Date: Wed, February 5, 2025 | 02:36 PM GMT

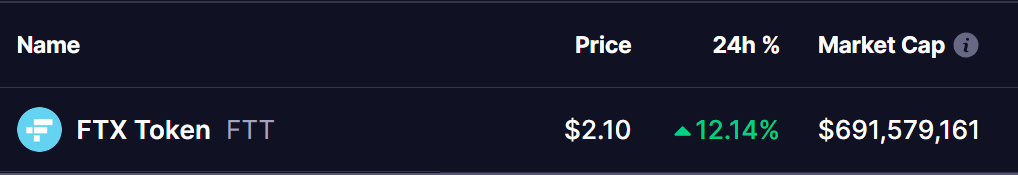

In the cryptocurrency market today, FTT, the native token of the collapsed FTX exchange, is coming in spotlight with an impressive 12% rally in the last 24 hours. The surge comes after a major update regarding creditor repayments, bringing fresh optimism to investors.

Source: Coinmarketcap

Source: Coinmarketcap

FTX to Begin Repayments to Creditors

According to an email sent to creditors on February 4, FTX will start reimbursing eligible users for lost assets. The repayments will begin at 10 AM ET on February 18, specifically for claims under $50,000. These claimants, known as the “Convenience Class” in court proceedings, have received official notifications from the Joint Official Liquidators (JOLs) regarding the process.

Is a Breakout Ahead?

With this positive news, FTT has climbed to $2.10 rebounding from its 24-hour low of $1.77.

The daily chart reveals that FTT has been trading inside a falling wedge pattern, a bullish technical setup. Currently, the price is approaching the upper resistance of the wedge, supported by the 200-day simple moving average (SMA).

FTX Token (FTT) Daily Chart/Coinsprobe (Source: Tradingview)

FTX Token (FTT) Daily Chart/Coinsprobe (Source: Tradingview)

If FTT successfully breaks out and retests the resistance, it could trigger a strong upside move. Key resistance levels to watch are $2.44 and $2.81, representing a potential 34% gain from the current price.

Final Thoughts

FTT’s latest surge, fueled by creditor repayment news, has brought renewed optimism among investors. However, a confirmed breakout above resistance will be crucial to sustain the rally. Traders should monitor volume and price action closely, as failure to break out could lead to a retest of lower support levels.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.