Traders Brace For Impact As Over $4 Billion in Bitcoin and Ethereum Options Expire

With $4.1 billion in crypto options expiring, BTC and ETH traders are bracing for price turbulence driven by macro risks and market sentiment.

The crypto market will witness $4.11 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

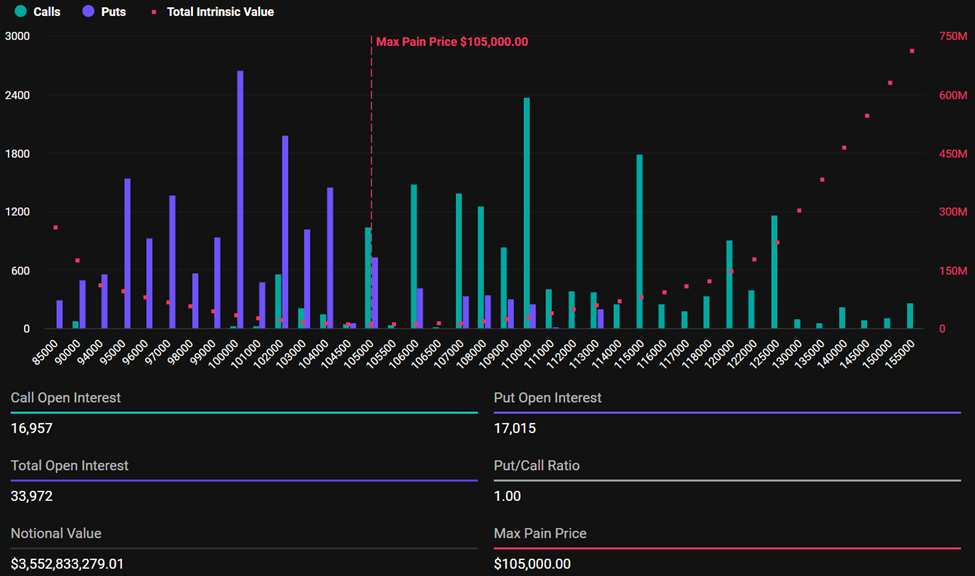

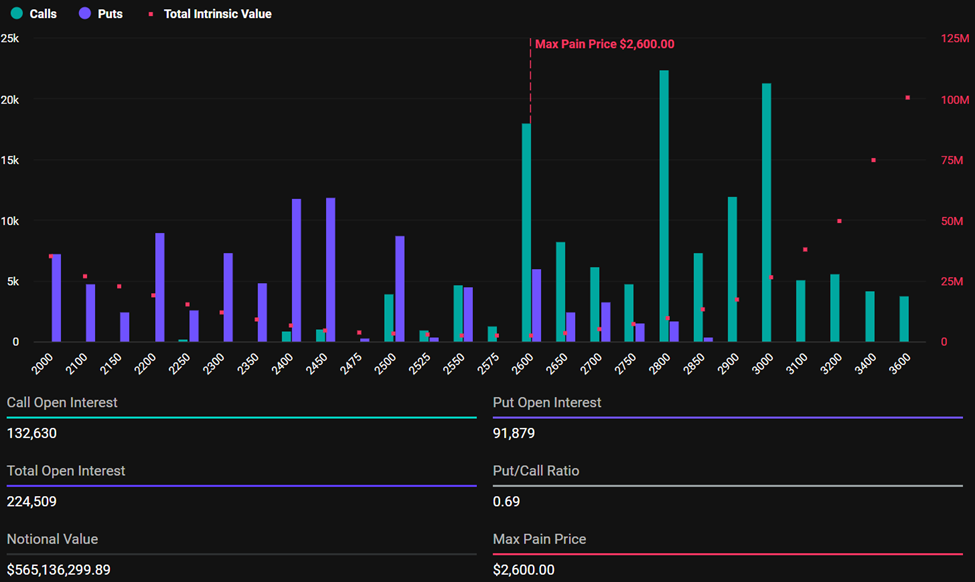

With Bitcoin options valued at $3.5 billion and Ethereum at $565.13 million, traders are bracing for potential volatility.

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

According to Deribit data, Bitcoin options expiration involves 33,972 contracts, compared to 27,959 contracts last week. Similarly, Ethereum’s expiring options total 224,509 contracts, down from 246,849 contracts the previous week.

Expiring Bitcoin Options. Source:

Deribit

Expiring Bitcoin Options. Source:

Deribit

For Bitcoin, the expiring options have a maximum pain price of $105,000 and a put-to-call ratio of 1.00. This indicates traders might be equally divided between bearish (buying puts) and bullish (buying calls) outlooks.

It reflects uncertainty or a consolidation phase in the market, aligning with BeInCrypto’s recent report on Bitcoin’s resilience amid geopolitical tension. The pioneer crypto remains range-bound, with institutional support and low volatility bolstering its position.

Nevertheless, the call and put open interests indicate a slight lean toward puts, hinting at mild bearish sentiment or hedging.

In comparison, their Ethereum counterparts lean bullish with a put-to-call ratio of 0.69 and a maximum pain price of $2,600.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

The maximum pain point is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless, inflicting maximum financial “pain” on traders.

Traders and investors should brace for volatility, as options expirations often cause short-term price fluctuations, which create market uncertainty. Based on the Max Pain Theory, asset prices tend to gravitate toward their respective max pain or strike prices.

Ethereum, trading below its max pain level at $2,506 as of this writing, means a bullish outlook and explains the call options as traders bet on price increases. On the other hand, though also below its max pain level, Bitcoin shows more balanced positioning with a put-to-call ratio of 1.0.

“BTC shows more balanced positioning near max pain, while ETH flows tilt bullish with calls dominating up the curve. How will the market respond this time?” analysts at Deribit posed.

However, markets usually stabilize soon after traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing crypto market trends into the weekend.

Geopolitical Risks and Fed Outlook Weigh on Sentiment

Elsewhere, analysts at Greeks.live note that market sentiment among crypto derivatives traders has turned notably bearish in the short term. This comes after the Federal Reserve Chair Jerome Powell’s latest FOMC statement.

The trading group is broadly positioning for downside risk through July, while maintaining long-term optimism into the fourth quarter (Q4).

“Traders are running negative delta for July positions while planning to add positive deltas for Q4,” Greeks.live wrote in a post.

Geopolitical tensions, particularly the rising risk of US involvement in the Middle East, are emerging as the dominant short-term catalyst. Several traders are reportedly positioning long puts ahead of potential US involvement and Iran tensions, hedging against a further market downturn.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.