Bitcoin Hash Rate Reaches an All-Time High on its 16th Birthday

Bitcoin’s hash rate reached a record high on its sixteenth anniversary, reflecting miner confidence amid post-halving challenges and market uncertainty.

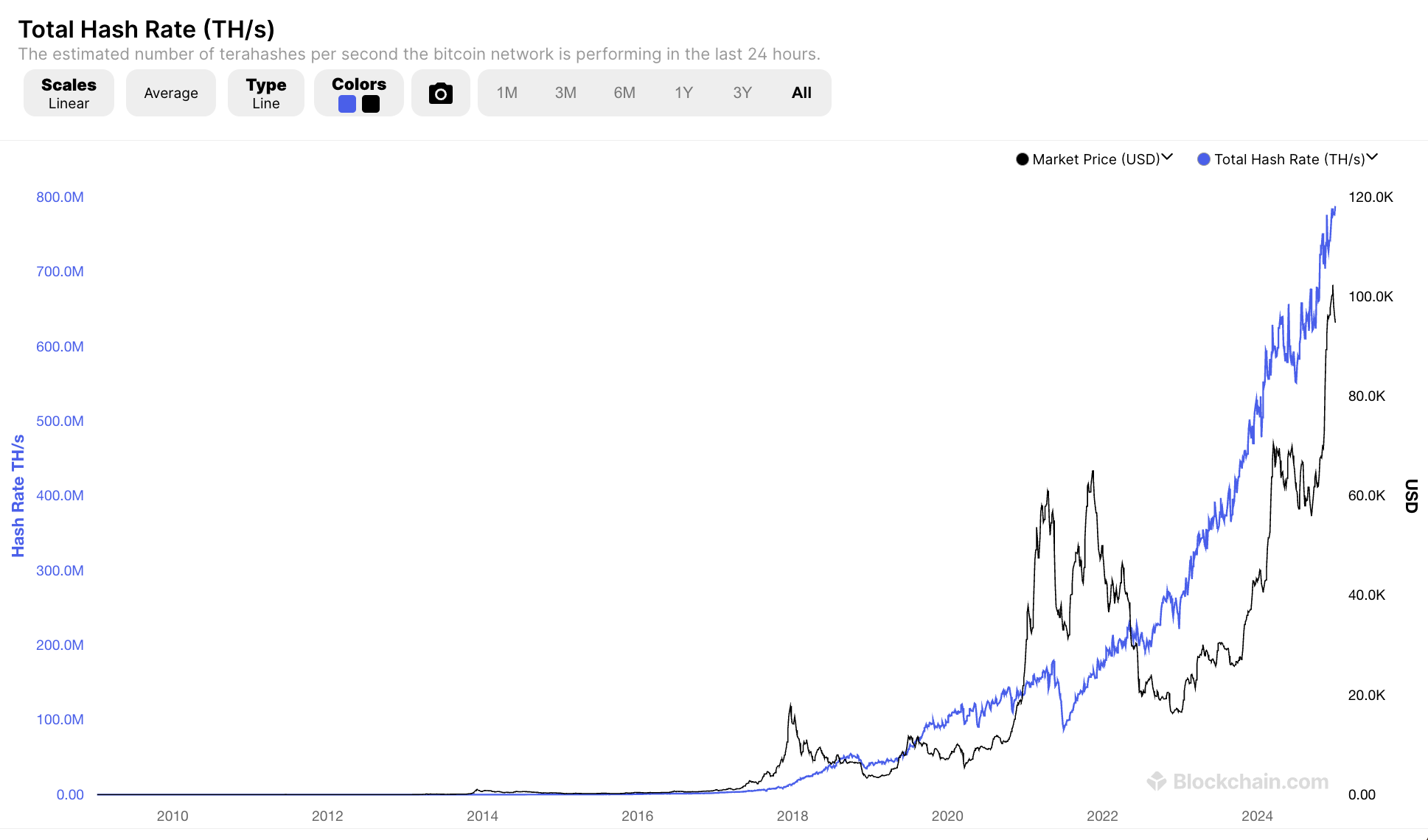

Bitcoin’s hash rate reached a new all-time high today on January 3, 2025. Although BTC’s hash rate has risen dramatically in recent months, it broke another new record on Genesis Block’s sixteenth birthday.

Bitcoin mining operations have consolidated in the last 12 months, especially in the wake of the most recent halving. Surviving miners, however, paint an optimistic view of the future.

Bitcoin Hash Rate Steadily Rising

Bitcoin turned 16 this year, and the world’s oldest decentralized currency is going through a historic market cycle. Its price briefly rose today after days of intensely bearish signals, and new data shows that its hash rate is at an all-time high. A number of uncertain factors stand between BTC and the future.

Hash Rate of Bitcoin. Source:

Blockchain.com

Hash Rate of Bitcoin. Source:

Blockchain.com

The most recent Bitcoin halving took place in early 2024, which had a substantial impact on the hash rate. Months before the halving, accelerated miner activity steadily inflated it, but these activities dropped off immediately afterward. The immediate post-halving period had a chaotic impact on Bitcoin’s price, which further complicated matters.

These events, alongside other critical factors in the Bitcoin ecosystem, helped dramatically shift its hashing paradigm for the foreseeable future.

For example, the US mining industry consolidated to the point that two companies control most of the Bitcoin network’s hash rate. One of these two mining titans even laid off 60% of its workforce despite this advantage.

Despite these concerning trends, the mining sector definitely has a few notable winners. For instance, Hive Digital announced that it reached a new milestone today and plans to both upgrade its equipment and relocate its headquarters. Fred Thiel, CEO of the biggest Bitcoin mining firm MARA, also forecasted “very bullish” outlooks for 2025 in a recent interview.

In short, recent liquidations and rampant mining difficulty have not deterred bullish sentiment among Bitcoin miners. Since October, increasing numbers of miners have been holding their assets rather than selling them, and the recent bull market has rewarded this behavior.

As Bitcoin turns older by another year, plenty of miners are looking forward to the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Has the four-year cycle of Bitcoin failed?

The various anomalies in this cycle—including waning sentiment, weakening returns, disrupted rhythms, and institutional dominance—have indeed led the market to intuitively feel that the familiar four-year cycle is no longer effective.

At an internal Nvidia meeting, Jensen Huang admitted: It's too difficult. "If we do well, it's an AI bubble," and "if we fall even slightly short of expectations, the whole world will collapse."

Jensen Huang has rarely admitted that Nvidia is now facing an unsolvable dilemma: if its performance is outstanding, it will be accused of fueling the AI bubble; if its performance disappoints, it will be seen as evidence that the bubble has burst.

After a 1460% Surge: Reassessing the Value Foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.

The demise of a DAT company

The $1 billion Ethereum DAT plan led by Li Lin and others has been shelved due to the bear market, and funds have been returned. This "going with the flow" approach may reflect consideration of investor sentiment.