Date: Fri, April 11, 2025 | 05:50 AM GMT

The cryptocurrency market appears to be shifting gears after weeks of turmoil. Following a sharp correction phase—where Ethereum (ETH) recorded its worst Q1 performance since 2018, tumbling 45%—markets are beginning to breathe signs of life. Much of the renewed optimism can be attributed to President Trump’s unexpected announcement of a 90-day pause on tariffs, which has significantly improved investor sentiment.

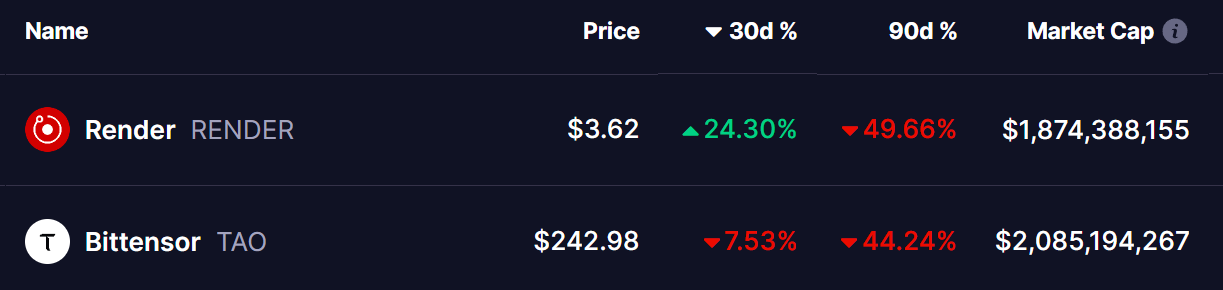

However, among the AI-focused tokens, Render (RENDER) is beginning to rebound. It has climbed 24% in the past 30 days, trimming its 90-day losses to 49%. Meanwhile, Bittensor (TAO) still lags with a 44% decline, but its developing technical setup hints it could be gearing up for a similar recovery trajectory as RENDER.

Source: Coinmarketcap

Source: Coinmarketcap

Render (RENDER)

RENDER’s daily chart is showcasing a textbook double-bottom pattern — a classic bullish reversal signal that typically indicates the end of a downtrend and the beginning of a potential rally. The downtrend for RENDER accelerated after a failed breakout at the $4.21 neckline in late March, driving it down to the key $2.50 support level — which now appears to have formed a reliable base.

Render (RENDER) Daily Chart/Coinsprobe (Source: Tradingview)

Render (RENDER) Daily Chart/Coinsprobe (Source: Tradingview)

From that low, RENDER has surged back above its 50-day moving average, now trading around $3.60 — a 32% bounce from recent lows. This recovery not only flips the 50MA into support but also confirms growing buyer momentum.

The next key test is the neckline at $4.21. A breakout above this level could catapult RENDER toward the $4.83 resistance zone — another 33% upside from current levels.

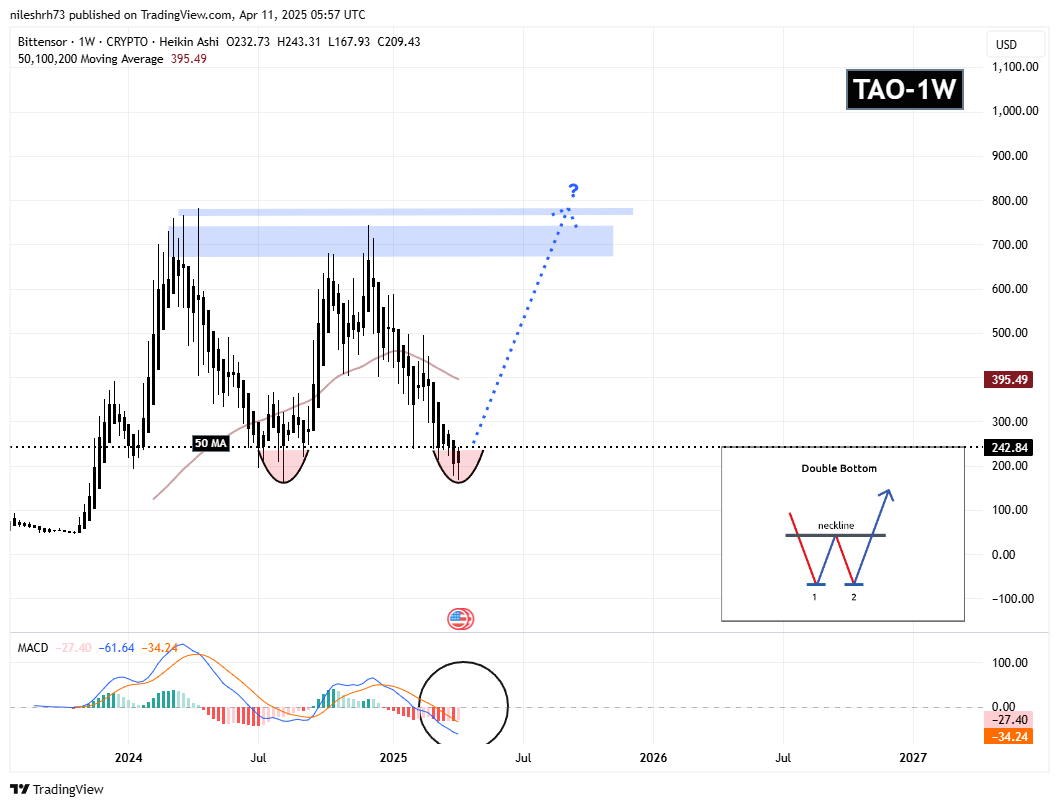

Bittensor (TAO) – Mirroring RENDER’s Path

Bittensor (TAO) might be gearing up for a similar reversal. TAO’s price action has traced a nearly identical structure, having bottomed around the $167 mark after a prolonged decline from its December 2024 high of $743.

Bittensor (TAO) Weekly Chart/Coinsprobe (Source: Tradingview)

Bittensor (TAO) Weekly Chart/Coinsprobe (Source: Tradingview)

The weekly chart reveals a developing double-bottom, with TAO now trading near $241 — a promising sign that the bottom might be in. Should this pattern play out, the next target would be a test of the neckline, followed by potential upside toward the $741–$783 resistance zone.

Additionally, the MACD is curling upward, hinting at a bullish crossover — often a precursor to a trend reversal.

What’s Next for These AI Tokens?

RENDER has already kicked off its rebound with a clear double-bottom breakout and bullish signals building up. A move above the $4.21 neckline could open the door to $4.83 and higher.

TAO is still forming its setup but shows early signs of a similar reversal. If confirmed, a rally toward the $741–$783 zone may follow.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.