Solana Price Analysis Hints $300 Recovery Amid TVL Spike

This week, the cryptocurrency market recorded damped volatility as Bitcoin wavers between the $100k and $90k levels. This consolidation trend has stalled the prevailing correction sentiment in most major altcoins, including SOL. The Solana price holding above a confluence of major support signals a potential for a bullish recovery.

According to Coingecko, SOL price currently trades at $184.5, with an intraday loss of 2.5%. The asset market cap stands at $88.5 Billion, while 24-hour trading is at $3.6 Billion.

Key Highlights:

- A renewed uptrend in Solana’s TVL and open interest signals increased adoption and investor confidence if further rally.

- A downsloping trendline drives the current correction in Solana price.

- The $175 support is closely aligned with the 50% Fibonacci retracement level, and the 200-day Exponential moving average creates a high accumulation zone.

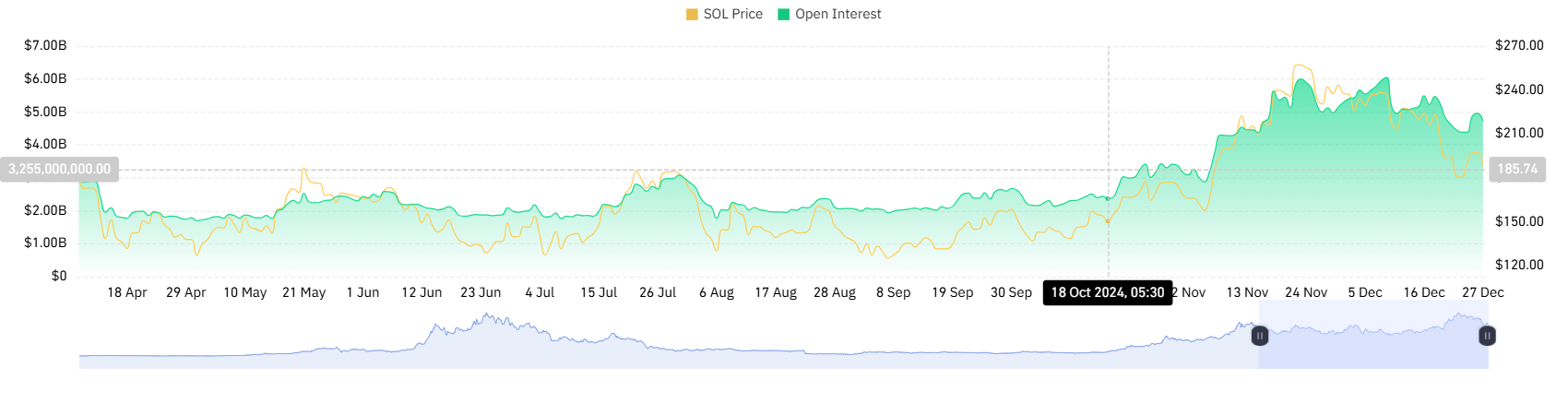

SOL Rebounds as Open Interest and TVL See Notable Increases

According to Coinglass data, the SOL futures open interest records a notable surge from $4.38 to $4.96— a 13% increase since last week. Open interest refers to the total number of outstanding derivative contracts that have not yet been settled.

A rise in open interest often suggests increased trader activity, signaling heightened interest and confidence in SOL’s price movements.

In the same period, Solana’s Total volume locked (TVL) records a jump from $8.06 to $8.67 Billion, registering a 7%. A growing TVL showcases increased trust in Solana’s DeFi platforms, suggesting that more users are staking, lending, or providing liquidity within its ecosystem.

Solana Price Correction Hits Key Support

For over a month, the Solana price has witnessed a major correction from $264 to $183, registering a 30% loss. The pullback is currently seeking support at $175, a horizontal coinciding with 50% FIB, 50-day EMA, and an emerging support trendline.

This creates a high area of interest for buyers to recuperate the bullish momentum and drive price reversal. An analysis of the daily chart shows the support trendline has acted as suitable pullback support for SOL since mid-September.

A potential reversal could drive the price 7.8% before a key breakout from the downsloping trendline. A successful breakout will further accelerate the bullying pressure to drive a rally past $300.

Also Read: Bitwise Files for Bitcoin Standard Corporations ETF with the SEC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: IMF Warns of Widespread Risks Amid Growing Popularity of Tokenized Finance

- IMF highlights tokenized finance's efficiency gains but warns of systemic risks like smart contract interdependencies and liquidity vulnerabilities. - Upcoming Chainlink ETFs signal growing institutional adoption, with Grayscale and Bitwise advancing regulated exposure to $100B+ oracle network assets. - Analysts predict over 100 new crypto ETFs in six months, but XRP's 18% price drop underscores market volatility despite regulatory approvals. - IMF anticipates regulatory frameworks to address cross-platf

South Korea's Revamped AML Framework: Is It Possible to Balance Security with Innovation?

- South Korea's FSC overhauls AML rules to tighten crypto transaction oversight, targeting transfers under $680 and expanding pre-emptive freezes. - The crackdown follows Upbit's $30M hack linked to North Korea, prompting tax authority raids and blockchain tracking for evasion cases. - AI-powered monitoring flagged 200 suspicious accounts in 2 months, balancing automation with manual audits to detect illicit patterns. - Global enforcement remains fragmented as South Korea pushes stricter VASP registration,

"Privacy or Compliance: The Trust Challenge for Crypto in Payments and DeFi"

- Economist Saifedean Ammous critiques crypto privacy tools like Houdini Pay, arguing centralized compliance models undermine true cryptographic anonymity. - Houdini Pay's "compliant privacy" retains metadata (wallets, IPs) despite hiding onchain addresses, contrasting with zero-knowledge solutions like zkBob. - Balancer's $116M 2025 hack exposed vulnerabilities in audited DeFi protocols, highlighting risks in complex financial primitives like stable pools. - The crypto industry faces a trust dilemma: bala