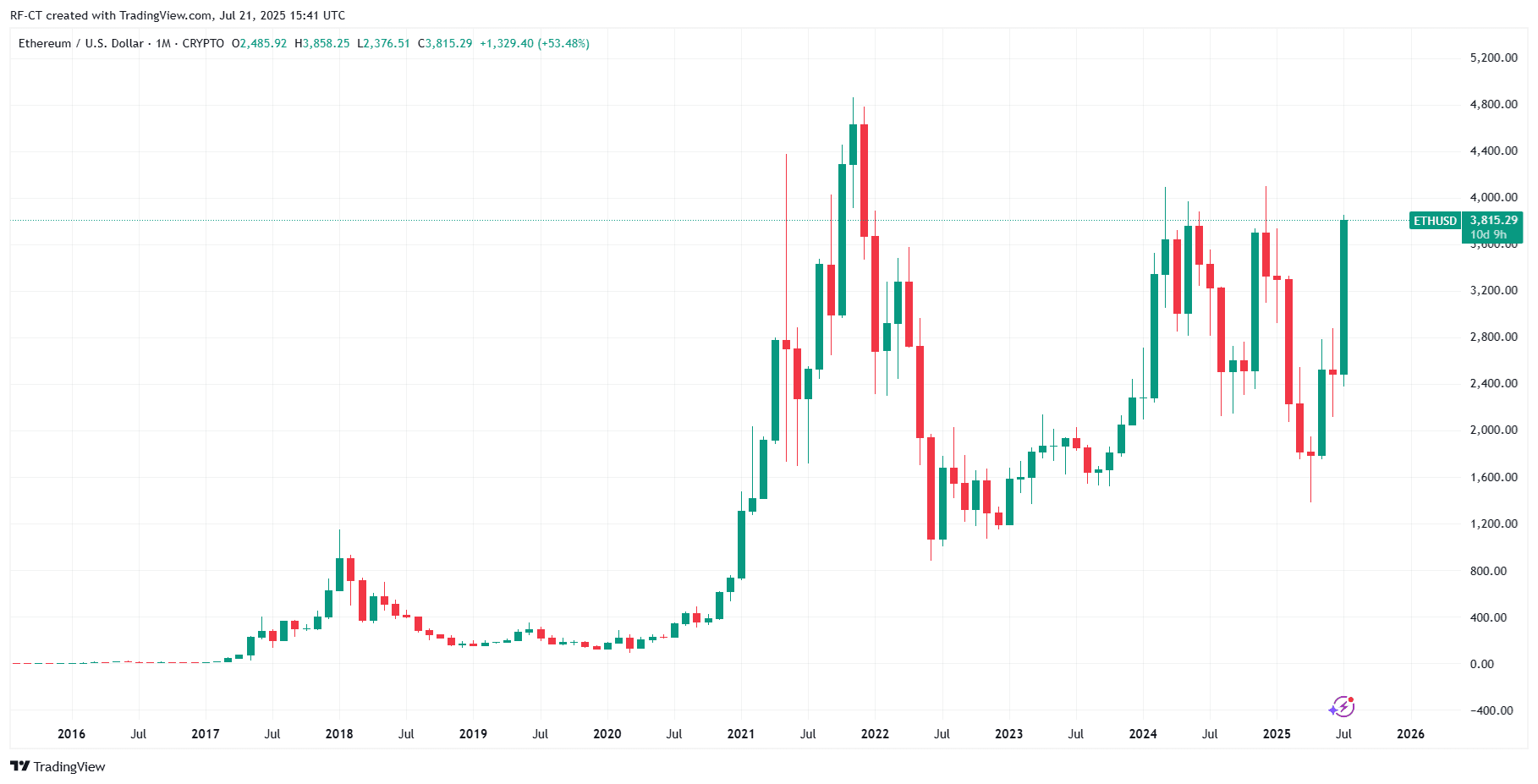

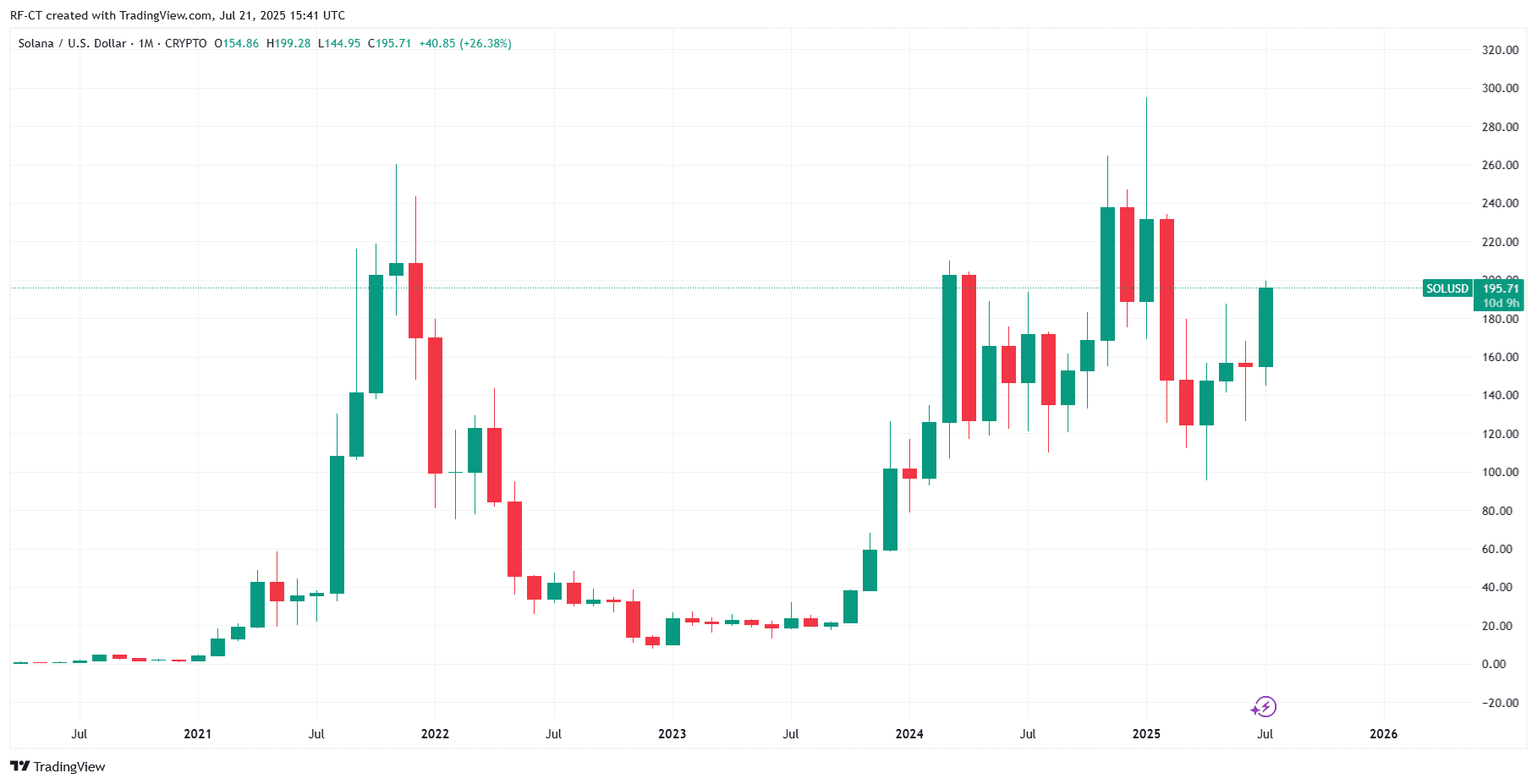

As of July 21, 2025:

- Ethereum is trading around $3,800, just 22% below its ATH of ~$4,878.

- Solana is hovering near $174, sitting 33% below its ATH of ~$260.

With altcoin season gaining traction and institutional money flowing into crypto, the battle is on.

Latest News Fuelling the Surge

Ethereum Gains Institutional Momentum

Ethereum’s growth is powered by ETF inflows , rising staking participation, and support from upcoming U.S. legislation like the Genius Act and Clarity Act, which aim to regulate stablecoins and define crypto asset classifications. Analysts suggest these developments are reinforcing ETH’s dominance as the leading smart contract platform.

Solana Rides the Meme & RWA Wave

Solana, meanwhile, is seeing massive adoption thanks to :

- A surge in meme coin launches like $TRUMP and $DOOD,

- An explosion in Real World Asset (RWA) protocols, up over 140% YTD,

Its ultra-low fees and fast throughput making it a favorite for developers and retail traders alike.

Technical Analysis: Who’s Closer?

| ETH | ~$3,800 | ~$4,878 | -22% | Steady uptrend |

| SOL | ~$174 | ~$260 | -33% | High volatility |

Ethereum is slowly grinding higher with strong support zones and bullish RSI patterns. Solana recently broke past the $165–170 resistance and could test $200 in the coming weeks.

Analysts Are Split

According to market sentiment:

- Ethereum is more likely to reach its ATH first, backed by long-term demand, growing institutional adoption, and strong fundamentals.

By TradingView - ETHUSD_2025-07-21 (All)

By TradingView - ETHUSD_2025-07-21 (All)

- Solana, however, has higher upside potential in percentage terms. A breakout above $200 could open the door to $260 and beyond — especially if meme coin hype and RWA activity continue.

By TradingView - SOLUSD_2025-07-21 (All)

By TradingView - SOLUSD_2025-07-21 (All)

21Shares’ analysts even stated that while ETH is “safer,” SOL could be the top-performing altcoin in a bull cycle due to its faster growth curve.

Risk vs Reward Comparison

| Institutional Support | ✅ Strong ETF backing | ❌ Less institutional focus |

| Developer Ecosystem | ✅ Largest ecosystem | ✅ Fast-growing |

| Volatility | 🔵 Medium | 🔴 High |

| Hype Potential | 🔵 Moderate | ✅ Extreme (Meme/Fair Launch) |

| Network Fees | 🔴 High | ✅ Low |

Final Verdict: The ATH Race Is ON

- Ethereum is likely to reach its ATH first, due to stronger fundamentals and sustained institutional support.

- Solana might outperform in speed and % gains, especially in a meme-driven, speculative rally.

Investors are watching both charts closely, and as market dominance begins to shift from Bitcoin to altcoins, the ETH vs SOL rivalry is one of the most exciting narratives of 2025.

买入机会前瞻

是否考虑在突破前布局?

$SOL, $ETH

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.