Nexo to reenter US market after two-year regulatory exit and $45 million settlement

Quick Take The crypto lender announced its U.S. comeback at a private event attended by Donald Trump Jr., son of the President, among others. Nexo previously exited the United States due to multi-agency investigations and eventually paid $45 million to settle charges with federal and state watchdogs.

Crypto lender Nexo is reentering the U.S. market , nearly two years after halting services for American clients due to regulatory scrutiny of its Earn Interest Product.

The company revealed its return during a closed-door business event, where it announced plans to reintroduce crypto savings accounts, asset-backed loans, and other core offerings for both retail and institutional customers.

Zug-based Nexo left the U.S. market in 2022 amid centralized lenders like BlockFi, Celsius, and Voyager declaring bankruptcy. Unlike competitors, Nexo’s retreat stemmed from regulatory probes rather than insolvency. The company started halting access to its Earn Interest Product in several US states in 2022.

Agencies like the Consumer Financial Protection Bureau (CFPB) and the Securities and Exchange Commission (SEC) accused Nexo of failing to register the offer and sale of its Earn product to retail clients. The company officially ceased U.S. operations in December 2022 and later agreed to a $45 million settlement in January 2023 without admitting wrongdoing.

Now, under President Donald Trump’s administration, which has signaled a shift in crypto oversight and a pivot away from the enforcement action style adopted by former SEC Chair Gary Gensler, Nexo is staging a comeback. The Trump administration has signaled intentions to reduce regulatory hostility toward crypto, including withdrawing some SEC investigations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

x402 The most crucial piece of the puzzle? Switchboard aims to rebuild the "oracle layer" from scratch

Switchboard is an oracle project within the Solana ecosystem and proposes to provide a data service layer for the x402 protocol. It adopts a TEE technology architecture, is compatible with x402 protocol standards, supports a pay-per-call billing model, and removes the API Key mechanism, aiming to build a trusted data service layer. Summary generated by Mars AI. The accuracy and completeness of this content, generated by the Mars AI model, is still in an iterative update phase.

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.

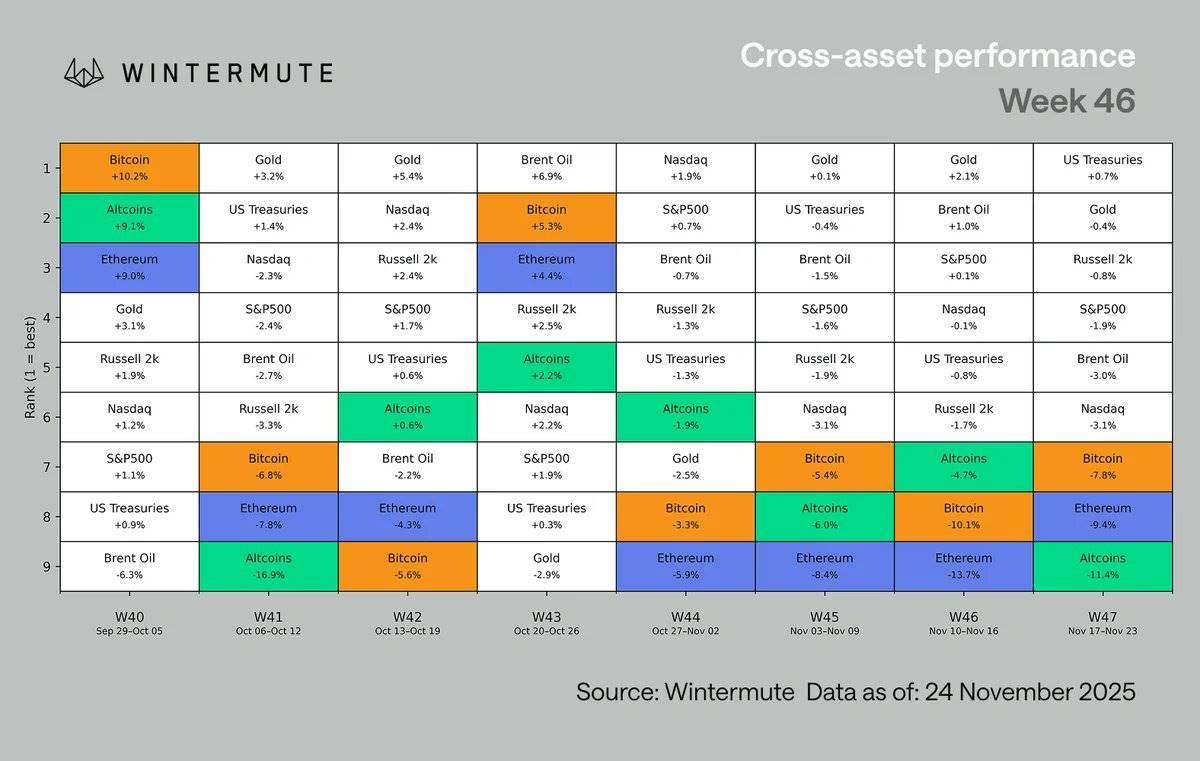

Wintermute Market Analysis: Cryptocurrency Falls Below $3 Trillion, Market Liquidity and Leverage Tend to Consolidate

This week, risk appetite deteriorated sharply, and the AI-driven stock market momentum finally stalled.