-

Bitcoin is experiencing unprecedented interest from institutional investors, signaling a pivotal moment in its evolution as a mainstream asset.

-

With total inflows exceeding $1.4 billion in just three days, the cryptocurrency is gaining traction as both an investment and a safeguard against economic uncertainty.

-

According to COINOTAG, “This surge in institutional capital could redefine Bitcoin’s status in the financial landscape.”

Bitcoin surges with $1.4 billion in ETF inflows, showcasing a shift towards institutional demand and evolving perceptions of the cryptocurrency marketplace.

Institutional Demand Fuels Bitcoin’s Ascent

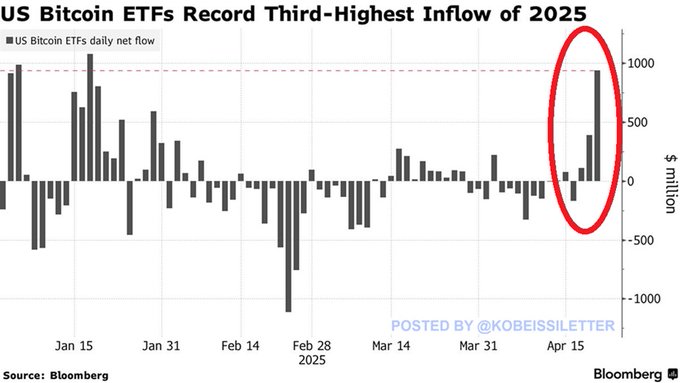

In a remarkable display of institutional confidence, Bitcoin ETFs recorded meteorological inflows, with $936 million in net inflows observed in a single day—marking the third-largest increase of 2025. These inflows signify a robust renewal of interest from large-scale investors, amplifying Bitcoin’s potential as a viable investment vehicle.

Source: X

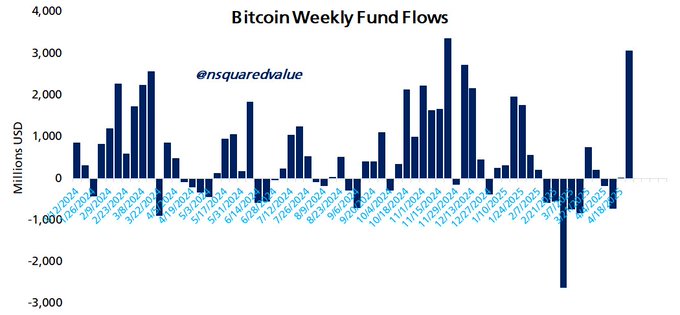

Over a three-day period, inflows reached an astonishing $1.4 billion, bringing weekly inflows to a total exceeding $3 billion—an achievement reminiscent of Bitcoin’s post-election performance in late 2024.

Source: X

Notably, the recent trend marks a significant departure from the sluggish inflows observed in March, with daily inflows turning sharply positive. This newfound optimism emphasizes the dynamic shifts taking place within institutional capital, positioning Bitcoin for an exciting trajectory ahead.

Decoupling from Traditional Risk Assets

As global markets grapple with various economic pressures, Bitcoin has exhibited a remarkable divergence from traditional risk assets. In stark contrast to faltering stock markets, BTC’s upward momentum cements its status as a potential safe haven for discerning investors.

The supportive policy environment under the current administration, coupled with increasing institutional ownership, appears to trigger a systematic shift in investor outlook—one that no longer categorizes Bitcoin solely as a speculative endeavor.

The existing narrative that ties Bitcoin and tech stocks is coming apart at the seams, paving the path for an emergent view of Bitcoin as a secure asset during volatile market periods.

What Drives Bitcoin’s Price Rally?

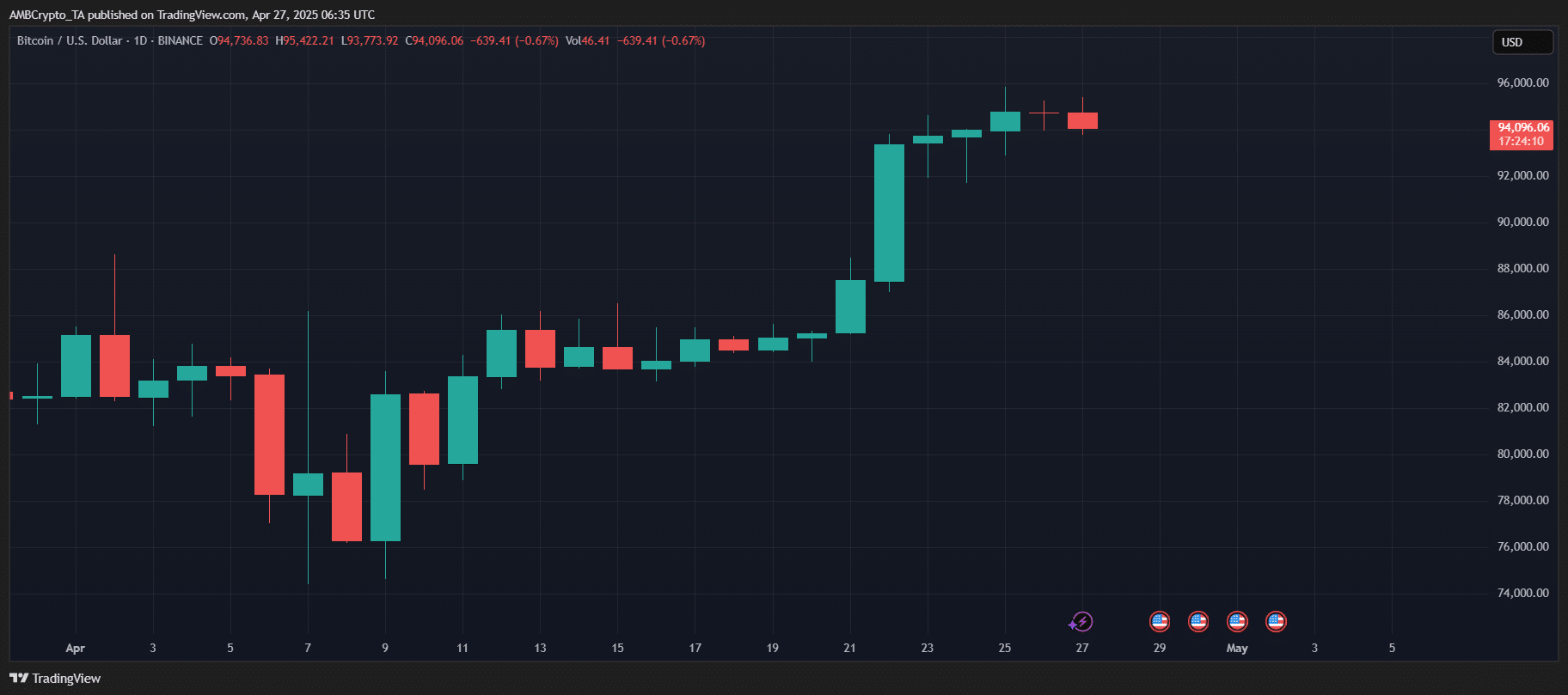

Since the price bottomed out on April 7, Bitcoin has surged over 25%, rejuvenating from below $75,000 to almost touch $94,000. This previous rally was preceded by substantial ETF inflows—highlighting a noteworthy trend where investor enthusiasm is now becoming a leading indicator rather than a following one.

Source: TradingView

The rapid price appraisals reflect a growing consensus surrounding Bitcoin, suggesting institutional engagement is shifting from a reactive stance to a proactive investment strategy. Given its current consolidation around $95,000, the market increasingly anticipates that a breakout to the highly awaited $100,000 is on the horizon.

Conclusion

The recent surge in Bitcoin’s price, accelerated by substantial ETF inflows, highlights a clear shift in institutional perceptions toward the cryptocurrency. With the cryptocurrency increasingly positioned as a safe-haven asset, the dynamics of investor engagement may lead to a redefined landscape for Bitcoin. The outlook remains positive, with the potential for further milestones in the near future. Investors should remain vigilant as the appetite for mainstream adoption continues to grow.