New Zealand to ban crypto cash machines in anti-money laundering measure

- New Zealand restricts cryptocurrency exchanges to combat money laundering

- Ban affects more than 200 crypto exchanges in the country

- Reform includes limit on international money transfers

The New Zealand government announced Plans to ban cryptocurrency ATMs are underway as part of a comprehensive overhaul of anti-money laundering and countering the financing of terrorism (AML/CFT) legislation. The measure was confirmed by Associate Minister of Justice Nicole McKee in an official statement released on July 9.

According to McKee, the proposed bill seeks to prevent serious financial crimes and prevent the misuse of the country's financial system for illegal activities. "This government is serious about fighting criminals, not about trapping legitimate companies in unnecessary bureaucracy," the minister stated.

The proposed ban on cryptocurrency ATMs came as a response to the widespread use of these machines to convert illicit money into digital assets. New Zealand currently ranks eighth in the global ranking of cryptocurrency ATMs, with 221 in operation. If the legislation is passed, this infrastructure will have to be shut down.

This decision aligns with measures already adopted by other countries. Germany, for example, confiscated the equivalent of US$28 million in illegal crypto asset cash machines the previous year. Australia and some US states have also tightened controls on these terminals.

In addition to the ban, the reform proposes limiting international money transfers to US$5.000 per transaction. The goal is to make it more difficult for criminal organizations to move large sums of money without being detected by regulators.

The changes also involve adjustments to compliance requirements for companies considered low risk, allowing enforcement resources to focus on entities with the greatest potential for violations. McKee explained that the Financial Intelligence Unit (FIU) will be allowed to request data of strategic interest, facilitating the development of financial intelligence that assists investigations.

According to the minister, these actions are essential to align the country with international regulatory practices. "We need a smarter and more agile AML/CFT system—one that combats criminals' ability to launder money while allowing New Zealand companies to operate efficiently and competitively," she concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

SEC launches innovative exemption policy—Has U.S. crypto regulation entered a new era?

The door to exploration has just opened.

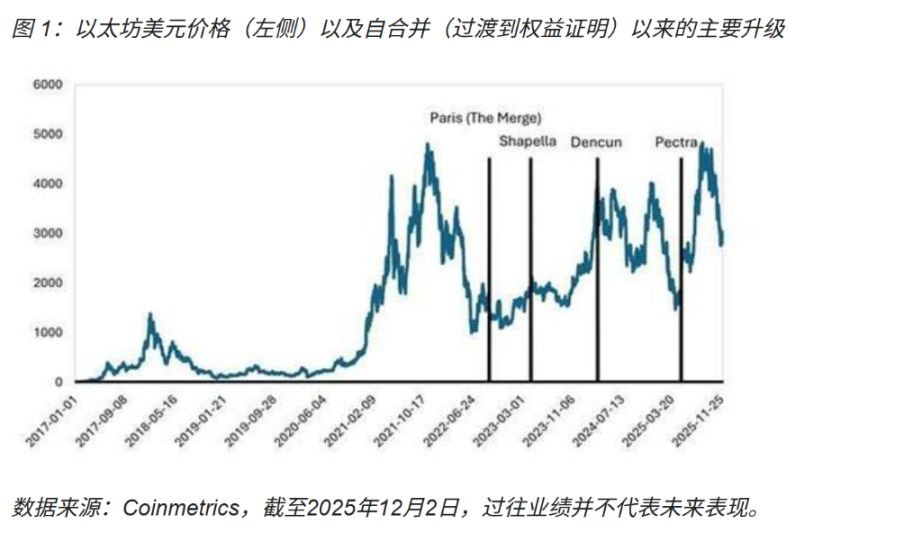

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.