Ethereum’s recovery faces resistance as large whale inflows raise fresh concerns about sell pressure.

-

Galaxy Digital deposited $42M in ETH, triggering market concerns amid whale inflow spikes.

-

Indicators suggest cautious accumulation amidst mixed derivatives sentiment and weak profitability.

Galaxy Digital’s OTC wallets have deposited 23,900 Ethereum [ETH] ($42.52 million) to Coinbase, signaling a potential intent to offload assets. This development comes as Ethereum shows signs of recovery, but the timing of the inflows raises concerns about short-term selling pressure.

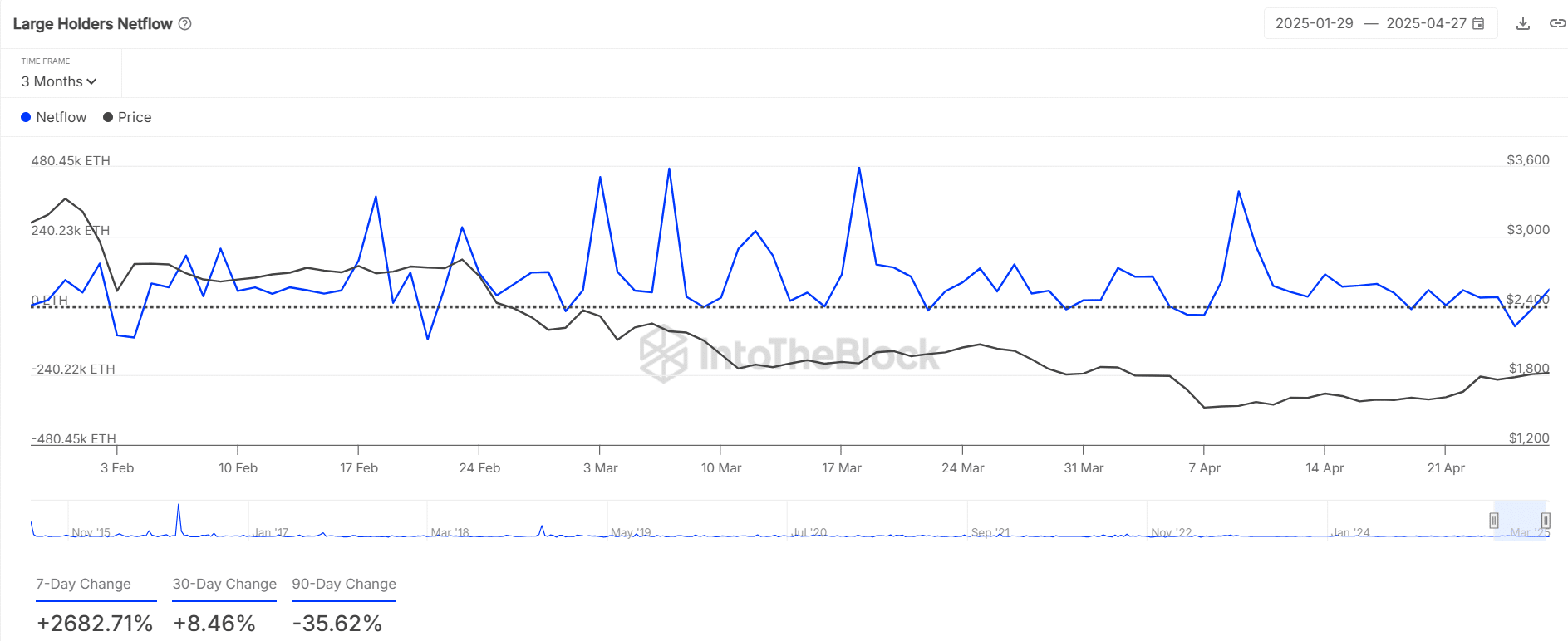

Additionally, large holder netflows have spiked significantly, adding to the caution. At the time of writing, Ethereum traded at $1,832.58, up 1.17%, but lingering uncertainty may challenge the strength of its rebound.

Despite the massive inflow to Coinbase, Ethereum’s supply on exchanges has steadily declined, now standing at just 8.23M ETH, its lowest in months. This suggests that most holders continue to opt for self-custody or staking rather than liquidating.

However, the 2,682% surge in large holder netflow over the past seven days indicates redistribution or strategic positioning. Although exchange supply remains low, sudden OTC activity may create short-term volatility.

Source: IntoTheBlock

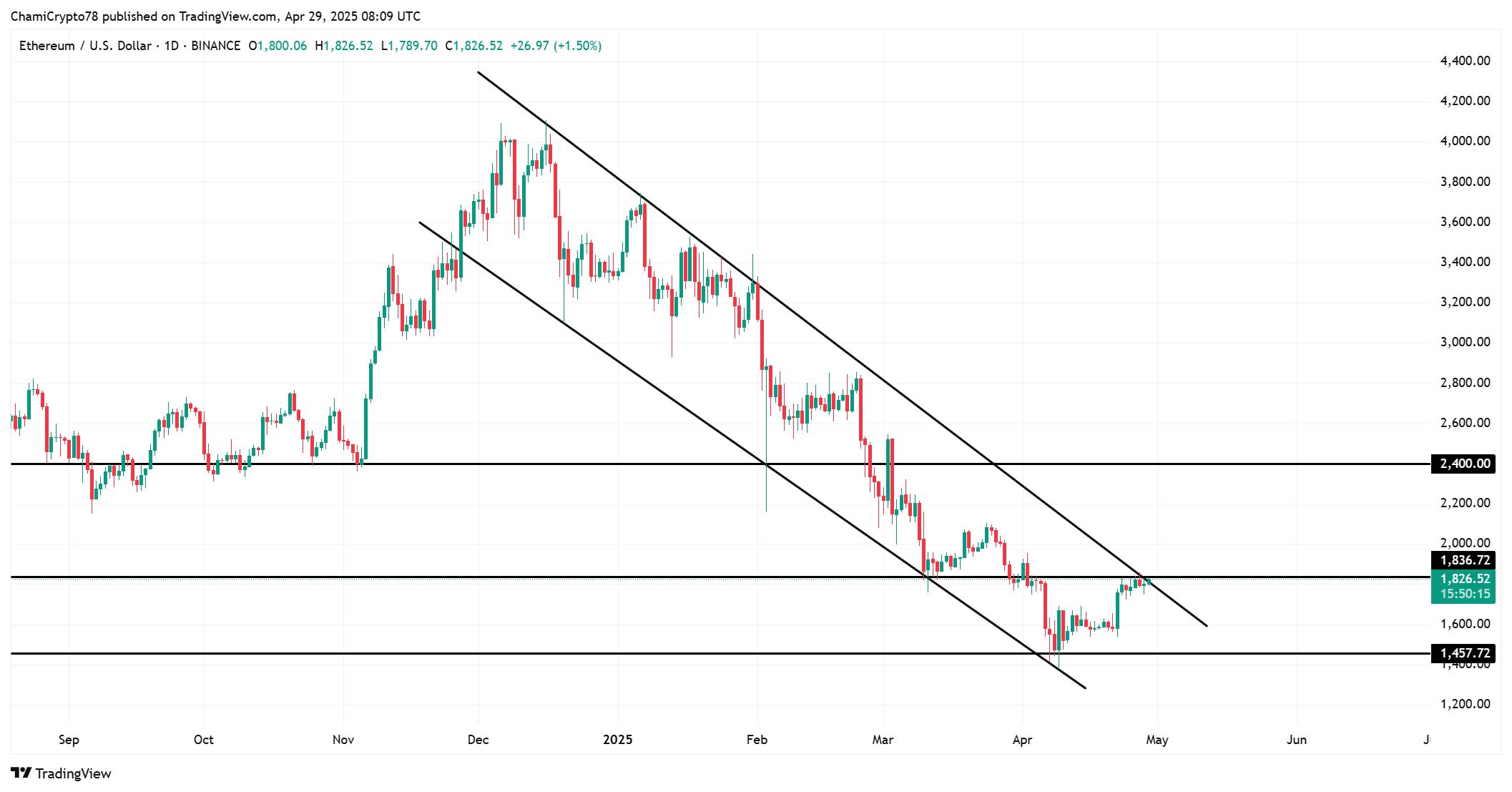

Price structure analysis: Key levels to watch

Ethereum has successfully broken out of a falling wedge pattern, a technical formation typically associated with bullish reversals. The breakout has propelled the price above the $1,800 mark, with $1,830 now acting as an immediate support zone.

However, Ethereum faces resistance around the $1,850 region, and a clean move above this level could open a path toward the $2,200 and $2,400 targets.

On the downside, failure to hold $1,830 could see Ethereum retest support levels near $1,670. Therefore, price action around these critical zones will be decisive for the next major move.

Source: TradingView

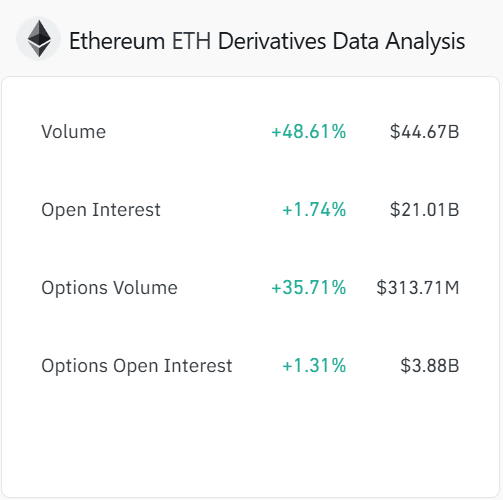

Growing speculative appetite but mild conviction

Derivatives data reflects a spike in speculative interest. ETH’s perpetual trading volume surged 48.61% to $44.67B, while Open Interest climbed 1.74% to $21.01B. Options markets also followed suit, with volumes up 35.71%.

However, Funding Rates on Binance remained nearly flat at +0.008%, showing that while leverage has increased, traders were cautious. This neutral bias suggests that conviction is still forming and not overly aggressive.

Source: CoinGlass

Is the market still in accumulation mode?

On-chain metrics pointed toward a continued accumulation phase. The MVRV Z-score was -0.67 at press time, indicating that most ETH holders were underwater, which historically correlates with accumulation zones.

Additionally, the neutral Funding Rate aligned with low-risk sentiment among derivatives traders. Therefore, even with whale inflows, profit-taking appeared limited, and the broader market may still be preparing for a larger move.

Source: Santiment

Ethereum’s recovery is underway but faces mixed signals. While exchange supply continues to fall and MVRV suggests accumulation, whale deposits and rising derivatives exposure introduce uncertainty.

Ultimately, the ability to flip $1,950 into support will determine whether Ethereum can reclaim bullish momentum or if it remains vulnerable to another correction.