Jamie Dimon criticizes US Bitcoin reserves, defends military focus

- Jamie Dimon Says US Should Not Hoard Bitcoin

- JPMorgan CEO defends military stockpiles and rare earths

- US Bitcoin Reserve Remains in Early Stage

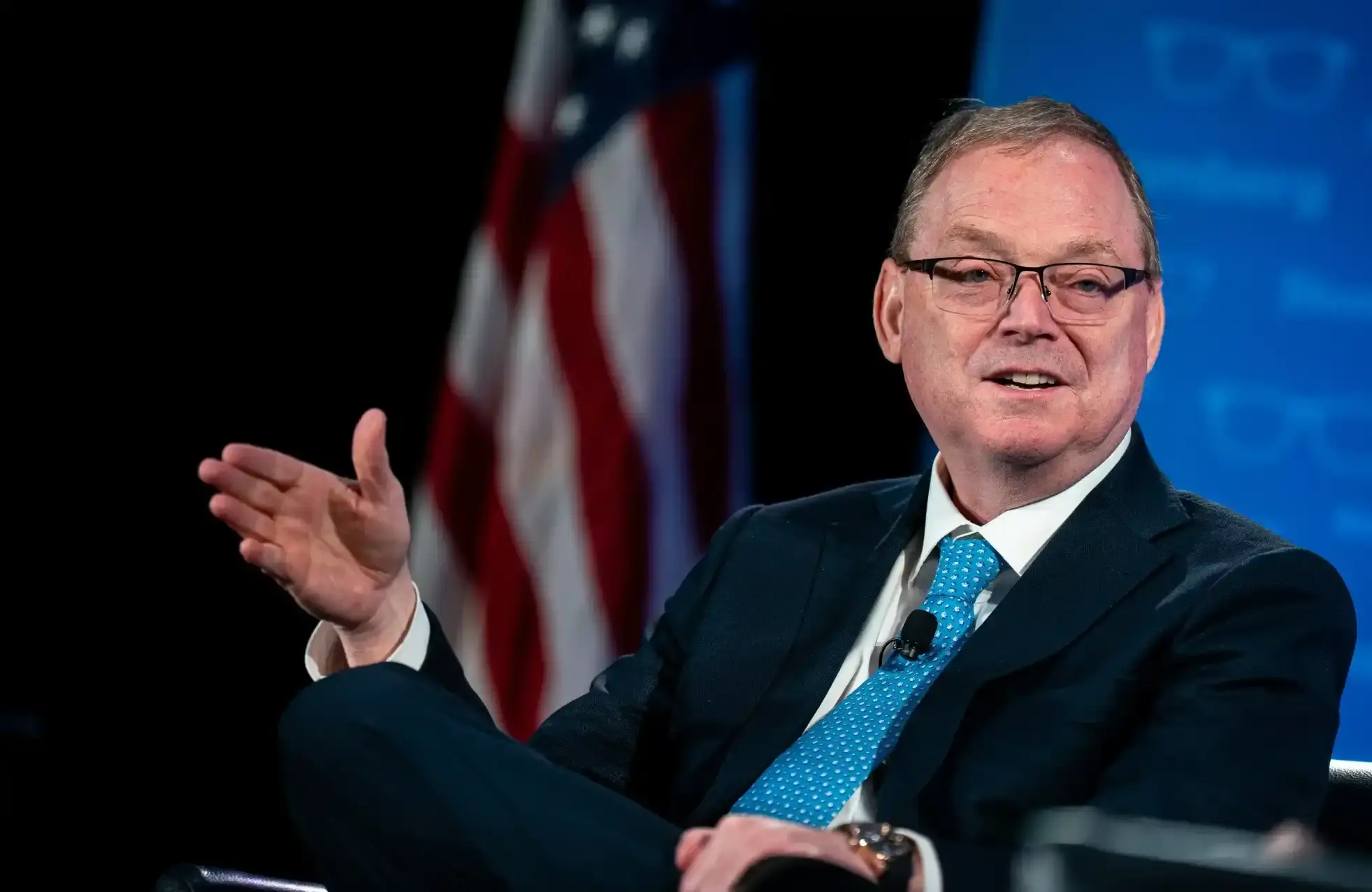

During his participation in the Reagan National Economic Forum, Jamie Dimon, CEO of JPMorgan, openly criticized the proposal to include Bitcoin in the United States' strategic stockpiles. For the executive, the government's focus should be on national security, prioritizing weapons, tanks, drones and rare earths instead of digital assets.

“We shouldn’t be hoarding bitcoins,” stated Dimon said during a panel discussion. According to him, US military stockpiles are at critical levels, with insufficient supplies of missiles and other essential equipment. This situation, according to the CEO, poses a direct risk to the country's military readiness.

🎯JUST IN: JPMorgan CEO Jamie Dimon speaks out AGAINST the 🇺🇸US Government crushing # Bitcoin reservations

“We shouldn't be stockpiling bitcoins… We should be stockpiling guns, bullets, tanks, planes, drones, you know, rare earths.”

— CryptosRus (@CryptosR_Us) May 31, 2025

The statements come in response to an executive order signed in March by former President Donald Trump that establishes a reserve of Bitcoin as a strategic asset, similar to gold or oil. The measure seeks to strengthen the economy and protect the stability of the dollar, according to Trump campaign crypto advisers Bo Hines and David Sacks.

Despite Dimon’s criticism, institutional interest in Bitcoin continues to grow. Senator Cynthia Lummis has introduced the Bitcoin ACT, a bill that would establish formal guidelines for government-mandated Bitcoin hoarding. The bill is awaiting review by the Senate Banking Committee.

Dimon's stance follows a historical line of criticism of Bitcoin. In the past, he compared the cryptocurrency to the tulip bubble and even declared that he would fire any JPMorgan employee caught trading the asset. However, more recently, the financial institution allowed its customers to purchase Bitcoin, although without offering custody services.

Other investment banks, including Morgan Stanley and Goldman Sachs, are also making moves into the crypto space. Morgan Stanley plans to include Bitcoin and Ether trading on its E-Trade platform from 2026, while clients already have access to ETFs linked to the cryptocurrency market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Bankruptcy" of Metcalfe's Law: Why Are Cryptocurrencies Overvalued?

Currently, the pricing of crypto assets is largely based on network effects that have yet to materialize, with valuations clearly outpacing actual usage, retention, and fee capture capabilities.

Need Funding, Need Users, Need Retention: A Growth Guide for Crypto Projects in 2026

When content becomes saturated, incentives become more expensive, and channels become fragmented, where lies the key to growth?

EOS faces renewed turmoil as the community accuses the Foundation of running away with the funds

The collapse of Vaulta is not only a tragedy for EOS, but also a reflection of the shattered ideals of Web3.

Exclusive: Revealing the Exchange’s New User Acquisition Strategy—$50 for Each New User

Crypto advertising has evolved from being barely noticeable to becoming pervasive everywhere.