Bitcoin’s Diamond Hands Double Down, Targets All-Time High

Bitcoin’s Permanent Holders are doubling down, continuing their accumulation even amidst market volatility. With demand surging, BTC is poised to test resistance and could break its all-time high if the momentum continues.

Since the beginning of February, Bitcoin has had difficulty stabilizing above the $100,000 mark. Donald Trump’s tariff wars have triggered significant market volatility, keeping traders on edge.

However, despite these headwinds, a key group of coin holders—those with no recorded history of selling—have intensified their accumulation. This signals a strong conviction in the asset’s long-term prospects.

Bitcoin Long-Term Holders Remain Resilient

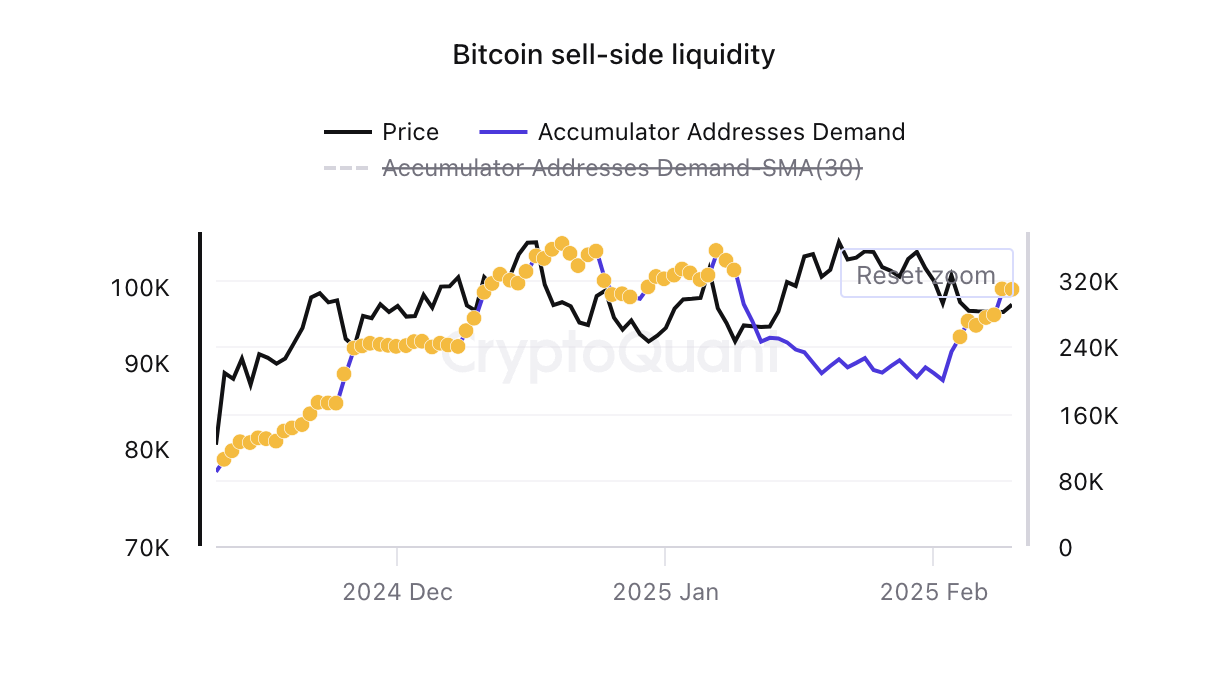

Data from the on-chain analytics platform CryptoQuant shows a spike in Bitcoin’s Permanent Holder Demand. According to the data provider, Bitcoin’s permanent holders consist of owners who primarily accumulate the coin over time and never engage in spending transactions, indicating a long-term holding strategy.

Bitcoin Accumulator Addresses Demand. Source:

CryptoQuant

Bitcoin Accumulator Addresses Demand. Source:

CryptoQuant

BeInCrypto’s assessment of the coin’s accumulator address demand reveals that since it hit a year-to-date low on February 2, it has soared. This reflects the surge in accumulation among these long-term investors.

Demand has rebounded even amid Bitcoin’s early February correction, signaling that long-term holders remain confident in the leading asset. Compared to previous cycles, fewer long-term holders are selling, reinforcing the bullish conviction.

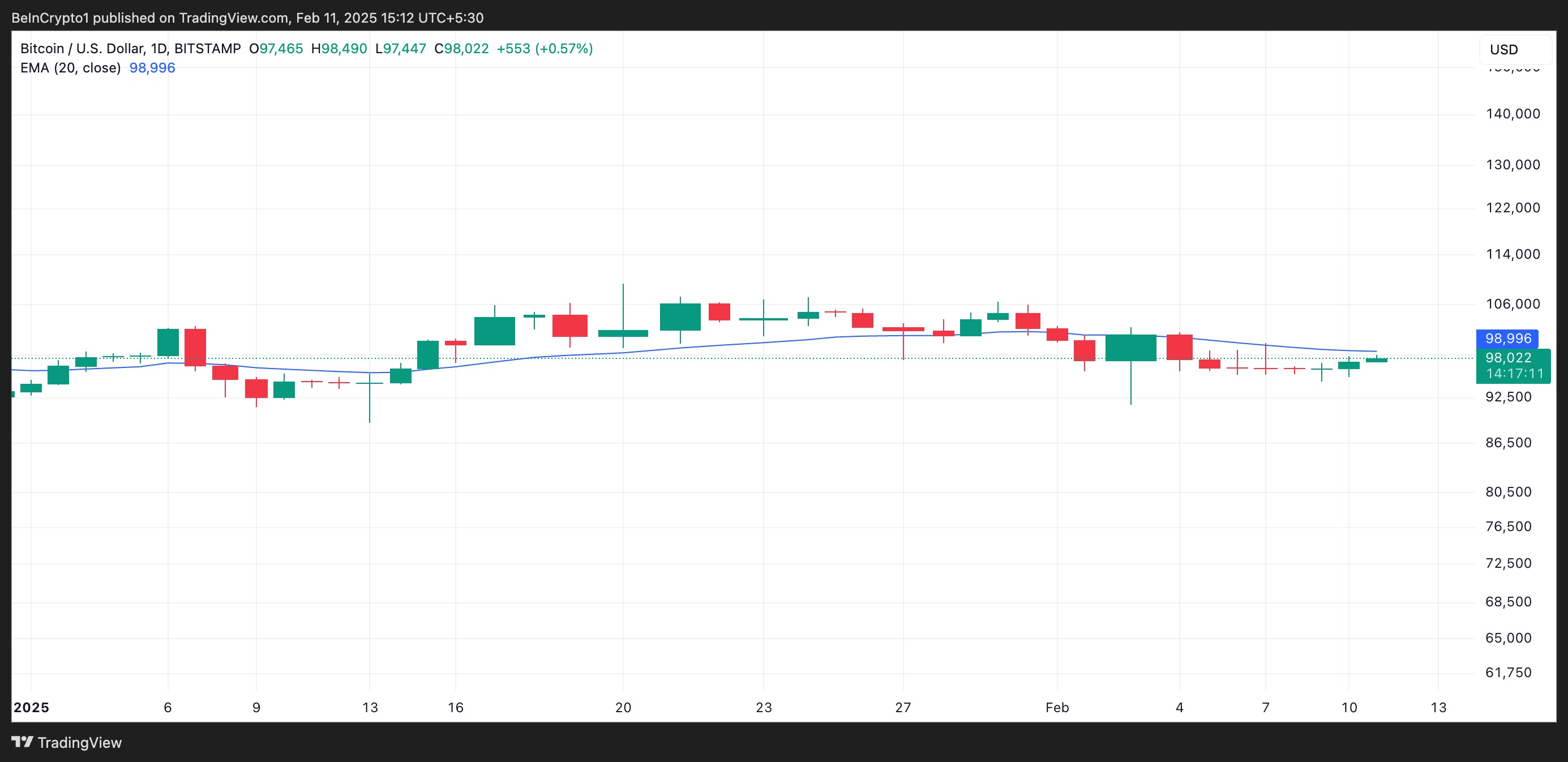

Furthermore, BTC’s attempt to cross above its 20-day exponential moving average (EMA) confirms the resurgence in demand for the king coin. At press time, BTC trades at $98,022, slightly below this key moving average, which forms resistance above it at $98,995.

BTC 20-Day EMA. Source:

TradingView

BTC 20-Day EMA. Source:

TradingView

The 20-day EMA tracks an asset’s average price over the past 20 trading days by giving more weight to recent price data. When an asset is poised to break above this moving average, it signals growing bullish momentum, suggesting a potential shift toward an uptrend if sustained.

BTC Price Prediction: Strong Holder Demand to Push BTC Above Key Resistance?

Sustained demand for BTC among its permanent holders could trigger a rally above the resistance formed by its 20-day EMA. A successful break above this level would provide the momentum needed for the coin to reclaim its all-time high of $109,356.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if accumulation stalls among BTC investors, it could reverse current gains and drop to $92,325.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI Grabs Headlines, Yet Gold Industry's Productivity Fuels Worth

- Two Gen Z entrepreneurs rejected Elon Musk's funding to develop a brain-inspired AI outperforming OpenAI and Anthropic models. - QGold Resources initiates economic assessment for its Oregon gold project with 1.543M oz reserves, signaling strategic expansion. - Galactic Gold appoints mining veteran Manley Guarducci to enhance operational efficiency amid industry consolidation. - Alamos Gold and B2Gold demonstrate resilience through record cash flow and production growth despite geopolitical risks. - Gold

Bitcoin News Update: As Major Crypto Firms Target Affluent Investors, Authorities Increase Scrutiny

- Binance launches "Prestige" to target high-net-worth clients, competing with Morgan Stanley and Fidelity through tailored crypto services. - KuCoin secures MiCA license in Austria, enabling EEA operations and emphasizing compliance with global regulatory standards. - Binance faces lawsuit alleging $50M+ in Hamas-related transactions, highlighting crypto's regulatory challenges amid expanded AML measures in South Korea. - Houdini Pay introduces privacy tools for freelancers, addressing wallet transparency

XRP News Today: Institutional ETFs May Exhaust XRP Reserves Earlier Than Expected

- XRP's institutional ETFs (e.g., Franklin Templeton's XRPZ) drive rapid supply depletion risks as inflows outpace expectations. - Analyst Zach Rector models potential $168 price targets if XRP ETF inflows mirror Bitcoin's $62B 2024–2025 surge pattern. - ETFs enhance XRP liquidity for SMEs and fintechs but expose risks from whale manipulation and unclear Asian regulations. - Market analysts warn XRP's limited 60.25B circulating supply faces accelerated institutional demand pressures amid growing ETF adopti

CME's Twofold Mission: Emergency Response and Advancing Cryptocurrency Innovation

- CME Group's November 2025 data center outage disrupted global trading, highlighting infrastructure vulnerabilities and prompting redundancy calls. - CME launched XRP and Solana spot futures on December 15, 2025, addressing surging institutional demand for altcoin exposure beyond Bitcoin and Ethereum . - Crypto derivatives trading hit record volumes, with 794,903 contracts traded on November 21, 2025, as year-to-date volume grew 132% compared to 2024. - CME plans 24/7 crypto trading in early 2026 but rema