Aave Considers Fee Switch as USDe Pegging Proposal Draws Concerns

Aave, a leading DeFi platform, is preparing to activate a fee switch mechanism to enhance its revenue model and ensure long-term sustainability.

Aave, a leading decentralized finance (DeFi) platform, is gearing up to introduce a fee switch mechanism aimed at boosting its economic model.

This step aligns with broader efforts to ensure long-term sustainability and deliver value to the Aave ecosystem.

Aave’s Fee Switch Initiative

On January 4, Stani Kulechov, Aave’s founder, hinted at plans to activate a fee switch initiative. This proposal aims to enhance the platform’s revenue management by enabling the Aave DAO to adjust how fees are collected and distributed.

Such mechanisms are common in DeFi platforms and typically reward token holders and stakers through transaction fee redistribution.

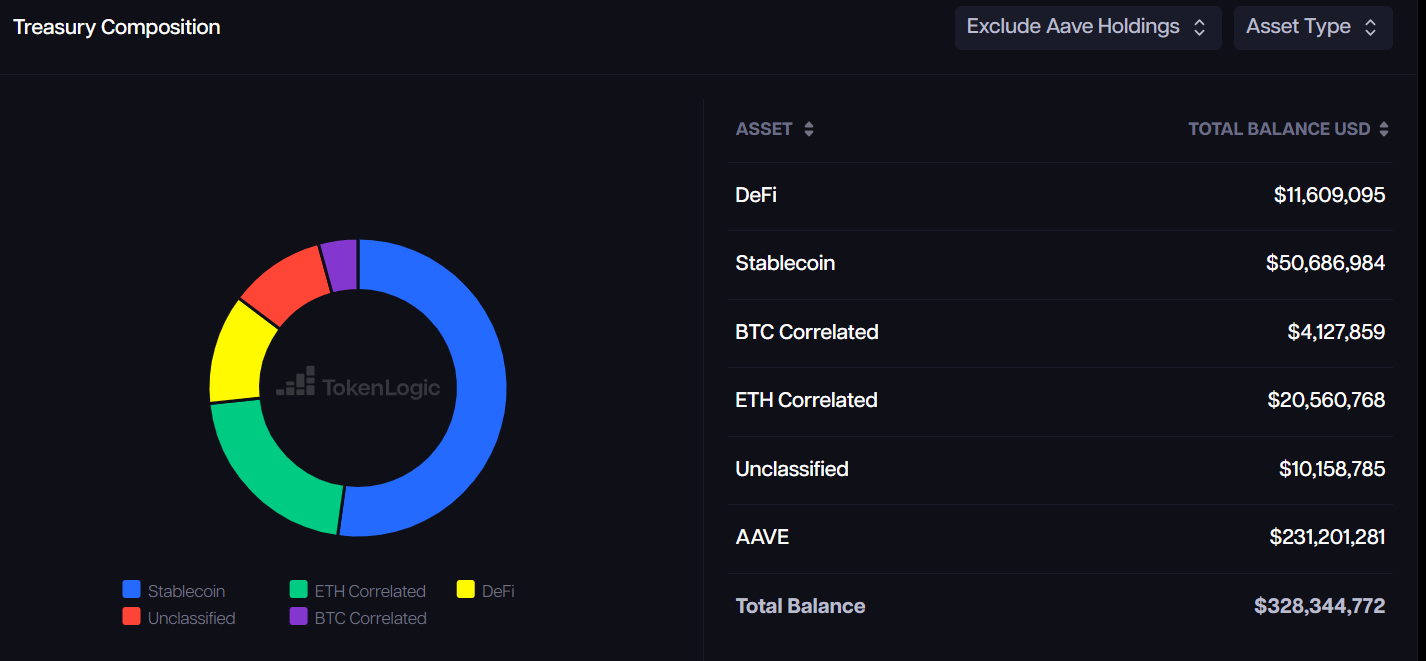

Aave’s robust financial standing supports this initiative. Its treasury holds nearly $100 million in non-native assets, including stablecoins, Ethereum, and other cryptocurrencies. When factoring in AAVE tokens, this figure exceeds $328 million, according to TokenLogic.

Aave’s Treasury. Source:

TokenLogic

Aave’s Treasury. Source:

TokenLogic

Marc Zeller, founder of Aave Chan, first introduced the idea of a fee switch last year and emphasized its inevitability earlier this year. According to Zeller, Aave’s net revenue significantly surpasses its operational expenses, making the move not just viable but strategic.

“When your protocol treasury looks like this, and DAO net revenue is more than twice the Opex (incentives included), The Fee Switch isn’t an if; it’s a when,” Zeller stated.

Aave is the largest DeFi lending protocol, providing users with decentralized borrowing and lending options. According to DeFillama data, more than $37 billion worth of assets are locked on the platform.

Aave’s USDe-USDT Proposal Sparks Criticism

Meanwhile, the Aave community is also evaluating a more contentious proposal to link Ethena’s USDe, a synthetic stablecoin, to Tether’s USDT.

This change would align USDe’s price with USDT using Aave’s pricing feeds, replacing the existing Chainlink oracle. The goal is to mitigate risks associated with price fluctuations and unprofitable liquidations.

USDe stands out from traditional stablecoins like USDT due to its reliance on derivatives and digital assets like Ethereum and Bitcoin rather than fiat reserves. USDe is the third-largest stablecoin, behind USDT and USDC, according to DeFillama data.

Despite significant support for the proposal, some community members have argued that it could create conflicts of interest, as advisors involved in drafting the proposal have ties to Aave and Ethena. Critics, like ImperiumPaper, have suggested that these advisors recuse themselves to ensure impartiality.

“LlamaRisk is on Ethena’s Risk Committee, which comes with monthly compensation. Ethena hired Chaos early on to help design and develop the risk frameworks used by Ethena. Both should recuse themselves from any oversight of USDe parameters,” Imperium Paper stated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.