-

Ethereum’s recent performance highlights a complex tapestry of whale activity, price fluctuations, and market sentiment, drawing attention from crypto investors.

-

Despite a notable decline to $2,492, whales have demonstrated strong interest, leading to increased accumulation amidst signs of market volatility.

-

A recent observation from COINOTAG indicated that whale wallets are diversifying their holdings, showcasing a push towards resilience in uncertain times.

This article delves into Ethereum’s price trajectory, whale activities, and significant shifts in trading behavior to unveil potential market movements.

Doubling down or signaling caution?

Whale wallets holding 10K–100K ETH have increased their holdings to 16.793 million ETH, suggesting strong accumulation. This shows a strategic move by large holders despite the current price drop.

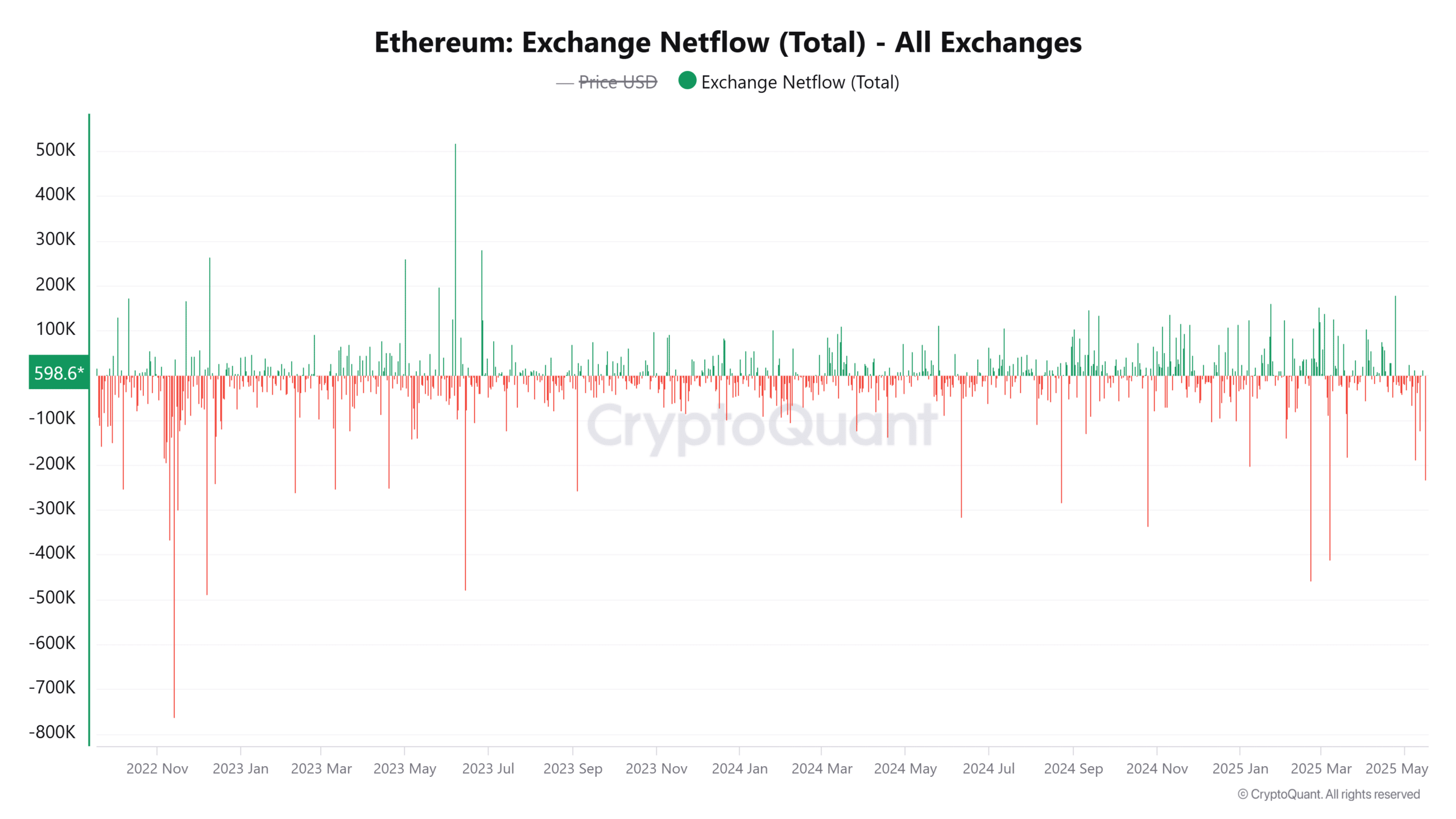

At the same time, Exchange Netflows exhibited a sharp 84.22% weekly spike in ETH outflows, further reinforcing a bullish long-term perspective among major investors.

However, a recent sale by one significant whale of 10,543 ETH at $2,476 reflects persistent market unease, highlighting the volatile sentiment that surrounds Ethereum. This can induce caution among smaller investors.

Source: CryptoQuant

What does $398M in USDT and $540M in ETH signal?

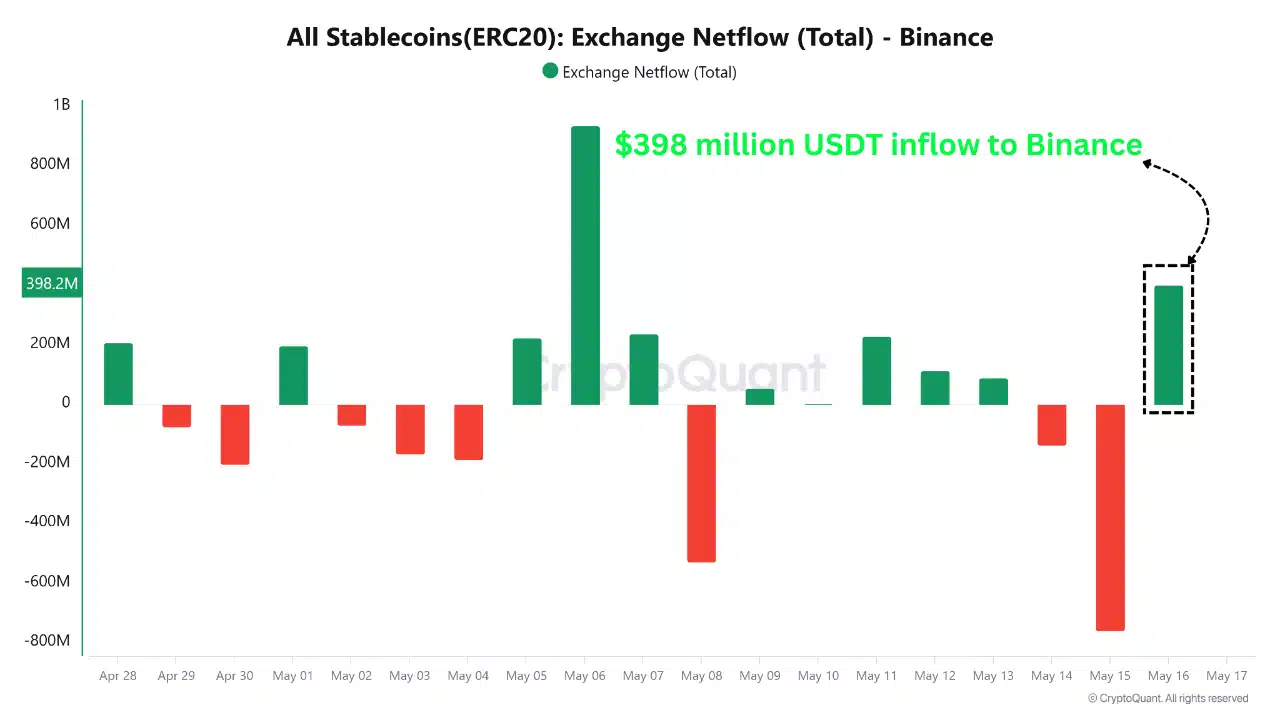

On-chain data revealed a significant shift: $398 million worth of Tether (USDT) flowed into Binance, while $540 million worth of ETH was withdrawn from centralized exchanges on the same day.

This marks the largest single-day ETH net withdrawal since early April, indicating that large holders are likely transferring assets to cold storage or staking platforms for security.

This substantial USDT influx suggests whales are preparing to capitalize on current ETH prices, which are perceived as conducive for accumulation.

Source: CryptoQuant

More users join Ethereum, existing users go quiet

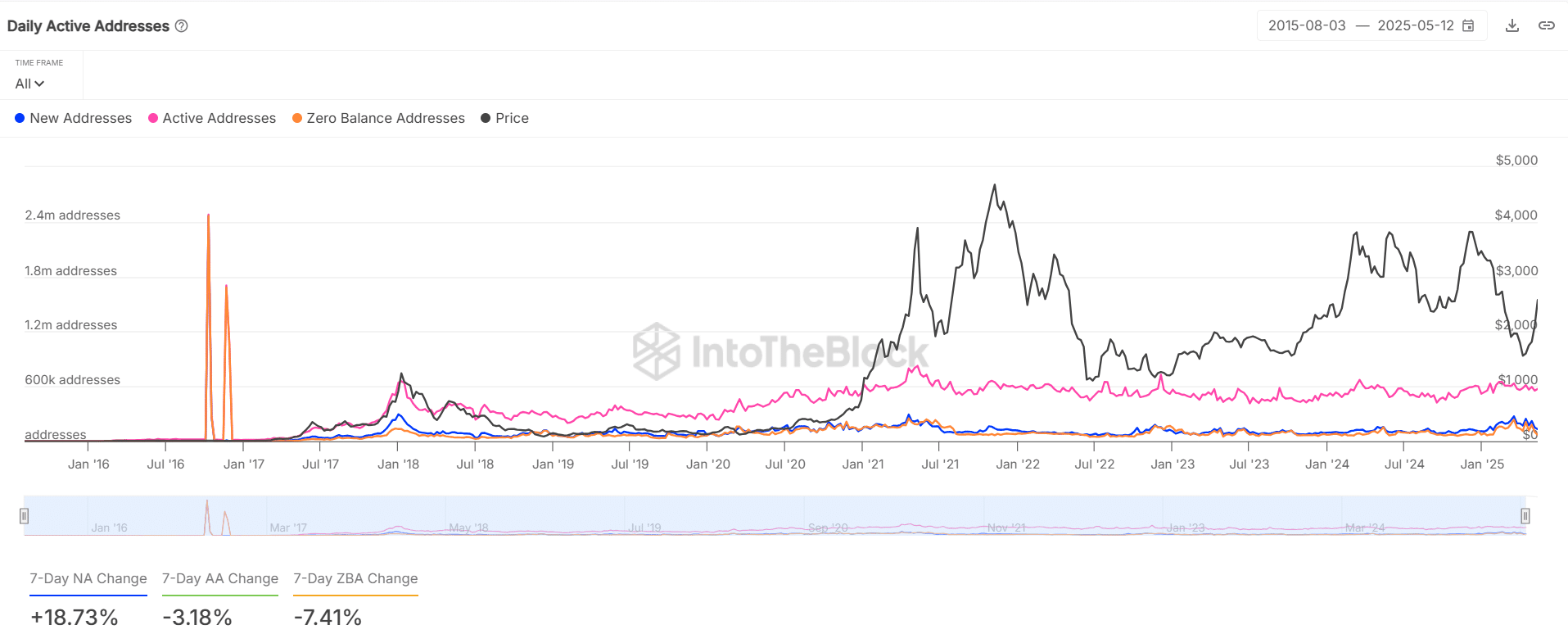

Interestingly, Ethereum’s network reported an 18.73% increase in new addresses over the past week. Yet, Active Addresses saw a 3.18% decrease, indicating that while new interest is growing, existing user engagement is waning.

This divergence implies that while the long-term outlook for Ethereum might be brightening, current market conditions are leading many existing users to adopt a more cautious stance.

Source: IntoTheBlock

Is ETH finding support or stalling at key Fib levels?

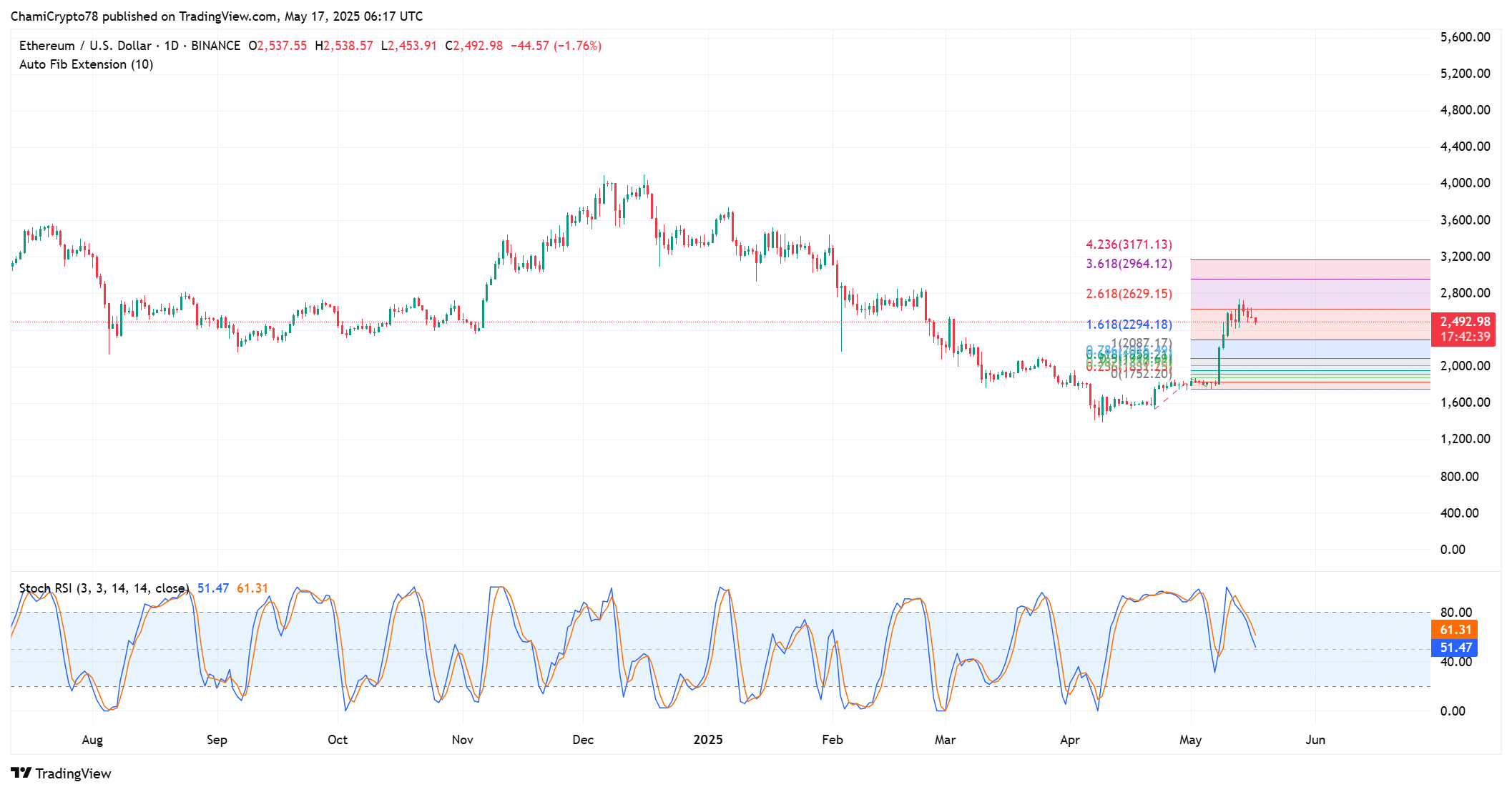

Ethereum recently touched $2,629, aligning with the 2.618 Fibonacci extension, before retreating. The current price hovers near $2,492, positioned between crucial support and resistance zones.

Stochastic RSI readings indicate neutral momentum, suggesting that ETH might be in a consolidation phase before a decisive breakout occurs.

Monitoring price action around this Fibonacci level will be essential. A sustained hold above $2,292 (Fib 1.618) could pave the way for upward continuation.

Source: TradingView

Despite today’s drop, Ethereum reveals strong whale support and rising stablecoin inflows. If buyers defend current levels, a rebound toward $2,800 may still hold potential.