-

Bitcoin’s ascent beyond $110,000 has sparked unprecedented demand in the U.S., illustrated by a significant rise in the Coinbase Premium Index (CPI).

-

The surge in interest has led to substantial inflows into BTC exchange-traded funds (ETFs), totaling $609 million, underscoring a pivotal shift in investor sentiment.

-

According to analysts, the recent bullish trends indicate a resilient market, with positive indicators suggesting further upside for Bitcoin.

This article analyzes the recent surge in Bitcoin demand in the U.S., driven by a new price level and significant ETF inflows, highlighting market dynamics.

Bitcoin Sees Renewed US Interest

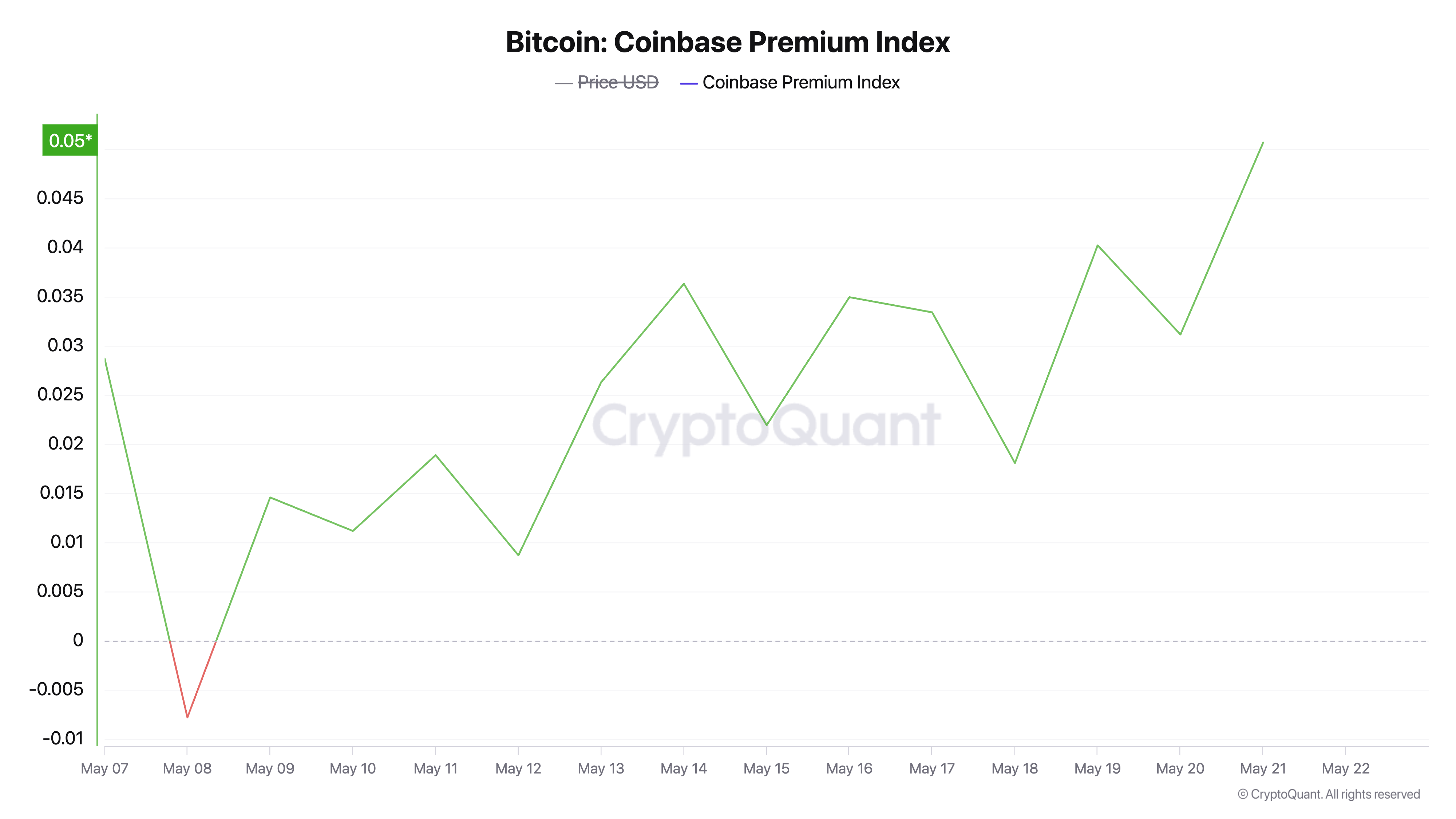

As Bitcoin recently crossed the crucial $110,000 milestone, demand surged among U.S. traders. The heightened interest is reflected in the Coinbase Premium Index (CPI), which recorded its highest point in 24 days, demonstrating increased trading activity on Coinbase.

Bitcoin Coinbase Premium Index. Source: CryptoQuant

The CPI provides insights into the buying activity of BTC on Coinbase compared to Binance. A value above zero indicates stronger interest from U.S. investors, while a drop into negative territory suggests declining trading activity.

The recent spike in the CPI reflects an invigorated bullish sentiment, with traders showing readiness to pay more for BTC. This trend could potentially culminate in further price increases.

Moreover, Bitcoin spot ETFs have shown remarkable performance, with total inflows reaching $609 million. This figure signifies an impressive 85% increase from the previous day’s total of $329.02 million, marking a continuous six-day accumulation of net positive flows.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

These developments underscore growing interest from both retail and institutional investors, providing an optimistic outlook for Bitcoin as demand escalates across various trading platforms and investment vehicles.

BTC Trades Near Record High With Strong Buying Pressure Intact

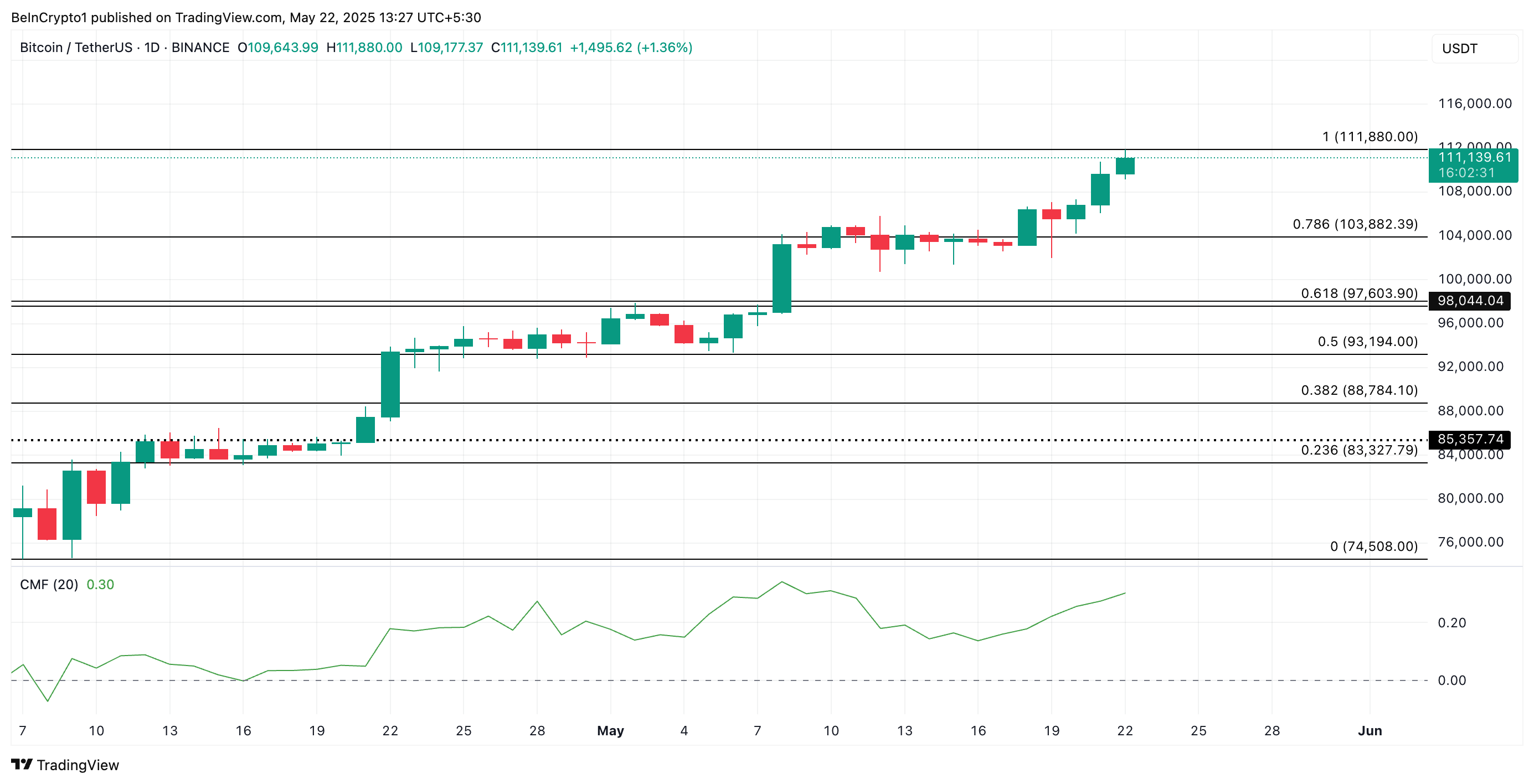

Currently, Bitcoin is trading at approximately $111,139. Despite a slight 1% pullback from its recent all-time high of $111,888, the underlying bullish momentum remains intact.

Technically, Bitcoin’s Chaikin Money Flow (CMF) is a key indicator to watch, currently holding at a positive 0.30, which indicates persistent buying pressure among investors. Should this trend continue, Bitcoin is poised to potentially break its recent record.

Bitcoin Price Analysis. Source: TradingView

Conversely, should market conditions shift significantly towards selling, Bitcoin’s value might drop to around $103,882, illustrating the delicate balance within the current market dynamics.

Conclusion

In summary, Bitcoin’s rise above $110,000 is creating waves in the U.S. market, characterized by increased trading activity and ETF inflows. This growing interest and bullish sentiment indicate that Bitcoin may maintain its upward trajectory in the near future. Investors should remain vigilant as market indicators evolve, keeping in mind potential volatility that may arise.