The European Central Bank may be more cautious in cutting interest rates after June

Danske Bank's Co-Head of Fixed Income and FX Research, Philip Anderson, stated in a report that the reasons for the European Central Bank to take more cautious measures after the expected rate cut in June have recently increased, but further easing should follow. We still consider rate cuts in July and September as the benchmark. A new round of speeches by ECB officials may provide more clues to understand the ECB's change in sentiment after the US softened its trade stance. (Jin10)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

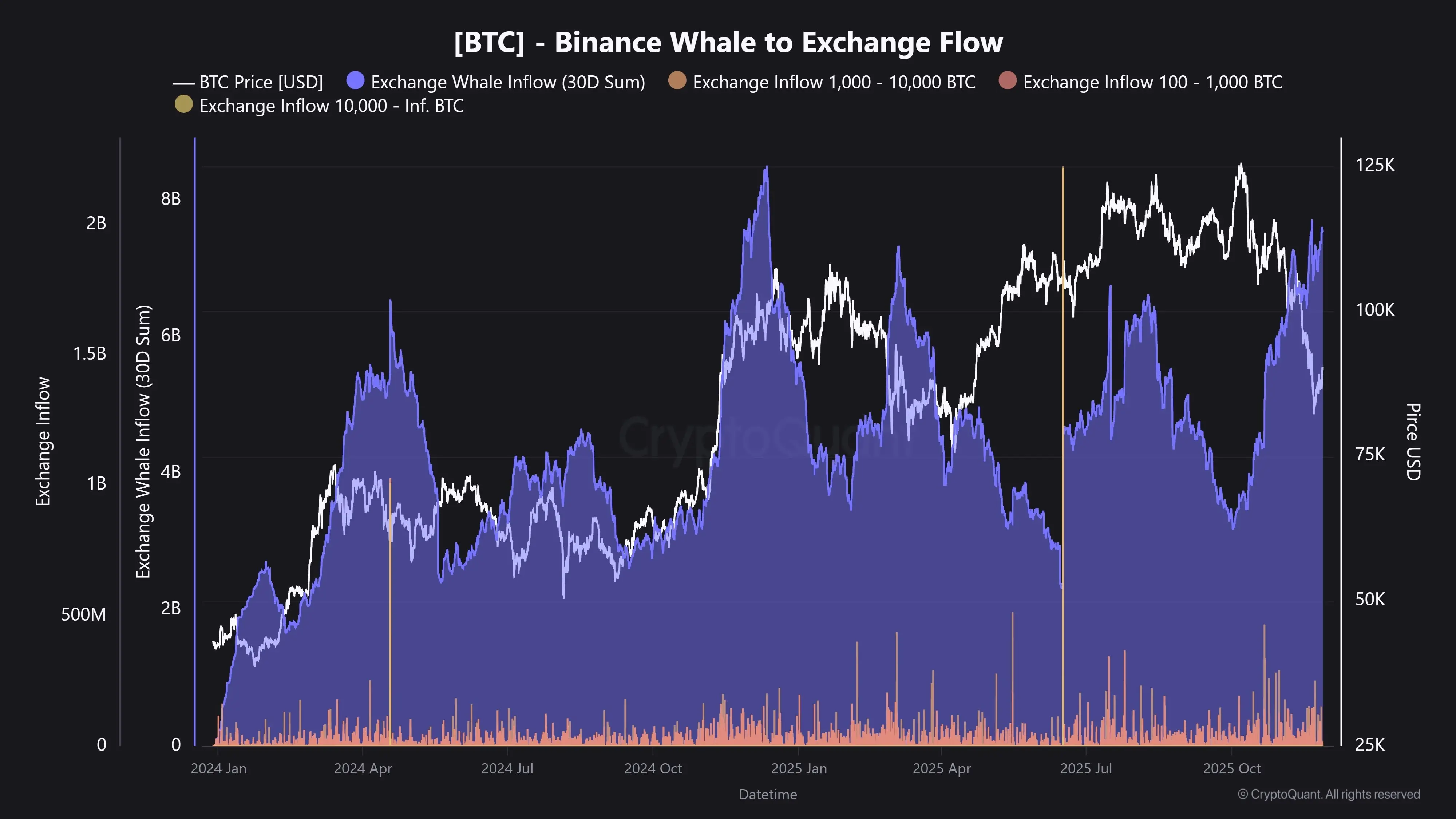

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended