-

Recent patterns in whale accumulation and persistent low volatility are indicating a potential breakout for Bitcoin [BTC] as it approaches key resistance levels.

-

With whale wallets now controlling 67.77% of the total Bitcoin supply, the sentiment among significant stakeholders remains bullish despite market fluctuations.

-

“The contrast between long-term accumulation and short-term hesitation raises the question—will this wave of whale demand drive the next breakout?” said a COINOTAG analyst.

This article explores Bitcoin’s current market dynamics, focusing on whale activities, resistance levels, and potential breakout scenarios as BTC approaches critical price points.

Can bulls ignite a run to $92K?

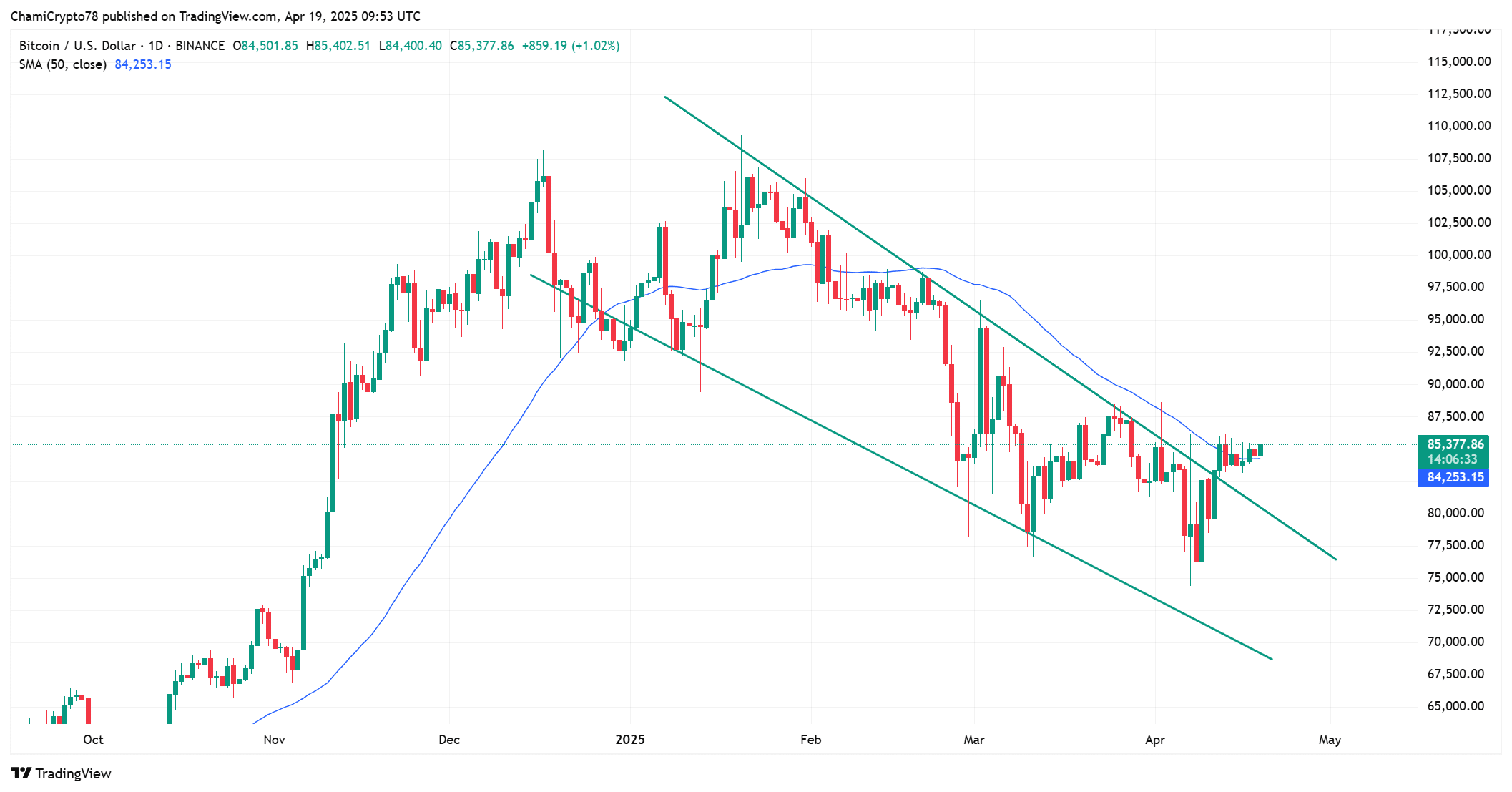

Bitcoin’s price action is now approaching a decisive technical juncture, as bulls challenge the daily EMA 50 resistance at $85.3K. Recent chart patterns indicate that the asset has broken out of a descending wedge, often seen as a bullish reversal signal. However, the ongoing uptrend remains unconfirmed until BTC secures a clean close above the EMA 50.

A successful reclaim of this level could open the path to $92K, aligning with projected targets from the current technical setup. Therefore, upcoming price movement will be pivotal in establishing short-term direction.

Source: TradingView

A potential resistance cluster?

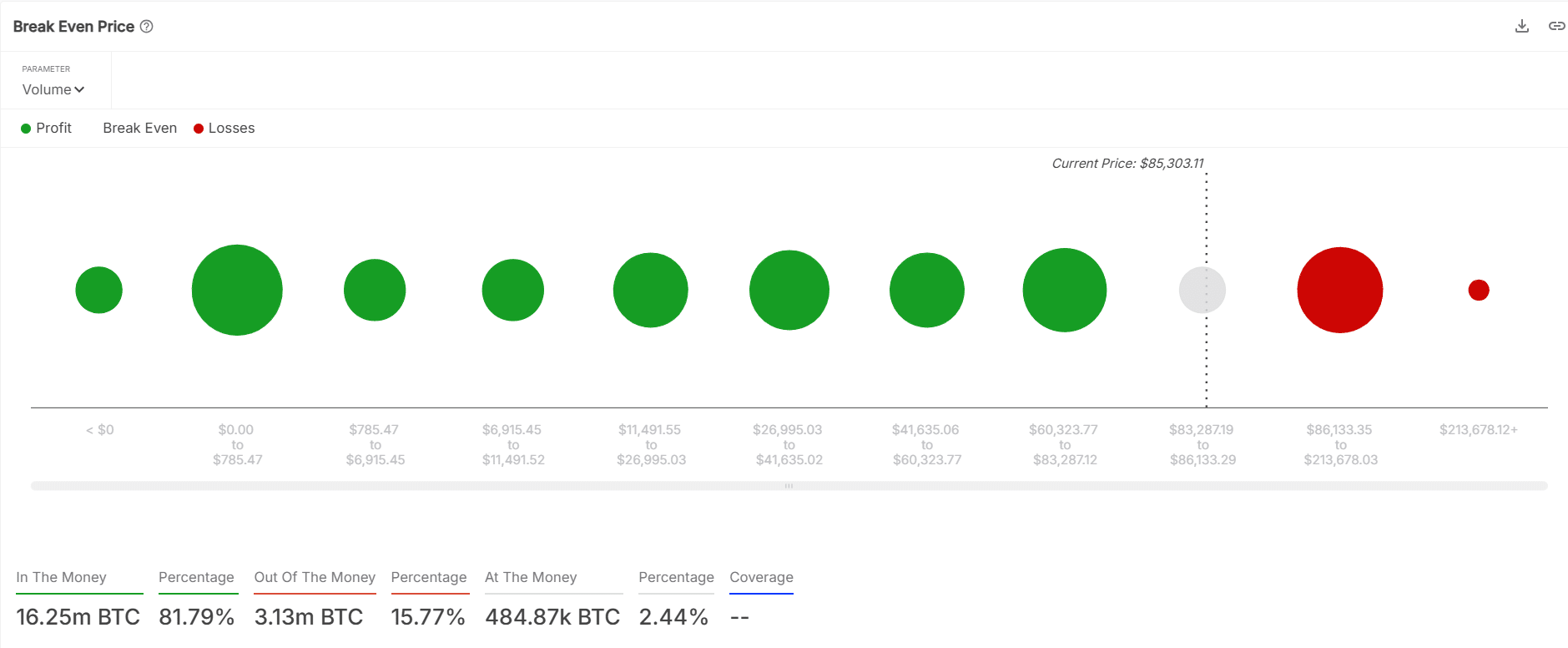

On-chain data adds critical insight into Bitcoin’s price action. Currently, approximately 81.79% of Bitcoin holders are in profit, signifying strong hands amid market fluctuations. However, many addresses acquired BTC between $86.1K and $213K, creating a significant resistance cluster just above current price levels.

This suggests that while Bitcoin possesses robust structural support, the $86K–$92K zone may attract increased selling from holders aiming to recover their investments or take profits. As a result, bullish momentum will be essential to breach this resistance and sustain upward movement.

Source: IntoTheBlock

Bitcoin’s brewing momentum

On-chain indicators continue to bolster the bullish narrative for Bitcoin. The Puell Multiple stands at 0.99, indicating that Bitcoin has not yet overheated, leaving ample room for further growth. Additionally, there is a notable decline in exchange reserves, which reflects diminishing sell-side pressure and aligns with whale accumulation trends.

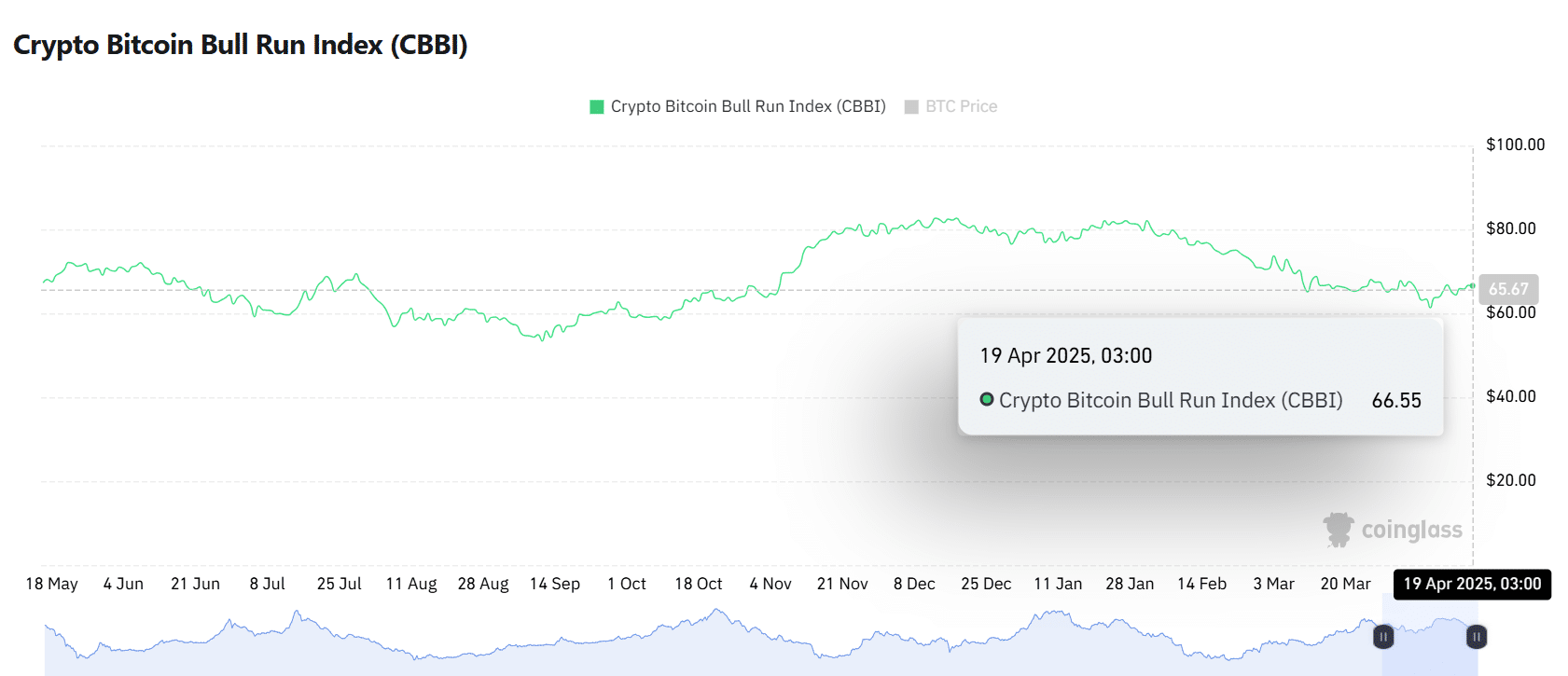

The Crypto Bull Run Index (CBBI) is currently at 66.55, signaling optimism in the market without reaching euphoric levels yet.

Source: CoinGlass

Moreover, Bitcoin’s current volatility level is at 2.72%, a historically significant marker that often precedes sharp directional moves. Collectively, these metrics suggest that Bitcoin is building momentum for a potential rally.

Is Bitcoin ready to explode past $85.3K?

In light of the ongoing whale accumulation, decreasing exchange supply, and low volatility, Bitcoin seems well-positioned for a breakout. However, the $86K–$92K zone remains a critical resistance point. If bulls can decisively flip $85.3K into support, a movement towards $92K appears increasingly likely.