Data: The scale of Grayscale Bitcoin's covered call options and premium income ETF asset management has broken through 4.5 million US dollars

Golden Finance reports, according to official data from Grayscale, its newly launched and NYSE-listed Bitcoin covered call options and premium income ETF asset management scale has broken through $4.5 million, setting a new record. Among them, the circulating shares of Grayscale's Bitcoin covered call option exchange-traded fund BTCC reached 70,000 shares, with the assets under management (AUM) currently reaching $2,363,725.46; The AUM of Grayscale's Bitcoin premium income exchange-traded fund BPI reached $2,324,291.26.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

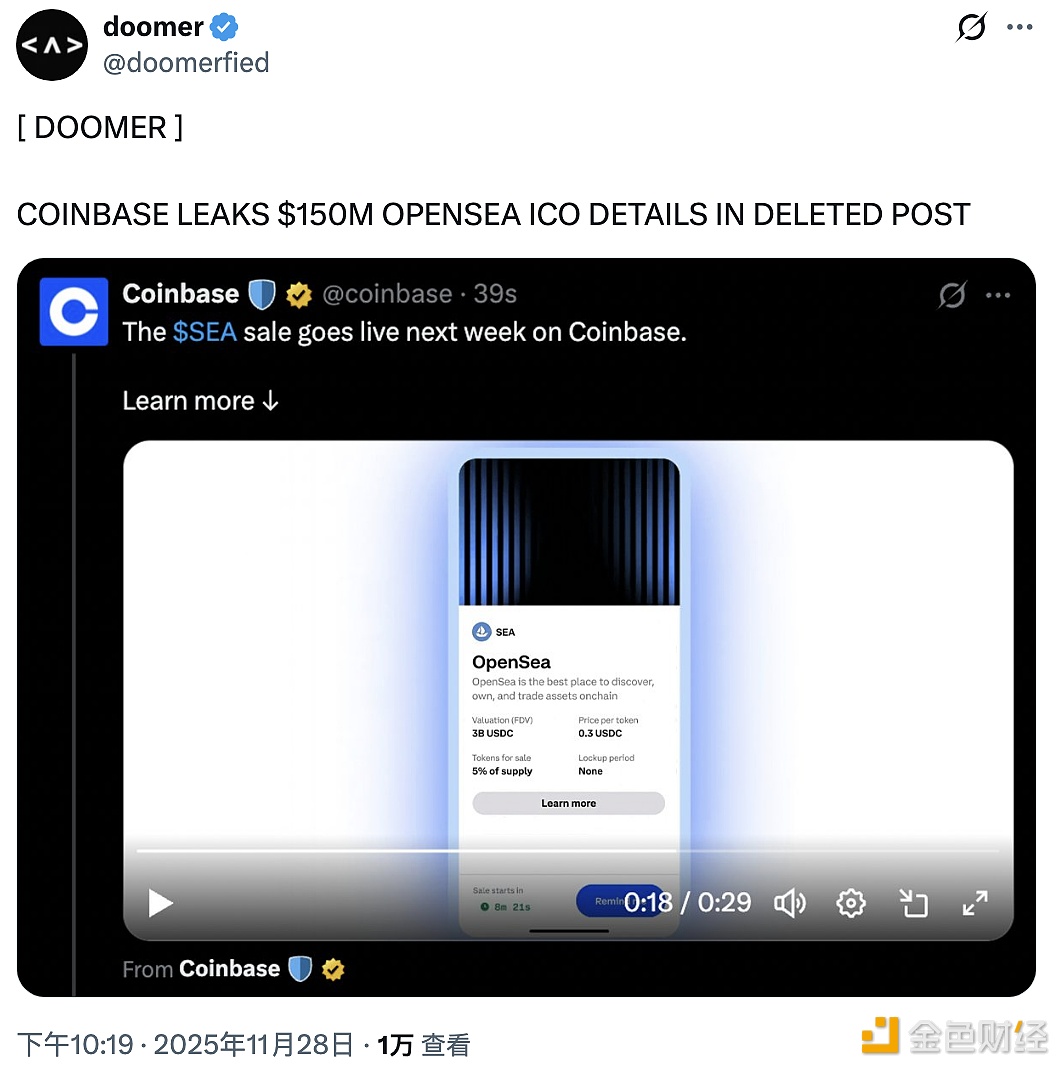

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.