Kiyosaki Reveals Next Big Opportunity; Bitcoin and Gold Debunked?

- Robert Kiyosaki bets on silver.

- Industrial demand drives appreciation.

- Limited supply and undervaluation of silver.

In a surprising statement, Robert Kiyosaki, author of the bestselling book “Rich Dad, Poor Dad,” has revealed his latest bet: silver. In a comment on his official X account, Kiyosaki stated that silver outperforms Bitcoin and gold's potential for appreciation, citing a combination of factors that make it a unique and promising asset.

Kiyosaki highlighted in his statement the growing industrial demand for silver, driven by sectors such as solar energy, electric vehicles, electronics and medicine. This versatility, according to the financial expert, gives silver an unparalleled advantage over gold and Bitcoin, which have more limited applications.

“Is SILVER more VALUABLE than gold or Bitcoin? A: I say yes. BECAUSE: Demand for silver is increasing for use in: 1: Solar panels 2: Electronic vehicles 3: Computers 4: Electronics 5: Weapons systems 6: Medicine 7: Water purification The supplies of gold and Bitcoin are not decreasing… However, the supplies of silver are decreasing. And best of all… silver is the least expensive when compared to gold and Bitcoin.”

Q: Is SILVER more VALUABLE than gold or Bitcoin?

A: I say yes.

BECAUSE: Deman for silver is increasing for use in:

1: Solar Panels

2: Electronic Vehicles

3: Computers

4: Electronic products

5: Weapon Systems

6: Medicine

7: ...—Robert Kiyosaki (@theRealKiyosaki) April 2, 2025

In addition to the rising demand, Kiyosaki points to the limited supply of silver, which is declining due to reduced mine production. In this sense, the combination of scarcity and growing demand creates a favorable scenario for the appreciation of the metal.

Another factor that draws the expert’s attention is the undervaluation of silver in relation to gold and Bitcoin. Kiyosaki believes that this undervaluation is the result of decades of price manipulation to keep the metal affordable for industrial buyers. In addition, he believes that silver will reach a new all-time high this year.

“As the price of gold breaks all-time highs… the price of silver remains 60% below its all-time high. WHY?: Because silver is useful and its price has been suppressed for decades to keep it affordable for industry. I believe the manipulation of the silver price is over. I strongly believe the price of silver will “shoot up” to new all-time highs… possibly 2X to $70 an ounce by 2025. Time for you to buy some more silver?”

At the time of publication, the price of Silver was quoted at US$ 32,233 with a decrease of 2% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who controls XRP in 2026? Top 10 addresses control 18.56% of circulating supply

Steak ‘n Shake Increases Bitcoin Exposure Following Eight Months of Crypto Payments

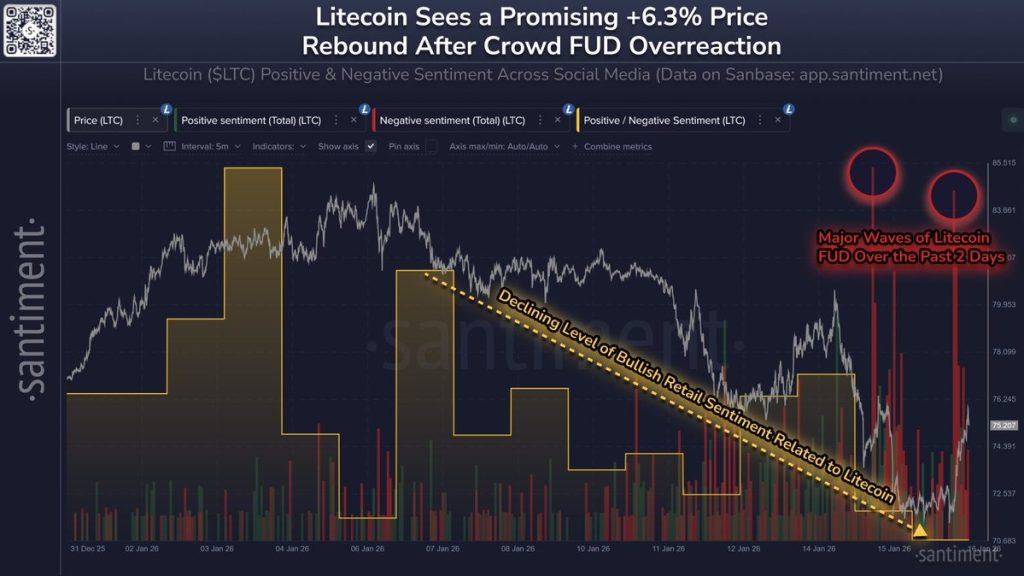

Are Traders Leaving Litecoin (LTC)? What It Means for This OG Crypto