Viewpoint: The divergence in profit models between Tether and Circle intensifies

According to analysis, Tether's net profit reached 13 billion USD in 2024, of which only 54% came from US bond interest. Nearly 5 billion USD came from unrealized floating gains from BTC and gold, with BTC holdings exceeding 100,000 coins, showing a high volatility income structure.

Circle disclosed in its IPO prospectus that its revenue reached $1.676 billion in 2024, with 95%-99% coming from interest income and service income accounting for only 0.9%. Tether tends towards an "offshore hedge fund" model while Circle steadily advances compliance listing more like a "digital currency fund" deeply anchored to the interest rate cycle. The profit structures of these two stablecoins are becoming increasingly differentiated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Stablecoin circulating market cap returns to $305 billions, with a cumulative increase of 0.8% recently

S&P 500 index futures rise 0.2%

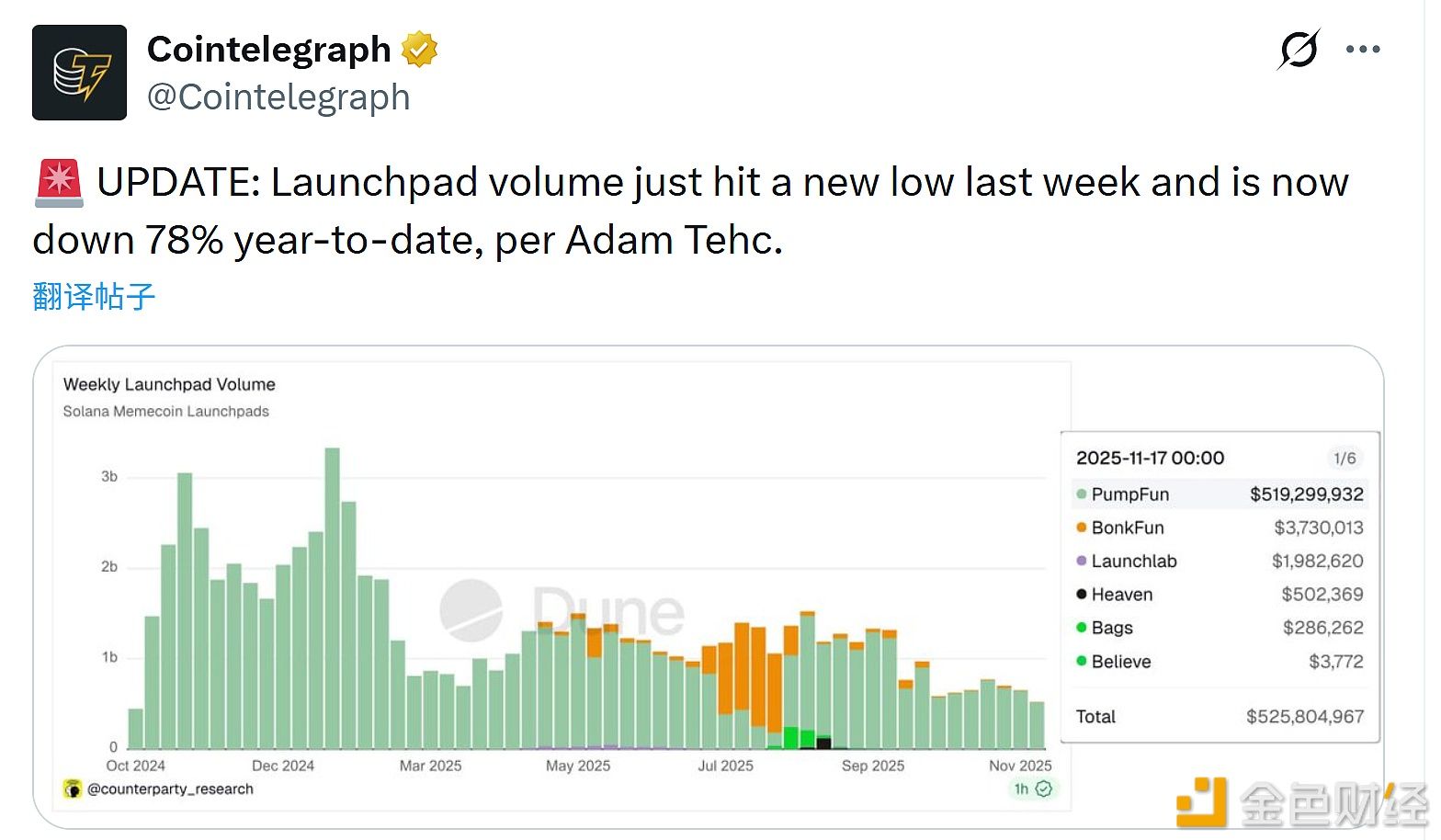

Adam Tech: Launchpad trading volume hit a new low last week